| « Back to article | Print this article |

4 things you MUST KNOW about your DEBIT card!

ATM cards or debit cards are by far one of the most convenient options that have been introduced to encourage cashless transactions. It is convenient, easy to maintain and almost a direct replacement of cash. Unlike credit cards, which by design cannot and do not operate as cash, ATM cards are precisely designed for the purpose.

ATM cards or debit cards can do all that cash can do and much more. They are a perfect combination of cash and credit cards, imbibing only the positives of both. With debit cards being accepted in almost all sorts of online transactions, they can do what a credit card does minus the credit card's drawbacks. They are limited like cash, acting as a good stop-cork for any unwanted expenditure that necessarily seeps in with the flexibility of credit cards. But unlike cash, they are easy to handle and way more convenient.

The benefits of ATM cards are countless making them one of the most preferred modes of transaction for the common man. However, Murphy's Law is true for every sphere of life and debit cards are no exceptions. And with the kind of record that banking industry in India has when it comes to consumer issues, anything that can go wrong with debit cards will and does go wrong, leaving a set of extremely bothered consumers in its wake.

As always, we sifted through the complaints that landed on our desks and dug out the issues that were most striking and uncommon when it came to debit cards.

4 things you MUST KNOW about your DEBIT card!

1. No SMS alert for transactions

We had never thought this could be this relevant concern till one of our complainants drew our attention to its implications and the regulations which deem this compulsory. RBI has actually issued express regulations that mandate that customers get SMS alerts for all transactions done through their debit or credit cards from June 30, 2011.

These regulations are aimed at checking fraudulent transactions and encouraging usage of cards by customers. According to these guidelines by the Reserve Bank of India all lenders are instructed to provide SMS alerts for all card (credit as well as debit card) transactions irrespective of amount latest by June 30.

This clearly implies that you must get an SMS alert for every single transaction and if your bank fails to do so, you should immediately inform the bank and demand that alerts should be sent under all circumstances.

This may hardly seem relevant in normal circumstances especially for debit card usage. But the procedure is in place for a reason and one should not ignore the instances of its non-compliances till some disaster strikes. As was in case of this consumer who had lost thousand of rupees by the time he realised that he had actually lost his card just because his bank did not send SMS alert for the transactions his stolen card was being used for.

While this seems an extreme case, it is a pretty probable one too and nobody should leave such issues to chance. Always remember that your bank has a regulatory obligation to send you those alerts and if it does not, you should take it to task.

4 things you MUST KNOW about your DEBIT card!

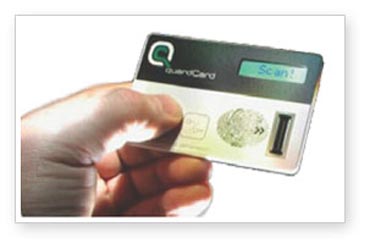

2. Secure online transactions

The amount of money that is lost by consumers in fraudulent online transactions is humongous. This despite the fact that this is one of the areas where banks have always been uncharacteristically cautious. Not only express instructions/ warnings are issued to the consumers about not disclosing their PIN number and other details on any web site on a regular basis, most banks have also brought in the concept of 3D pins to ensure further check on fraudulent transactions.

The consumers should themselves be extra cautious during online transactions. Make sure your 3D pin is generated as soon as you procure your card and keep it a secret.

Furthermore, while making online payment through debit/credit card, ensure the transaction is secure. Look for https instead of http in the web site's name. The additional's' stands for secure.

4 things you MUST KNOW about your DEBIT card!

3. Lost ATM card, lost money

What happens when you lose your ATM card? Apart from the partial heart attack of course. Well, you get your card blocked immediately obviously. But then, what if you still lose your money? Don't be shocked. That is very much a possibility as had happened with one of the consumers whose complaint landed with us.

In all such circumstances, where a consumer loses money via his lost ATM card despite informing the bank, the bank is held liable for the loss and is bound to compensate the consumer.

In all such circumstances, inform the relevant authorities in the bank and if the issue is still not redressed, take up the matter immediately before the Banking Ombudsman. Also, in case any such loss or theft, immediately file an FIR with police to establish the time of theft/loss.

Also an added advice, if you ever manage to recover a lost/stolen ATM card, never ever use it again. Cut it diagonally and throw it away. Get a new one issued from your bank for a minor fee.

4 things you MUST KNOW about your DEBIT card!

4. Money lost in transit

One of the most common occurrences during online transactions via debit cards or net banking services is losing money in transit. This happens when money gets deducted from your account but never actually reaches the seller's account due to technical hiccups.

In all such circumstances, such money is credited back into your account within five working days of such failed transactions and if this does not happen, you should immediately take up the matter with your bank. Also, as an added precaution, if one transaction fails and the money is stuck, try and avoid attempting another transaction immediately.

Most probably, the transaction will fail again and you will end with twice the money stuck in the system.

ATM cards are cashless and yet they are cash, the carriers of your hard earned money. Just as the responsibility of your cash lies with you, your ATM card and whatever happens to it is ultimately your responsibility. Be cautious, be vigilante and most importantly be aware of all the regulations and rights that are associated with debit cards.

Ultimately for any consumer, information is the most potent defense and most deadly weapon.