Photographs: Rediff Archives Ramalingam K

Find out which amongst the three tax-saving options investors should opt for.

There are so many tax saving investment options. You may consider options like mutual fund ELSS, ULIPs, PPF.

1. Mutual fund ELSS

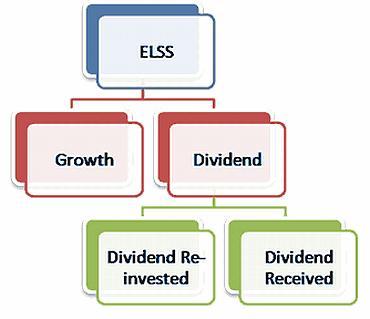

A mutual fund ELSS is similar to diversified equity funds. That means the fund manager can invest in shares of various companies across various industries. The difference is ELSS has got the added tax benefit, something a diversified equity fund does not offer.

ELSS is part of the section 80C instruments which are cumulatively eligible for a deduction from income up to Rs 1 lakh. This gives the taxpayers benefits from 10 per cent to 30 per cent (excluding the educational cess) based on their current tax slab.

NEXT: PPFThe author is Ramalingam K, an MBA (Finance) and Certified Financial Planner. He is the Founder and Director of Holistic Investment Planners (www.holisticinvestment.in) a firm that offers Financial Planning and Wealth Management. He can be reached at ramalingam@holisticinvestment.in.

Best tax-saving option: MF ELSS, ULIP or PPF?

Photographs: Rediff Archives

2. PPF

The othertax saving investments like NSC, PPF will give only 8 per cent return per annumwhereas the mutual fund ELSS has got the potential to deliver more than 12 percent return per annum. Also the lock-in period in mutual fund ELSS is 3 yearsand with NSC it is 6 years lock-in and with PPF it is 15 years.

Among thevarious tax saving investment option, mutual fund ELSS has got the leastlock-in period.

NEXT: ULIP

Best tax-saving option: MF ELSS, ULIP or PPF?

Photographs: Rediff Archives

3. ULIP

ULIPs arealso one of the tax saving investment options. But now everyone has realisedthat ULIPs come with heavy front loaded charges. Moreover smart investors wantto separate their insurance from their investments. They no longer seeinsurance as an investment; they see insurance as a protection plan. So thesmart investors go only for pure term insurance and reject ULIPs.

This is howmutual fund ELSS stands out of the crowd.

NEXT: Finalverdict

Best tax-saving option: MF ELSS, ULIP or PPF?

Photographs: Rediff Archives

Finalverdict

Beforedeciding to go for mutual fund ELSS, here are some points to ponder over. Firstcheck your overall portfolio. Does it need more equity exposure? If yes thenyou can go for ELSS; if no then you can go for PPF or NSC.

Secondthing to keep in mind: the equity investments are for long term, say five yearsor more. Though the lock-in period in ELSS is three years it is better toinvest with a time horizon of five years or more.

Points tobe considered while investing in MF ELSS:

Investorsneed to keep in mind, SIPis the best form of investing in mutual funds and ELSS is not an exception.So doing an SIP in ELSS is a good strategy to follow.

Thepoor-performing ELSS has given around 10 per cent annualised return in the lastfive years whereas the best performing ELSS has delivered around 25 per centannualised return in the last five years. So investors need to be careful inchoosing the right ELSS scheme.

Pastperformance, risk adjusted return, consistency are a few parameters to beevaluated in selecting a best performing ELSS scheme. Investors also can

Best tax-saving option: MF ELSS, ULIP or PPF?

Whichgroup you are in?

There aretwo groups of ELSS investors. Majority of investors belong to the first group.They will wake up late to these tax saving investments.

Forsalaried individuals, it is typical that they will be informed by theiraccounts department somewhere around end of January to provide proof of taxsaving investment immediately or else extra tax will be deducted from theirFebruary salary. At the neck of the moment, the choice ends up being guided byconvenience alone. They tend to think about tax first and investments later.

As long assomething saves tax, its real benefits and features as an investment are paidless attention to. That means the investments will be chosen more forconvenience than for suitability.

There isanother group of investors. Though this group is a very small group, it is avery smart group.

They willnot rush for taxsaving scheme at the last minute. They will plan in advance. That meansthey will have more time to choose the right product. They will save tax aswell as choose a good investment option.

They willalso check whether this particular tax saving scheme will suit their overallportfolio or not; will this tax saving investment fit into their comprehensivefinancial plan. That means they will consciously choose an investment whichsaves tax as well as helps them in achieving their financialgoals like children'shigher education, buying a house, retirementplans, etc.

So... nowjust check up which group you are in.

Comment

article