| « Back to article | Print this article |

7 most common myths and facts about fixed deposits

Rising interest rates and volatile stock markets, it's that time when banks and financial institutions are aggressively marketing the safe investment option: Fixed deposits. However, very often we see that various misconceptions about fixed deposits prevail among investors.

Here's making you aware about some of the most common myths and facts that you may face while investing in one.

Myth 1: Only banks offer fixed deposits.

Fact 1: Fixed deposits are offered by companies too.

If you thought you could only approach your bank to invest in a fixed deposit, well that's not so. Various companies and financial institutions too offer fixed deposits for retail investors.

Companies offering deposits are governed by proper guidelines under section 58A of the companies act. They generally offer a little higher interest rate than bank deposits.

However, when compared to bank deposits, company fixed deposits are considered as an unsecured option. This is because bank deposits come with insurance for up to a maximum of Rs 1, 00,000 but company deposits don't.

7 most common myths and facts about fixed deposits

Myth 2: More number of regular interest payments, more the returns.

Fact 2: A cumulative FD with returns only on maturity would fetch you more.

Fixed deposits come with two options: of receiving interest payouts at regular intervals, or a cumulative deposit, where the whole amount (that is, principal + interest) is received on maturity.

Your annualised yield on your FD works out to be higher if you opt to receive the proceeds on maturity. This is due to the power of compounding.

In cumulative deposits, the interest is compounded at regular frequencies, instead of it being paid out. Higher the frequency of compounding more is your yield on investment.

7 most common myths and facts about fixed deposits

Myth 3: All 5 year deposits fetch you a tax benefit.

Fact 3: Only select 5 year fixed deposits fetch you a tax benefit.

Under Section 80C, investments in select fixed deposits of 5 year tenure, provide an exemption of up to Rs 1 lakh.

Such fixed deposits, must be essentially from a bank, and are locked for the tenure, during which time, they can not be pledged nor withdrawn.

Also the fixed deposit certificate must mention the tax benefit under section 80C, on the face of the certificate.

7 most common myths and facts about fixed deposits

Myth 4: TDS on FD cannot be avoided, as it has to be paid by all.

Fact 4: Providing necessary documents could help avoid TDS.

Tax deducted at source on a fixed deposit is deducted once interest, in one single financial year, exceeds Rs 10,000 for bank deposits and Rs 5,000 for company deposits.

Housewives, minors or senior citizens, who do not have any other source of income, or whose income is below the taxable limit, could avoid this TDS. All that needs to be done is to provide the bank, Form 15G, or Form 15H in case of senior citizens, well in advance in the financial year.

7 most common myths and facts about fixed deposits

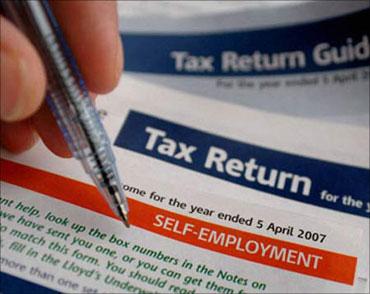

Myth 5: FD interest earned need not be declared in your tax returns.

Fact 5: Income earned on FD should be included in annual tax returns.

Well, if you are earning an income from your fixed deposits, you need to declare the same.

Interest earned from your FD must be included in your annual tax returns under the head 'Income from other sources'.

7 most common myths and facts about fixed deposits

Myth 6: Premature withdrawal is the only way if I need money mid way.

Fact 6: FDs have other options in times of contingencies.

If at any time you require money from your FD, most banks offer part withdrawal of funds, so that you could withdraw the actual amount you require, and the balance would continue to earn interest.

Some banks also offer flexi-deposits where the deposits are linked to a savings account. All excess amounts in the saving account are automatically swept into a deposit.

If one requires money at any time, he could withdraw just as he would from a savings account. Automatically parts of the deposit are broken to cater to the withdrawal.

Also, overdraft facilities are available of up to 80 to 90 per cent of the FD amount.

Please note: Tax saving FDs do not have these options.

7 most common myths and facts about fixed deposits

Myth 7: In the long term, fixed deposit offers better returns than the stock market.

Fact 7: The effective returns from an FD are lower than stock market returns

This is due to the fact that fixed deposits are unable to beat inflation.

For example, if the deposit earns you 9 per cent per annum and the inflation is at 8 per cent, the inflation adjusted returns works out to only 1 per cent (9 less 8).

A stock market portfolio may probably give you a much higher effective inflation adjusted returns in the longer run.