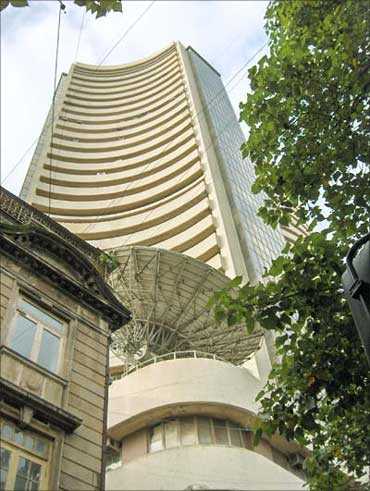

Photographs: Rediff Archives Pankaj Priyadarshi, Investmentyogi.com

In this article, we will discuss some of the short term strategies that investors and speculators follow. Most of the these look for short term gain. This, however unpalatable, is the fact of stock market everywhere in the world. In some markets, investors are more short-term oriented than those in other markets.

Indian stock market is also full of speculators who look forward to exploit the discrepancies in the market to achieve short-term gains.

There is nothing wrong in expecting short-term gains from market volatility. However, we should know the techniques and risks of short-term investing. Let's look at some techniques investors use for short-term gains.

Click NEXT for more

Disclaimer: This article is to give you an idea about various short-term investing strategies. You should evaluate all options and follow what suits you the best. This is not an advice or a recommendation.

4 short-term strategies for investing in stocks

Day trading

Day trading involves buying and selling the stocks in a very short period of time. The investor hopes to make money from rising prices of the stocks in the very short term. Hence you buy stocks and hope the prices will go up because the market is bullish.

This seems a very easy way to make money in the market. The only problem is that most of the day traders lose money.

Caution

If you want to indulge in speculative day trading, make sure you do not exceed a limited amount parked for it.

Usually investors should not keep more than 10% of their investment for day trading purposes. Anything beyond this is harmful for your wealth. Day trading is the most speculative technique.

Click NEXT for more

4 short-term strategies for investing in stocks

Image: People walk past a bronze replica of a bull at the Bombay Stock Exchange (BSE) building in MumbaiPhotographs: Punit Paranjpe/Reuters

Margin trading

This involves borrowing a part of the sum to buy stocks. The broker lends you money to buy the stock. The initial margin is the money that you have to contribute on buying stocks. Rest will be provided by the broker.

If the price goes down, your contribution will go down as well. If this falls below a certain level, your broker asks you to deposit more money to maintain the required margin. This request by broker is also called margin call.

This is the most dreaded call in the trading community.

Caution

A good practice to follow is to never put further money after you receive margin call. Let the broker sell the margin stocks and recover her/his money. This will limit your losses. It is better to accept that the speculation did not work out as expected.

Click NEXT for more

4 short-term strategies for investing in stocks

Short selling

Short selling is a practice where investors borrow stocks and sell. Later, they buy the same stocks and give it back to the lender. The investor expects the stock prices to fall after he or she has sold the borrowed stocks. Once the prices go down, investor can buy it cheaply and give it back to the lender, pocketing the difference.

Caution

This is a highly speculative game. If the prices go up, investors end up losing.

Remember, there is no theoretical limit on rise of prices and hence your loss is unlimited. Hence put a very small amount of your investment in short selling, if you are keen on trying it.

Click NEXT for more

4 short-term strategies for investing in stocks

Trading in options

An option gives you the right (but not the obligation) to buy or sell a stock at a pre-determined price after a certain period of time.

A call option is right to buy and a put option is right to sell.

Buying an option involves three components: option price, strike price, expiry date. Hence you pay a small price to buy an option. This means you will execute a trade in future at the strike price on the expiry date.

You can sell the option before the expiry also. The investor buys/sells call or put option depending on her/his view of the market.

Investors who expect the prices of a stock to go up would buy a call option (right to buy at a pre-determined price). If the price goes higher than the strike price, they stand to gain.

Similarly investors, who expect the price of a stock to go down, will buy the put option (right to sell at a pre-determined price).

In both the cases, investors are betting that the price of stock will increase or decrease in future and that will benefit investor. If this doesn't happen, investors stand to lose.

Caution

Trading in option is very tempting for investors because the price of options looks cheap. However, the possibility of loss is high because any fluctuation in price of option will be significant. Before you venture into options trading, understand the risks involved.

Click NEXT for more

4 short-term strategies for investing in stocks

Final words

Investing cannot be anything but long term. Short-term investing is called speculation. It is easy for people to fall for short term, speculative trading because the brokers push for it. There are also stories built around successful short term traders.

Remember, however, for one successful short-term trader, there are many that have failed and never made it to news.

Comment

article