Anil Rego

Financial expert Anil Rego feels that there is nothing much Union Budget 2012-13 offers to the taxpayers.

Like always, finance minister Pranab Mukherjee walked a tight rope indeed, but he put up a realistic budget -- mostly reformist with a tinge of populism to please the common man. While he let loose some, he tightened the noose elsewhere ensuring a fine balance.

Here's a quick roundup on what the finance minister has in store for the common man this time round:

Personal taxes

On the personal taxes front, expectations were rife that the basic exemption limit would be hiked substantially, however, there was only marginal relief provided at the lower end of the income hierarchy. Table 1 gives a snapshot of the tax slabs and the impact of change in the slabs...

Clearly, there is greater benefit to be had at higher income levels because of increasing the threshold limit for the 30 per cent tax bracket.

The impact on income at Rs 8 lakh would be Rs 2,000, for those above Rs 10 lakh the impact would a wholesome Rs 22,000, approximately Rs 1,833 per month of increased take home. Here's a table (Table 2) illustrating the impact for various income slabs.

There is also a proposal of introduction of an equity savings scheme named after Rajiv Gandhi, which is likely to provide tax relief to the extent of 50 per cent to individuals whose income is less than Rs 10 lakh.

Apart from the increase in basic exemption limit, senior citizens have been favoured by exempting them from payment of advance tax. There was already the general relief for all individual assessees with the non-requirement to pay advance tax for tax payable less than Rs 10,000.

A new deduction of up to Rs 5,000, has been proposed for expense made on preventive health checkups. While this could encourage individuals to go in for preventive checkups and avail tax benefit for the same, there is no extra benefit as the figure is within the overall limit for payment of health insurance premium.

Budget 2012: A perfect GIVE and TAKE!

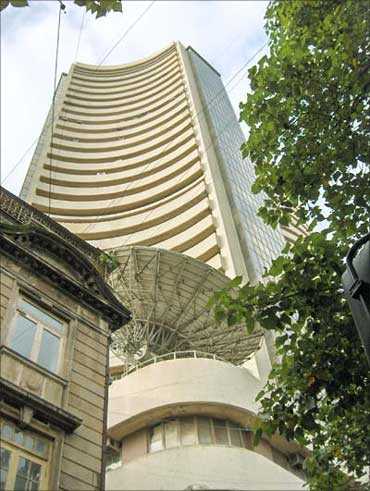

Photographs: Rediff Archives

Sops to market participants

Reduction of STT (securities transaction tax) from 0.125 per cent to 0.1 per cent will lure more market participants and the churn of portfolio will increase.

A positive move to encourage participation in the capital markets, this definitely took the market participants by surprise as markets surged on a happy note on the announcement of this move for a brief while before the euphoria died out.

There is also some consideration to encourage foreign participation in capital markets; there were however, no revision on FDI limits for the aviation sector and no updates on FDI into multi-retail space (apart from a statement of intent).

The new IPO (Initial public offer norms) will encourage rural / semi-urban participation in the IPO market.

Budget 2012: A perfect GIVE and TAKE!

Photographs: Rediff Archives

Services to cost more!

Service tax was increased from 10 per cent to 12 per cent, further a host of service industries were brought under the service tax net, barring a few such as pre-school and high school education, entertainment services etc., was a complete shocker and is likely to fuel inflation severely in the long term.

Every mundane thing like eating out / leisure activities / travel etc., is likely to cost a tad bit more.

By bringing about this key change, the FM put reforms ahead of populism; the move is likely to be a bit of a solution to problem of fiscal deficit as the tax revenue collection would go up by an estimated Rs 18,660 crore.

Budget 2012: A perfect GIVE and TAKE!

Photographs: Rediff Archives

Some luxuries could cost lower

On the other hand, items like imported LCD and LED TV panels of about 20 inches will have lesser increase in price due to the excise duty hike. Customs duty on these items has been removed. Similar is the case with LEDs used for making lamps. Branded garments will escape the impact of increase in excise duty as abatement has been provided. Mobile phone parts will become cheaper as excise duty has been cut to 2 per cent from the existing 10 per cent.

There are other luxuries which have turned dearer; some of them are -- large cars, gold / platinum jewellery (customs duty on imported standard bar has been hiked to 4 per cent from 2 per cent). The duty on non-standard gold bar has been hiked to 10 per cent from the 5 per cent earlier.

Budget 2012: A perfect GIVE and TAKE!

Photographs: Rediff Archives

Additional allocation for tax-free bonds

It is proposed to increase the tax-free infrastructure bonds limit to Rs 60,000 crore which is towards financing of infrastructure projects. These provide attractive post tax returns to investors, especially those in the higher tax brackets.

There were some disappointments such as DTC (Direct Tax Code) not being tabled and GST (Goods Sales Tax) missing yet another deadline but then we did not expect the FM to get it all right!

Comment

article