| « Back to article | Print this article |

GOLD: Best INVESTMENT or ultimate BUBBLE?

Investing (or not investing) in gold may be a function of whether you're betting on or against the global economy.

Gold's parabolic rise has surprised many investors. If you are considering investing in the yellow metal but are confused with the pro- and anti-gold arguments you see in the financial media, here are certain pointers to help you.

Gold price history

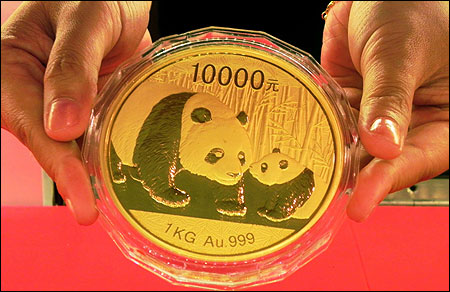

Gold has been on a tear in the past 10 years, rising from an international price of $250 per ounce in 2001 to about $1,600 currently (it recently topped out at $1,900). The price of the precious metal advanced every year in the past decade.

In rupee terms, gold has risen from about Rs 5,100 per 10 grams in late 2001 to about Rs 27,000 recently (compounded annual growth rate of 18.3 per cent) to even slightly beat the impressive growth of the BSE's benchmark Sensex, which gained from 3,000 in late 2001 to about 16,000 now (CAGR: 18.2 per cent).

But one should not just look at an isolated 10-year price chart of an asset class to try and predict its future trend (extend the chart to 30 years and gold's inflation-adjusted returns lag several stock indices globally).

GOLD: Best INVESTMENT or ultimate BUBBLE?

Why is gold rising?

Traditionally, gold has always been perceived as a safe haven. During ancient times, it was used as legal tender and till the mid-20th century was the standard against which central banks would print fiat currency (till it was abolished completely in 1971).

Since the abolition of the gold standard, central banks have greater leeway to print and infuse money into an economy, a monetary tool used during financial crises that lifts asset prices and kick-starts activity. The downside of the policy is it devalues the currency (which, though, could be another added short-term advantage) and could lead to inflation.

During such crises, governments also take on more debt and boost lending to further stimulate consumer spending.

Since the 2000s, the Federal Reserve of the United States has adopted an easy-money, low interest-rate policy to boost that nation's economy. It further perked up its liquidity injections since 2008 after the global financial crisis.

The rise in gold can easily be attributed to fears that the current policies of governments worldwide to flood the world with currencies could lead to a sharp fall in the value of their currencies and give rise to runaway inflation.

Also, the excess debt levels of several countries, especially in the Euro-zone, carry the risk of sovereign defaults, prompting investors to seek refuge in the precious metal that typically tends to rise during economic uncertainty.

GOLD: Best INVESTMENT or ultimate BUBBLE?

Is gold in a bubble?

Given the recent price rise, several economists and investment advisors around the world have said gold prices are poised to crash (legendary hedge-fund manager George Soros and Nobel Prize-winning economist Paul Krugman call it the "ultimate bubble").

Statistics available with the World Gold Council till the second quarter suggests demand for gold dropped for three consecutive quarters while prices were in a steady uptrend.

At the same time, the investment community is also abuzz with disparate predictions that gold prices are slated to rise further. Economist Peter Schiff, who foresaw the housing crisis in the US, predicts prices to top even the $5,000 per ounce mark in the next few years.

GOLD: Best INVESTMENT or ultimate BUBBLE?

Different views, different viewpoints

Gold buyers or those considering an investment must keep in mind a key point when making a decision. In the investment community, economists who are taking largely opposite views on gold originate from two different backgrounds.

Economists who belong to the conservative, free market-oriented Austrian school of economics -- which calls for limited government intervention in the management of an economy -- usually tend to be long-term bullish on gold.

According to the Austrian-economics thinking, the easy-money policies of the central banks in the developed world would likely lead to long-term devaluation of currencies and give rise to runaway inflation, in which case investment in gold would serve as a hedge.

Jim Rogers, the commodities guru (he correctly called the global commodities bull run that started in the late 90s), investment advisor Marc Faber, editor of the Gloom, Boom and Doom report and economist Peter Schiff all belong to the Austrian school of economics and are noted critics of the Federal Reserve.

On the other hand, economists belonging to the conventional school of thinking derived from John Maynard Keynes (most mainstream economists and central bankers are its proponents), which advocates government-spending ("stimulus") packages and calls for short-term deficits to kick-start economic activity, largely believe gold as being in a bubble.

GOLD: Best INVESTMENT or ultimate BUBBLE?

Should you buy?

The answer lies in your view of the state of the global economy. If you share the Austrian view that the current bout of prevailing loose monetary policies, especially in the US, will pummel the value of currencies like the dollar and lead to a serious crisis of the global financial system in the next few years, you must consider keeping the precious metal part of your investments.

While if you believe the global economy is undergoing a sluggish but steady recovery after the shock of 2008, and the monetary and fiscal policies of governments worldwide will be effective and things will get normal over time, you may want to stay away from gold.

One must keep in mind that investors flock to gold's perceived safety when faith in the other safe haven, the US dollar, takes a hit. As a result, gold enjoys an inverse relationship with the greenback and any short-term strength in the US currency may result in weakness in gold.

Finally, it is worth noting that, compared to other asset classes, gold has historically outperformed in a wide range of uncertain economic scenarios: deflation (falling prices accompanied by low or negative growth), stagflation (high inflation and low growth as seen in the US in the 70s) and in potential hyper-inflationary outcomes while it tends to lag when the global economy is booming.