| « Back to article | Print this article |

How to manage financial risks

There is no foolproof formula but if you plan your financial goals carefully the chance is you will fulfil them.

Risk and return are an integral part of any portfolio and the same is true for every individual investing in various asset classes towards the achievement of listed financial goals.

In an ideal scenario the investor would want the risk to be minimised and the return to be maximised at the same time, and in the practical world achieving the two together is seldom possible and hence a middle of the path approach is warranted where risk is incorporated in the portfolio at a decided level ensuring at the same time that the portfolio is able to generate reasonable returns.

The next logical question that arises is: How to decide on the extent of risk in the portfolio? This is a question facing a wide variety of investors across the globe and the answer to this is risk profiling.

It is considered appropriate that the level of risk incorporated in the portfolio be the function of risk profile of the individual which in turn is determined by several factors including age, liabilities, attitude, life cycle events amongst others.

There are various methods of evaluating the risk profile of an individual investor and even the regulators have acknowledged the importance of the same across the globe.

In the Securities and Exchange Board of India (Investment Advisers) Regulations 2013 it has been clearly mentioned that determining risk profile should be a part of the advice process. Financial Services Authority in the United Kingdom has also made it mandatory for the financial advisors to determine the risk profile of investors.

While the importance of the risk profiling cannot be contested, risk could be effectively managed by virtue of:

Risk containment

Risk Containment ensures that there are no loose ends in the risk management process. The same needs to be ensured at the time of asset allocation and asset creation both. The aim is to cover the losses in case of harm or low performance of asset. Example could be buying property insurance while buying a house property etc. or buying an insurance while travelling may also be cited as an example.

Diversification

Diversification refers to investing in different asset classes to insulate the portfolio from the adverse price movements of one particular asset class.

This could be followed by employing a need based approach that advocates asset allocation as per the likely use of the fund and time horizon for the same in addition to the one based on the one suggested by the risk profile of the investor. This approach is in concurrence with the financial planning approach which calls for the goal based management of one's finances.

Ascertaining the need for the particular investment is the first step of the process, and this can form a part of a broader financial planning process which envisages the need based planning in the following areas:

- Insurance

- Investment

- Retirement

- Taxation.

In the process of financial planning the goals need to be identified first preferably in consultation with an expert like a Certified Financial Planner professional.

It must be kept in mind that assets have different long term and short-term characteristics like equity investing is considered wise for long term and investing in debt could be better for short term.

These time characteristics of various asset classes can be aligned with the goals i.e. investment for a long term goal like retirement could be done in a dynamic asset class like equity while for a short term goal such as children education where the need is expected to arise in 1- 3 years, investing in debt could be a better idea irrespective of risk profile of the investor in question.

The writer is working with Financial Planning Standards Board India (FPSB India) in the capacity of Vice Chairman and Chief Executive Officer. The views expressed here are personal, and do not necessarily represent that of the organization. FPSB India is the sole marks licensing authority for the CFP marks in India, through agreement with US-based FPSB Ltd.

How to manage financial risks

If we take an example of a 43 year old investor Mr. A, whose family consists of a spouse and one son and daughter each being 18 and 15 years respectively. His monthly income is Rs 120,000 post taxes and spouse is a homemaker. He is a risk friendly investor as per the risk profile and is comfortable with investing 60% of the portfolio into dynamic asset classes like equity. He has taken the services of a financial planner which has helped him in identifying the following financial goals.

Insurance: Personal life insurance for self

Investment: He needs to invest for children education, marriage etc.

Retirement: He plans to retire at the age of 60 and wants to maintain current standard of living adjusted to inflation

Taxation: He wants to manage his tax liability efficiently

Asset allocation is relevant in the last three of his enumerated financial goals. He needs to invest for his children's education. His daughter is expected to get admission in the engineering in next one year and will require Rs 5 lakh at the time of admission and Rs 1.5 lakh as the fees while the son intends to pursue medicine and will require Rs 10 lakh 3 years from now and Rs 2 lakh every year since then.

For his retirement he requires a corpus to sustain his current monthly expenditure of Rs 60,000 per month till his life expectancy of 80 years. He wants to buy a house next year.

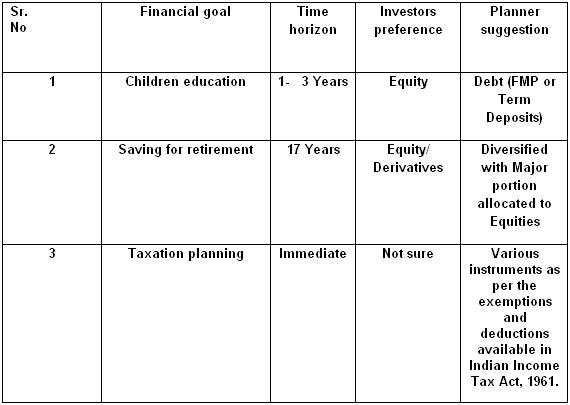

He is not averse to the risk and is inclined to invest the major part of his portfolio in equity and even some speculative instruments like futures and options. His risk profile also says that same may be done, but as his financial planner one needs to align his objectives with the asset classes in the following manner.

In this case goals like children's education are very short term in nature and equity being a dynamic asset class may not be relied upon, In case of long term goals like retirement, equity could be used as an asset class for investment as the client is comfortable but the same needs to be done judiciously with major portion of the investment going towards equity and rest allocated to other asset classes to reap the benefits of diversification.

On the taxation front, the investments need to be made as per the various provisions provided under Section 80 C of Income Tax Act, 1961. Schemes like Rajiv Gandhi Equity Savings Scheme (RGESS) may also be utilised. His goal of buying a house in a year's time may be very tax efficient as the benefits are available under section 24 of income tax act in which the interest on loan taken for a self occupied property may be deducted from taxable income to a limit of Rs 150000.

Thus it may be seen that while risk profiling is an important tool for deciding the kind of investments an investor should make, combining its risk containment measures and diversification along with the need based approach will give a deeper insight into the impact the investment that it is likely to make on the long term financial goals of the individual. However it is warranted that the same should be undertaken in consultation with an expert like a CFP who is well equipped for the same.