In the fourth part of the 'I Dream' series Anil Rego reveals the avenues that will help you to optimise your taxes and also make decent returns.

The first part of this series explained how you could become a millionaire by 30!

The second dealt with how you can lead a debt-free life.

The third dealt with owning a house.

It's that time of year again when you should start planning for your tax saving investments.

The most popular section under Indian taxation law is Section 80 C, which allows deduction up to Rs 1 lakh; investments can be made in traditional products like pension plans, equity products like tax-saving mutual funds and also combination of both -- unit-linked insurance plans, ULIPs.

Section 80 C is the most popular tool to save tax and most of the taxpayers make investments under this section to reduce their tax liability. However one can also utilise her/his expenses towards housing loan repayment to save on tax, as the same is tax-deductible expense.

Here are some avenues that will help you to save money by optimizing your tax outgo every year.

I Dream: Of optimising my taxes

Provident fund (PF)

Contribution to provident funds is directly deducted from your salary; both you and your employer contribute towards this. Employees' contribution is tax-exempt whereas employers' is not.

Public Provident Fund (PPF)

PPF is like small saving schemes. It provides a return of around 8 per cent and has tenure of 15 years and the amount that can be deposited in this financial product ranges between Rs 500 to Rs 70,000. One can start investing in this after opening a PPF account with a public sector bank.

FDs (Fixed deposits)

Fixed deposits which have a lock-in of more than 5 years and a minimum amount of Rs 1,000 is required to make it tax exempt. It gives a return of around 8 per cent and post tax the returns stands at around 5.6 per cent.

I Dream: Of optimising my taxes

NSC (National Savings Certificate)

This is a six year saving instrument, gives 8 per cent interest which is compounded half yearly hence the effective interest rate is around 8.16 per cent but after tax the returns stands at 5.6 per cent. The interest income from this is liable to tax but if the same is re-invested in the scheme, it will attract tax deduction.

5-year post office time deposit (POTD) scheme

Investment in POTD comes for different time period but only 5 year period attracts tax deduction, it offers somewhere around 7.5 per cent which is compounded quarterly and hence the effective interest rate stands at 7.7 per cent.

NABARD bonds

NABARD issues two types of bonds: NABARD Rural Bonds and Bhavishya Nirman Bonds (BNB) but only rural bonds are eligible for tax deduction.I Dream: Of optimising my taxes

ULIPs

These are unit linked insurance plans that along with insurance cover also offer benefits of equity investment. In the longer term they give decent returns to the investors this is why they have attracted a lot of investors.

ELSS

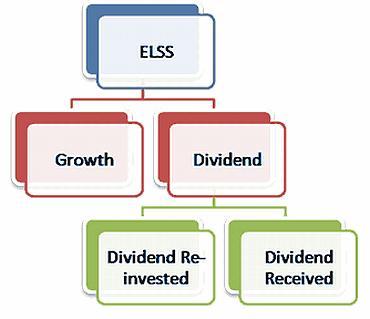

This are tax-saving equity mutual funds products, they come in with a lock-in of 3 years. It is observed that a fund in this category gives decent returns over a period of 3 years, this also have become quite popular among investors.

Home loan principal repayment

The EMI which is paid towards home loan repayment every month has two parts: interest and principal; of which principal component is eligible for tax deduction under this section. Interest component can be set off under Sec 24 of the Indian income tax act.I Dream: Of optimising my taxes

Life insurance premiums

Any amount, which is paid towards your own insurance premium, or your spouse's or your child's, is eligible for tax deduction. There are different plans in this scheme; one need to choose a plan very carefully since different scheme suit different needs.

There are two type of scheme -- endowment plan and money back plan. Endowment plans give money at maturity whereas money back plan gives the same at regular intervals.

Endowment plan will be suitable for retirement planning whereas money back plans are suitable for marriage and child education needs.

Sec 24

Interest on housing loan

The interest component of housing loan repayment can be allowed for deduction under this section. The maximum amount allowable for deduction is Rs 1.5 lakh if the loan is taken after April 1, 1999 for purchase or construction of house and if the money is borrowed before the said date than the maximum deduction allowable is Rs 30,000.

Sec 80 CCF

Infrastructure bonds

These are issued by infrastructure companies and not by government. This is a new avenue announced in the current year's budget. Recently some companies came out with large issues in this spectrum and also offering decent returns. The maximum limit under this section is Rs 20,000.

Of the various available alternatives you can choose the one which best suits your needs and objectives. Another important factor will be to look at post tax returns from different instruments the one which covers inflation risk will be better option to go for.

Comment

article