| « Back to article | Print this article |

GOLDEN RULES to invest in gold and silver

How should investors go about investing in gold and silver? Ankit Gala and Jitendra Gala, who have authored a wide range of books on trading and investing in the stock markets, mutual funds, commodities, IPOs, options and futures and precious metals, offer some valuable insights to help investors while investing in gold and silver.

Precious metals are stable in times of worldwide uncertainty, or when a country's economy goes through a bad phase. When confidence in other assets causes their values to plummet, precious metals often do well.

In last few months due to global uncertainties like Euro zone debt crisis and US debt crisis, gold and silver prices have sky rocketed. Sometime back, gold was trading at all-time highs around $1,880 per Oz and silver was trading around $45 per Oz.

This has caused a mad investor rush for these precious metals. Hence we felt the need to educate the laypersons and investors about how to invest in these precious metals so as to minimise their risk and maximise their returns by autoring Investing & Trading in Gold & Silver.

Gold, silver, platinum, and palladium are generally considered as precious metals. Historically, precious metals were used as currency. These metals have high demand in the market thereby having a high economic value. These are now regarded mainly as investment and industrial commodities.

When it comes to investment, we generally consider gold and silver as investment avenues. While both have industrial uses, they are better known for their uses in jewellery, art and coinage.

Note: We don't consider gold or silver jewellery as an investment option.

NEXT Slide: Advantages of investing in gold and silver

Ankit Gala and Jitendra Gala have written Guide to Indian Stock Market, Guide to Indian Mutual Funds, Guide to Indian Commodity Market, Guide to Day Trading, Guide to Future & Options, A Simplified Approach to Option Strategies, Everything About IPOs, Foreign Exchange & Forex Trading and Investing and Trading in Gold & Silver.

Published by Buzzingstock Publishing House (www.buzzpublishing.net), these books are available in English, Hindi, Gujarati and Marathi.

GOLDEN RULES to invest in gold and silver

1. Hedge against inflation

When inflation rises, value of precious metals also increases and hence they can be effectively used as a tool to hedge against inflation.

2. Diversifying portfolios

As you all know never put all your eggs in one basket; always diversify your investment portfolio. Precious metal investing can help you in diversifying your investment portfolio as it carries lower risk, and adds stability to your investment portfolio.

During global economic crises, when other investments like equities under perform, gold out performs.

Click NEXT for more

GOLDEN RULES to invest in gold and silver

3. Highly liquid

As compared to other assets one of the advantages of precious metals is that they are highly liquid assets. Gold, silver and other such metals can be easily sold even during crises as they are considered valuable and hence find buyers easily.

4. Safety

At any time, good or bad, precious metals have always retained their value and earned their reputation as safe investments.

Gold has long been perceived as being a superior store of value.

Click NEXT for more

GOLDEN RULES to invest in gold and silver

5. Recognised worldwide

Precious metals have an intrinsic value therefore they are recognised worldwide as an investment avenue, and can be bought and sold readily for same value in any part of the world.

6. Can be pledged for loan

Precious metals, mainly gold, can be pledged for loan as they are the easiest form of obtaining loan against security. Today, there are number of companies providing loan against gold. There is very little documentation work required for obtaining loan against gold and most of the companies approve loan against gold on the spot.

Click NEXT for more

GOLDEN RULES to invest in gold and silver

7. Available in various forms

Apart from buying precious metals like gold and silver in physical form, you can also select from various investing options like futures, ETFs, jewellery, coins, stocks of mining companies, or mutual funds.

Depending on your comfort and risk-taking ability you can select any of these options to invest in precious metals.

How to invest in precious metals?

When it comes to gold and silver, people have a belief that investing in precious metals means buying it in physical form or jewellery, but today there are number of other safe, secure and hassle-free ways to invest in them.

Click NEXT for more

GOLDEN RULES to invest in gold and silver

1. Buying in physical form

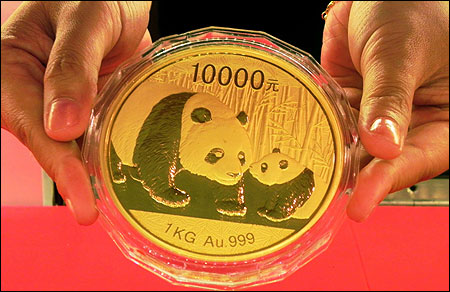

The simplest and easiest way to invest in precious metals like gold and silver is to purchase them in physical form of coins or bars available in standard denominations, depending upon the amount you have to invest.

2. Exchange traded funds, ETFs

Gold ETFs are mutual fund schemes that invest in standard gold bullion (99.5 per cent purity). They special ETFs track the prices of gold and are convenient and inexpensive alternative to owning physical gold.

There are no silver ETFs in India as of now.

Click NEXT for more

GOLDEN RULES to invest in gold and silver

3. Futures trading on commodity exchanges

If you are a speculator or a trader, then in India you can trade gold and silver futures which are traded on the National Commodity and Derivatives Exchange (NCDEX) and Multi Commodity Exchange (MCX).

4. E-gold and E-silver

National Spot Exchange Ltd (NSEL) has launched a unique investment product in gold and silver on its platform, named e-gold and e-silver.

It provides an opportunity for small investors to invest in gold and silver in smaller denominations of 1 gram for gold and 100 grams for silver and in multiples thereof in demat form.

Click NEXT for more

GOLDEN RULES to invest in gold and silver

5. Investing in shares of gold mining companies

An indirect way of investing in gold is via the equity route, by purchasing shares of gold mining companies.

The investing logic here used is that if the gold price rise, the profits of the gold mining company could be expected to rise and as a result the share price may also rise.

However, there are many factors to take into account and it is not always the case that a share price will appreciate when the gold price increases. It also depends on overall market movement and overall economic scenario.