Photographs: Dominic Xavier/Rediff.com Sameer Hassija

Tax advantage, absence of huge interest rate risks and better returns makes investing in liquid mutual funds a viable option to park your spare cash.

Ask most savers where they keep their emergency funds or just their cash, and more often than not the answer will be in a bank savings account. Many do believe that there is no alternative vehicle to park their surplus cash. Well, they are mistaken. The liquid fund is actually a much more viable option.

Liquid funds are open-ended schemes that invest in short-term money market instruments such as Treasury Bills, Pass Through Certificates, Certificates of Deposit and Commercial Paper. The logic of such funds is to have a portfolio that is high on liquidity and low on risk, exactly what an investor needs for her/his surplus cash.

How to earn returns better than your savings account

Photographs: Uttam Ghosh/Rediff.com Sameer Hassija

Liquidity

The liquidity needs of investors are not at all compromised. For all redemption requests submitted and time-stamped before the cut-off time, the payouts are made the very next day -- this is also known as redemption on T+1 basis.

How to earn returns better than your savings account

Photographs: Rediff Archives Sameer Hassija

Returns

In spite of the de-regulation of interest rates for savings bank accounts announced by the Reserve Bank of India, only a handful of banks offer 6-7 per cent interest on a savings account, most still offer just 4 per cent. Switching to another bank is a bother and also, there is no guarantee that the bank will keep offering such a rate. A smarter move would be to consider a good liquid fund.

In the current high interest rate scenario, the category of liquid mutual funds delivered annual returns of 9.5 per cent and 8.7 per cent for calendar years 2012 and 2011, respectively. In fact, the minimum return given by any liquid fund during these calendar years was 7.4 per cent for 2012 and 6.7 per cent for 2011, which is still much higher than the 4 per cent interest rate offered on your savings deposit.

How to earn returns better than your savings account

Photographs: Utam Ghosh/Rediff.com Sameer Hassija

Taxation

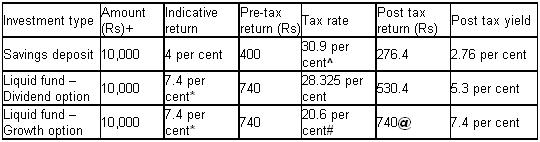

Interest from a savings bank account is added to an individual’s income and taxed at the applicable income tax rate, though interest up to Rs 10,000 in one financial year is exempt from tax. A point worth mentioning is that only a few banks pay the interest at quarterly intervals, most do so half-yearly.

Liquid mutual funds offer a tax advantage over savings deposits.

For the dividend plans, dividend distribution tax, or DDT, on liquid funds is 28.325 per cent. An individual who falls in the highest tax bracket will have to pay a tax of 30.9 per cent on the interest s/he earns on her/his bank savings account.

Similarly, in case of the growth option, returns from liquid funds would attract long-term capital gains if redeemed after a year (10 per cent without indexation and 20 per cent with indexation plus cess).

A look at the illustration below clearly indicates that the post-tax return on a liquid fund is likely to be higher than that the return earned on savings bank account.

+ The above example is purely for illustration purposes since interest up to Rs 10,000 earned on your savings bank account in one financial year is exempt from tax

* The lowest return given by a liquid fund in CY2012

^ Assuming that the individual falls in the highest tax bracket

# Due to indexation, long-term capital gains tax is 20 per cent

@ Indexation benefits have resulted in nil tax

How to earn returns better than your savings account

Photographs: Utam Ghosh/Rediff.com Sameer Hassija

Risk

Since the instruments in such a portfolio have a maturity period of less than 91 days, the interest rate risk does not exist to the tune it does in other debt funds. Moreover, the fund managers tend to stick to a high credit rating to maintain a very high quality portfolio which makes it less susceptible to default risk.

Just a note of caution though, liquid funds are not completely risk-free. This very year itself, in mid-July, the net asset values of liquid funds showed a negative return over a short period.

The Reserve Bank of India intervened very aggressively in the market to curb currency speculation and halt the slide of the rupee. The fallout was rising short-term rates and a tight liquidity position which made liquid funds lose out on mark-to-market valuations. Such funds had to make accounting of returns on mark-to-market basis in the case of all paper with a residual maturity of 60 days and above.

A sharp increase in overnight rates led to a fall in bond prices leading to the loss in valuation. As a result the NAV of liquid funds dropped. Though it spooked investors, the drop was marginal. For instance, between July 15 and 16, the drop in NAV of liquid funds was a maximum 0.34 per cent. This was a one-off event that did not last long. Normalcy returned soon and liquid funds are back on track.

Looking at all the parameters, liquid funds make for a strong case. If you still feel that you do not want to take such a risk, start by placing a part of your cash in liquid funds and the balance in your savings account.

Comment

article