You must have heard about the term IDV from your insurance agent or you may have read it in your vehicle insurance policy. But do you know what actually IDV is? Neeraj Gupta explains how IDV helps find the market value of your car as well as bike.

You must have heard about the term IDV from your insurance agent or you may have read it in your vehicle insurance policy. But do you know what actually IDV is?

In elaborated form, IDV is known as Insured Declared Value and is typically the current market value of your vehicle and the maximum sum assured payable by any insurance company on account of total loss of the vehicle.

Generally IDV is maximum 95 per cent of selling price of the car and does not include cost of registration and accessories. But if you are planning to sell the vehicle, you cannot sell it at the same cost as IDV.

For example, if you buy a new car with an ex-showroom price of Rs 10 lakh, the first year policy will have the IDV at Rs 9.5 lakh but you can’t expect to receive Rs 9.5 lakh even if you sell the car in the market after driving the same for a month.

In another case, for example, after purchasing your car you got it customised with expensive accessories, engine modifications by spending Rs 4 lakh on it. In this case, the market value of your car will be Rs 2-3 lakh higher than the IDV.

So, clearly the IDV is not the market value of the car, but only a reference to the same.

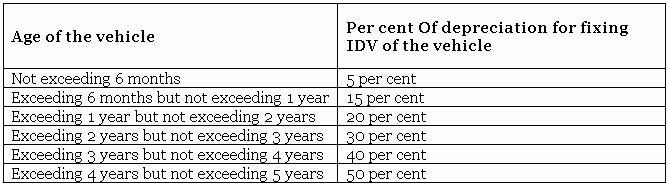

The insurance regulator, IRDAI (Insurance Regulator Development Authority of India) has laid down the rules for calculating the IDV of vehicles that are up to five-year-old.

Beyond five years, insurers would typically depreciate the value of the car at 5-10 per cent on mutual agreement between you and your insurer.

For instance, if the car at the end of 5 years is valued at Rs 2.5 lakh, then for the sixth year it would typically value anywhere between Rs 2.25- 2.37 lakh on your mutual agreement.

Why is IDV important?

Just like any other insurance policy, car insurance promises a sum assured and IDV is the most important factor to calculate it.

That is the amount which a person will get in case of total or constructive loss/ theft or accident.

Total loss is the scenario when the insurer’s share of the total repairing cost is more than 75 per cent of the IDV.

In such a case, insurer will pay you IDV after deduction of compulsory deductible charges and keep the scrap.

Why should you declare the correct IDV for your car?

While buying a new policy or renewing the policy, customers should disclose correct IDV. The thumb rule to determine the value is 10 per cent depreciation each year with (plus or minus) 10 per cent on that.

People sometimes agree to a lower IDV just to save a few bucks on the premium but it will reduce the claim amount at the time of utmost need.

At the same time, overstating the IDV can also lead to issues. If any insurer, irrespective of the IDV mentioned in the policy, finds it to be too high in comparison to the expected value, they will investigate the same while settling claims and pay money accordingly.

Photograph: Scott Umstattd/Unsplash.com

Neeraj Gupta is Head of Motor Insurance, PolicyBazaar.com

© 2025

© 2025