| « Back to article | Print this article |

5 reasons you shouldn't invest along the Yamuna Expressway

In the second part of the series on real estate investments in and around various hotspots in India we take a look at the Yamuna Expressway. Estatelister.com gives five reasons why the Yamuna Expressway will not turn out to be a multi-bagger in the next five years.

Yamuna Expressway, the flagship project launched by the Mayawati government in Uttar Pradesh is on the verge of completion and speculation is rife about how the response will be for the most ambitious expressway project in North India.

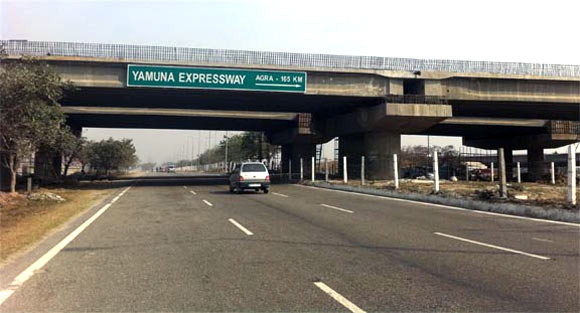

Built at a cost of more than Rs 10,000 crore by the Jaypee Group, Yamuna Expressway covers more than 165 km of road that connects Noida and Greater Noida to Agra, the city of the Taj Mahal.

This expressway is also an important means for reducing traffic on the busy National Highway 2.

Part I: Most promising real estate hotspot in Navi Mumbai

For Rediff Realtime news on Yamuna Expressway click here

5 reasons you shouldn't invest along the Yamuna Expressway

Yamuna Expressway, formerly known as Taj Expressway has been in the news since 2003, when a global tender was floated for the execution of the project. After the Jaypee Group was chosen as the concessionaire of the project, the project has gone ahead with full steam and so has the launch of real estate projects by Jaypee Group, Supertech, and 3C, to name a few along its 165-km stretch.

With property prices having increased a lot, there are a number of factors that need to be considered before committing any fresh investments in real estate projects in Yamuna Expressway.

1. Middle of nowhere

All compliments to the real estate developers but there are not many reasons that can be given for appreciation in property prices in the region. IT and services industry, one of the several middle-income jobs are not present in the region. Also, the Yamuna Expressway begins beyond Noida and Greater Noida, not exactly a part of the Delhi NCR region.

5 reasons you shouldn't invest along the Yamuna Expressway

2. Possession of projects

A majority of projects in the area are running behind schedule and with rising input costs and tight liquidity in the market, there is continued anxiety over possession of these projects.

5 reasons you shouldn't invest along the Yamuna Expressway

3. Opening of the Expressway

While the Jaypee Group has expedited the completion of the Expressway, assembly elections in Uttar Pradesh are likely to further delay the inauguration of the expressway.

5 reasons you shouldn't invest along the Yamuna Expressway

4. Toll rates on Expressway

Toll rates in India are growing at a fast pace and the extent of toll can prove to be a major point for actual end users / tenants to move into houses on the expressway. Tolls plazas, their placement, and provision of roads for local traffic are paramount when considering any fresh investment in real estate projects across the expressway.

5 reasons you shouldn't invest along the Yamuna Expressway

5. Competing supply

Many real estate projects in Greater Noida are nearing completion, and with Noida Extension projects now out of the woods with regards to land acquisition, there is a very strong competing supply coupled with much favourable location that can go against Yamuna Expressway projects. Not to forget that Gurgaon and Manesar real estate projects continue to attract strong investor interest.

According to the current prices that prevail along Yamuna Expressway, the pace of property price appreciation has witnessed a tempering. After the aggressive marketing of the past using the Formula1 event, it would require another big event to trigger sales momentum along the Yamuna Expressway. Overall, it can be firmly concluded that the boom period is over and one must not expect unrealistic returns over the next five year on their fresh investments.