| « Back to article | Print this article |

Five tips to achieve financial freedom

Once you achieve financial freedom you do not have to worry about being dependent on someone when you retire and do not have a source of income

What if we were to tell you that you cannot do anything with your money out of your free will and that you will have to depend on someone to even take care of your basic needs? You would be furious and say that who are we to curb your independence! But have you ever given a serious thought to financial independence and what you are doing to achieve it?

Money is as necessary as the water we drink everyday and managing our finances or achieving financial freedom is akin to keeping a pitcher full of water and regulating its flow through a tap. The pitcher will not get any bigger, but you have got to keep refilling it and save as much as you can when water supply is scarce.

When translated into the financial world it is called the act of saving money and thereby achieving financial freedom.

Here are some tips that will help you achieve financial freedom so that you do not have to worry about being dependent on someone when you retire and do not have a source of income.

Get a basic financial education

You do not have to be a stock market wiz or a banker to know about basic financial products such as mutual funds, insurance policies, stocks and bonds. Thanks to the internet there are various resources you can use to educate yourself on basic financial know how. You may also consider attending investor education seminars and conferences. Having a basic understanding of the myriad financial products will help you get a better grip on your finances.

Make a financial plan

At various stages of your life you will need money for different things. This means your financial goals will change as you grow older and your priorities change in life. It is therefore very essential to plan for the major expenses you foresee and chalk out a financial plan to meet them accordingly.

Keep a check on financial products and track your portfolio

Today, there are various sources that inform you about financial products.

You must use your knowledge and discretion to check out these products and see if they are suited to your needs. If you find a certain investment not giving you enough returns as compared to a product which seems better you should not hesitate to book profits and reallocate your investments elsewhere.

In order to do this, however, you will have to keep a regular check on your portfolio to track its performance. An invest-and-forget policy will just not work if you are interested in growing your investments and enhancing your returns.

Have enough provisions for an emergency situation

For any financially wise person, it is an imperative to keep a contingency fund. One can hope for the best, but one does not really know when and how calamity will strike. It may be a sudden medical emergency or a loss of a job.

You should therefore be prepared for a rainy day and keep enough resources for three to six months without any income.

To arrive at a figure on how much you need to save, you must list out all your unavoidable monthly expenses and multiply it by three or six.

You can leave this money in a separate savings account so as to earn some interest on it as well.

Explore ways to earn an additional income

Do you have a hobby that you think you can use to earn some extra money, apart from your regular job?

For instance, if you are a great sense of designing websites or can compose music, you can milk your talent to earn a supplemental income. Put social media platforms to good use and you will see projects coming in sooner than you think!

What's more, it will give you a great sense of achievement because it is something that gives you creative fulfillment. You can use this money to repay your debts or grow your investments over time.

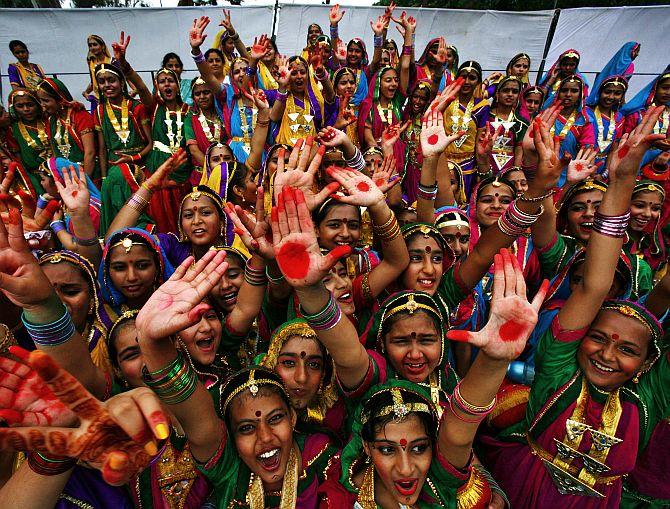

On the eve of India's independence day, it will do you well to ponder over these tips to help you achieve financial freedom so that you can live a worry free life and enjoy independence in the true sense of the word.

The author is Co-founder and Director Credit Vidya.