Photographs: Rediff Archives Neelima Shankar

Company fixed deposits offer many advantages over the traditional FDs

Conservative investors have always considered bank fixed deposit schemes as the safest investment option. But, in a falling interest rate scenario, banks are the first ones to slash deposit rates.

The falling bank deposit rates have been a constant worry for the investors but now there are other options available that can be considered. One such option is fixed deposit schemes offered by non-banking finance companies which offer superior interest rates than banks.

The Reserve Bank of India authorises companies to accept money from general public for a fixed term and these companies perform the tasks under specified regulations of RBI. There are set of guidelines and instructions from the RBI that investors willing to invest in NBFCs have to follow. These instructions can help protect an investor's interest in investing in these companies.

Courtesy:

How to get the most out of your fixed deposits

Photographs: Rediff Archives

Features of company fixed deposits:

Term

The term of the company/non-bank fixed deposits schemes are usually less because when it comes to these deposit schemes, the performance of the company and rating may change depending on different variables.

So, as a matter of security, shorter terms are generally preferred. The term of such schemes cannot be less than 12 months or more than five years as regulated by RBI.

How to get the most out of your fixed deposits

Photographs: Rediff Archives

Types of company fixed deposits

There are two types of fixed deposit schemes which fall under this category: cumulative and non-cumulative fixed deposit schemes.

Non-cumulative fixed deposit schemes, as the name suggests, pays off the interest earned on investment on regular basis i.e. half yearly or annual basis, so the interest will not get added to the principal amount and in turn earn higher interest in the years to come.

In cumulative fixed deposit scheme the interest adds to the principal so as to earn higher returns when compared to non-cumulative plan. This scheme pays interest accrued on deposit schemes on maturity of the deposit.

How to get the most out of your fixed deposits

Photographs: Rediff Archives

Rating of a company

There are certain institutes like CRISIL, ICRA that rates a company based on net owned fund (NOF) of the company. The companies are rated based on certain ceilings and slabs (example: NOF of more than Rs 200 lakh (Rs 2 crore) be rated in certain category and so on) and based on the rating a person decides on whether s/he should invest or not in a certain company.

How to get the most out of your fixed deposits

Photographs: Rediff Archives

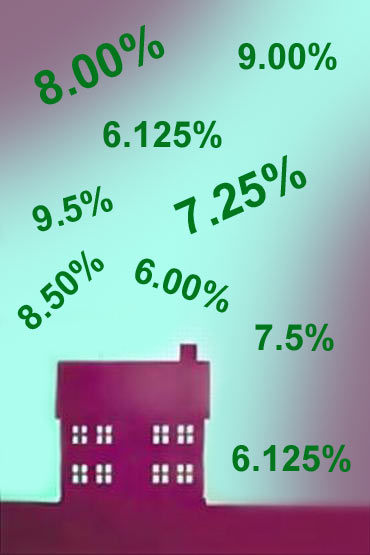

Interest rates

Company fixed deposit schemes offer higher interest rates than regular banks. This is one of the major reasons that people are interested in company fixed deposit schemes these days.

The interest rate offered on the FDs is limited to a maximum of 12.5 per cent by the Reserve bank of India and the interest rates can vary with time. A person has to stay updated about the change in interest rates before depositing in these schemes.

The interest rates available today in market ranges from 9 per cent to about 12.25 per cent.

How to get the most out of your fixed deposits

Photographs: Rediff Archives

Pre-mature withdrawals

Premature withdrawals are permitted in company FD schemes and the lock-in period of these schemes is three months. Interest accrued and penalties are as per the terms and conditions of the company.

Benefits of company fixed deposits

There are few benefits of company fixed deposit that makes it preferable over similar investment options. These are:

1. Interest rates on company FDs in general are 2 to 3 per cent higher than bank fixed deposits.

2. Suitable for short term as they earn better income with good liquidity.

3. The deposit scheme also has nomination facility.

4. The application process and eligibility clauses are much simpler than those of regular bank fixed deposit scheme which makes easier for investors to invest in company FDs.

Some companies that offer company fixed deposit in India are:

- Bajaj Capital

- Mahindra Finance

- Dewan Housing Finance

- Sundaram Finance

Comment

article