These are the top 8 out of 88 funds that the diversified equity fund category has to offer.

Diversified equity mutual funds are the most preferred category of equity funds for investors. Also known as multi-cap or flexi-cap, these funds invest across companies and sectors with varied market capitalisation.

That simply means, a diversified equity fund can invest in large cap, small cap and mid cap companies.

While large cap companies provide stability to the portfolio, the small and mid cap stocks enhance the returns of the portfolio over long period of time.

Our research shows that in terms of risk return characteristics, diversified equity funds have given superior returns than large cap funds.

As you can see below, the annual returns of diversified equity funds as a category have always been superior to large cap funds in most of the last 12 years -- starting from 2004 to till 2015 -- except in the year 2006, 2008 and 2011.

2006 was an exceptional year when large cap returns were better than that of diversified equity funds. Year 2008 and 2011 were the years when markets gave negative returns.

Even after the great fall in 2008, the diversified equity funds gave almost 85 per cent return in 2009 when the markets rallied, compared to around 65 per cent return by large cap funds.

Similarly, after a subdued performance in 2013 by both the categories, the diversified equity funds again bounced back by giving 50 per cent return compared to around 35 per cent return by large cap category in the year 2014.

Even in terms of annualised returns, we found that the trailing returns of diversified equity funds were superior than large cap funds over the last 1, 3, 5 and 10 years period (data as on December 23, 2016).

In this context, however you may find that while investing in diversified equity fund is a better option for seasoned investors, for new investors, large cap mutual funds can still be the best option.

How we have chosen the top diversified equity funds

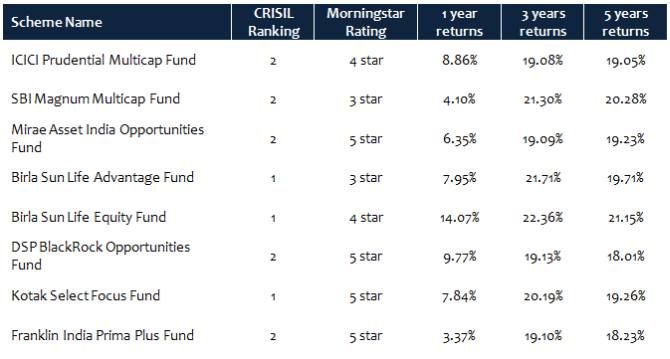

In this post we will review some of the top performing diversified equity funds for investment in 2017. Our selection is based on CRISIL's last mutual fund ranking report (quarter ended September 2016).

CRISIL ranks equity funds based on several parameters like average three year annualised returns, volatility, portfolio concentration risk (both industry and company) and portfolio liquidity risk.

Each of the diversified equity funds in our selection has been assigned either Rank 1 or 2 by CRISIL. In addition to the CRISIL ranking we have applied a secondary filter based on our own research on quartile ranking.

Mutual Fund Quartile ranking is an analytical tool which measures how well a mutual fund has performed against all other funds in its category.

From the CRISIL top ranked diversified equity funds, we have selected only those funds, which are currently ranked in the top quartile based on trailing 3 year returns.

Further, in order to see performance consistency, we have limited our selection to funds, which were in the top quartile in the previous two quarters out of three quarters.

The table below lists the top 8 diversified equity funds based on the above selection criteria.

Here, please note that categorisation of diversified equity funds in CRISIL, Valueresearch, Morningstar and Advisorkhoj are different. Therefore, even though we have considered the fund ranking of CRISIL, we have chosen the schemes based on Advisorkhoj diversified equity fund category.

As you can see in the chart above (Source: AdvisorKhoj), other than Birla Sun Life Equity Fund, none of the funds could deliver double digit return in the last 1 year. However, the returns in the last 3 and 5 years were in the horison of 18-22 per cent annualised. We at Advisorkhoj, always suggest that investment in equity mutual funds should be done with an investment horison of minimum 5 years.

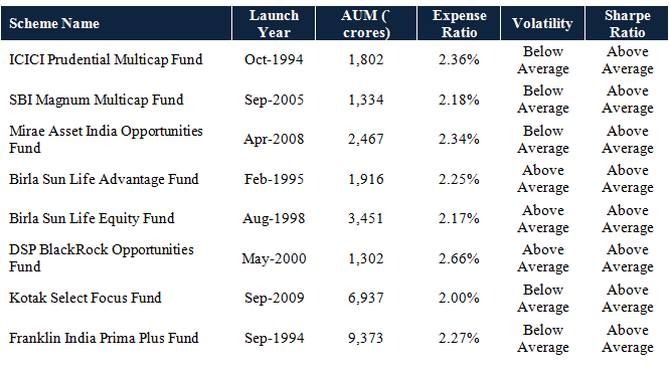

Let us now look at some other key statistics, like assets under management (AUM), launch date of the scheme, scheme expenses ratio, volatility and the sharpe ratio.

From the above chart (Source: AdvisorKhoj), you can see that fund expense ratios are varying from 2-2.66 per cent. However, as long as the fund manager is generating good alpha and beating the category and benchmark returns, retail investors should not worry much about the expense ratios. We suggest you should know the importance of Alpha in fund selection.

Benefits of investing in diversified equity funds

- Diversified equity funds invest across various sectors and market capitalisation. Different sectors play out differently in various market cycles. For example -- if the markets are rising the largest market cap stocks tend to perform well during the initial phase of the bull market. Mid and small cap stocks also tend to do very well when large cap valuations look stretched. However, when in bear markets, mid cap and small funds tend to more volatile than large cap funds. Therefore, we can say that while the large cap holdings of the diversified equity fund provides a certain degree of stability in volatile market conditions, the small and midcap holdings enhance the returns over a long investment horizon.

- Diversified funds are all season fund. As an investor, instead of choosing many funds from different categories you can choose couple of diversified funds and remain invested for the long term. For example -- you can choose funds from large cap, small cap, mid cap and sector funds and create a diversified portfolio. Whereas, if you are choosing good diversified equity funds then you need not select many funds from different categories.

- Diversified funds can provide superior returns compared to large cap and sector funds over a long investment horizon. As we have seen in the chart-1 above, diversified funds have performed better than large cap funds as it is investing across sectors/stocks and market capitalisation. The underperformance of one sector or market cap segment gets compensated by good performance of another sector or market cap segment.

- Diversified fund rebalances the risk. As you are investing across sector/market and capitalisation, your risk also gets rebalanced. For example -- you can invest in mid and small cap funds and take much higher risk but if you are investing in diversified equity funds the risk gets mitigated to a greater extent due to the large cap stock holding in the portfolio. While you may take moderate risk investing in large cap funds, in diversified equity funds, though your risk rises to moderately high level (due to mid/small cap holdings), you can be compensated by the superior returns.

Conclusion

We have seen and discussed the various benefits of investing in diversified equity funds, which remains a popular choice of investors and advisors. We have selected top 8 funds for you, out of 88 funds that the diversified equity fund category has to offer (according to categorisation of Advisorkhoj). However, please note that while diversified equity funds can provide superior return than large cap funds, they also carry higher risk. All the funds in our selection fall in 'Moderately High Risk' category according to their respective 'Riskometers'.

Therefore, investor must know their risk profile before investing in these funds or consult a financial advisor.

Photograph: Courtesy, picjumbo.com

© 2025

© 2025