| « Back to article | Print this article |

Investing: 6 things you wish should happen in 2012

The first month of the New Year began with a bang for the stock markets. Here are six other things we wish should improve for investors, borrowers and savers as we go ahead.

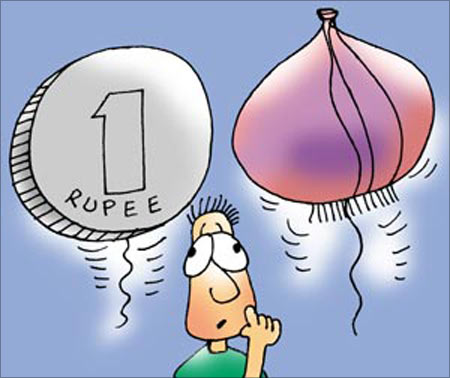

1. Wish that inflation would be tamed

The one item that plagued us most last year was inflation. Everyday items have become more expensive and most household budgets have gone for a toss. There is no relief seen over the short term, although there have been consistent reassurances by the government that by March, things could turn favorable. We just hope aaloo-pyaaz (potatoes and onions) gets cheaper and fuel for our vehicles becomes more affordable. If inflation is not tamed, it could have far reaching consequences on the economy and for all of us.

Interest rates would spike, liquidity issues would crop up and of course, the economy would grow at a slower pace.

Click here for Rediff Realtime News

Investing: 6 things you wish should happen in 2012

2. Wish commodity prices discover gravity

Commodity prices have defied gravity at this point. They seem to be headed on a one-way street, and the direction is upwards. This year could bring some cheer if the commodity prices soften. Most part of the commodity inflation is imported with the main culprit being crude oil prices that has relentlessly been range-bound for the second half of previous year. Although gold and silver have corrected marginally on the backdrop of a strengthening dollar, the rest of the commodities are yet to make a turnaround. Hopefully, that will happen in this year.

Investing: 6 things you wish should happen in 2012

3. Wish borrowing becomes more viable

Interest rates are continually on the rise. On the one hand, fixed income instruments have become immensely attractive with bank deposits offering as high as 9.25 per cent to 9.5 per cent per annum, all thanks to the numerous RBI interventions. On the other hand, borrowing has become unviable in this environment.

Most individuals who were keen to borrow to buy their homes, buy cars or cater to other personal needs have had a long wait for interest rates to wane. But that has not materialised over the past year. May the New Year dunk the interest rate a notch lower to make borrowing a viable option!

Investing: 6 things you wish should happen in 2012

4. Wish realty prices to stay real

Real estate prices have moderated and are currently at reasonable valuations. With the economy under duress, one is hopeful that we will get to invest in realty at even better bargains. Another 5 per cent to 10 per cent downside on realty prices would prove extremely beneficial for the investor. For most individuals, a home is the most important purchase of their lifetime; with borrowing costs being high, it will be nice if realty prices can play ball.

Investing: 6 things you wish should happen in 2012

5. Wish gold to shimmer a little lesser!

Gold reached unbelievable valuations; they have peaked and turned around. There have been some sharp corrections made but there is still a long way to go before they reach reasonable valuations. Many of us are wary of getting anywhere close to gold.

Although the demand in India for jewellery has remained broadly intact, it is definitely lower than what it was prior to 2008 when the dream run for gold began. The correction is due to US dollar strengthening and is a short-term phenomenon. With global cues continuing to look bleak, gold will continue to remain the safe haven for many investors -- retail and institutional. We still hope against hope that there is a sharp correction and that the yellow metal becomes more affordable.

Investing: 6 things you wish should happen in 2012

6. Wish end of mis-selling of financial products

This New Year we wish there would be better ethics and a code of conduct within the financial world and hope that mis-selling of financial products would wane. The insurance industry in particular is plagued by mis-selling. The insurance and stock market regulators IRDA and SEBI respectively, albeit with internal difference of opinions, are also working towards the goal of bringing in greater transparency and process orientation within the investment world. Hopefully, the year ahead will get even better.

Anil Rego is the founder and CEO of Right Horizons , an investment advisory and wealth management firm that focuses on providing financial solutions that are specific to customer needs.