Sorry guys and gals but you have really inspired me to write this. Honestly, this is dedicated to you. Here it goes!

1. Your cheques bounce

Oh not regularly but four times in a year. This could be because your salary came late, you forgot to transfer from salary account to EMI account, your wife withdrew money without telling you... blah blah blah, but the fact is four cheques out of 36 (3 EMIs per month you see -- car, house, mobike).

2. Last year out of 12 EMIs for your educational loan, 3 were paid for by your dad.

Not because of love, but because he did not want your credit rating to slip below default category

3. You cannot live for six months without in a job and your girl friend/ wife is in the same position. Safety net? You got to be joking.

4. You are scared of losing your job which you completely HATE. You have no choice but to stay on in this job and listen to all the nonsense that your boss gives you. Sadly your pregnant wife is in a similar situation. If the doctor suggests bed rest for your wife... OMG

5. You always pay slightly more than minimum amount to be paid on your credit card. You have NO clue how much interest and penalty you are paying.

6. You married on credit, you vacationed on credit, you bought your furniture and car also on credit. In most cases you are paying off the loan much longer than the use of the asset. Not talking of marriage, though!

7. Marriage came as a boon -- there was somebody to share your expenses, but you realised she is just as bad.

8. Credit score? Well well. You do not know what it is, right?

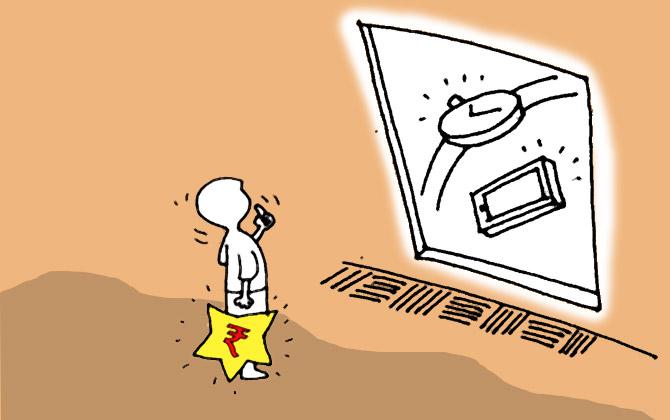

9. When you buy any asset the only thing you consider is 'can I afford the EMI?'. This means all your assets have an extra interest cost. You do not even KNOW this.

10. You regularly refinance your outstandings -- not because the interest rates have dropped but because you need to reduce your EMIs.

11. You have hopes of doing your own business, but do not even dare to dream because at 34 with a networth of Rs 22 lakhs you and your wife are wondering what to do.

12. You are in debt, but all your work is outsourced. Your clothes are laundered. You eat out 3 times a week.

13. Investing? Your classmate from MBA made you open a brokerage account -- you did some trading transactions, lost about Rs 20,000 and now have sworn never to go near the equity markets.

14. You bought a ULIP to help a friend meet a target but the policy lapsed when your friend left her job.

Want more? I thought this was enough!

Illusration: Uttam Ghosh/Rediff.com

© 2025

© 2025