| « Back to article | Print this article |

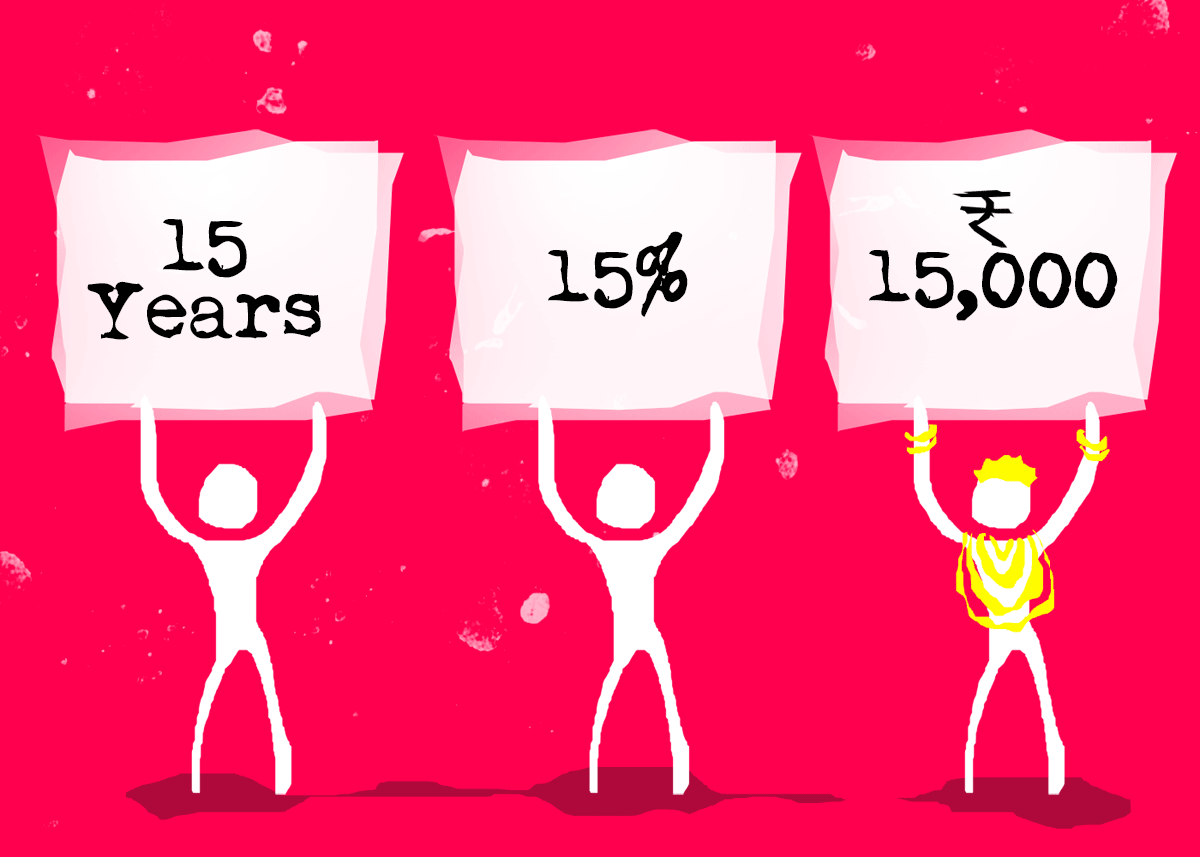

Follow this 15 x 15 x 15 rule to become a crorepati without taking big risks.

Ramalingam Kalirajan explains how.

Imagine a future where you've achieved financial freedom, where your investments have grown to make you a crorepati without requiring constant monitoring or high-risk bets.

This dream is within your reach and the key lies in a simple yet powerful strategy known as the 15 x 15 x 15 rule. By committing to this rule, you can turn disciplined savings and smart investing into substantial wealth over time.

Let's delve into how the 15 x 15 x 15 rule works and how you can leverage it to secure a prosperous financial future.

The 15 x 15 x 15 Rule: A Breakdown, Not a Breakaway

The formula is very simple:

Is a 15 per cent Annual Return a Sure Thing?

The financial market, as much as we'd like it to be a predictable paradise, operates with its own set of rules.

Historically, equity markets have delivered an average return of around 12-14 per cent. However, past performance isn't a crystal ball. Market fluctuations, economic upheavals, and unforeseen events can all impact your returns.

So, does this mean cracking the crorepati code is impossible? Not at All.

The 15 x 15 x 15 rule offers valuable insights, like:

The Reality Check

While the rule offers a basic framework, several factors can influence the outcome:

Building a Robust Investment Strategy

To increase your chances of financial success, consider these steps:

The 15 x 15 x 15 rule is a helpful framework, but it shouldn't be your sole guide. Consider these factors to build a personalised investment strategy that reflects your unique circumstances:

Limitations of the 15 x 15 x 15 Rule

While the 15 x 15 x 15 rule is a compelling strategy, it has its limitations:

Investing in mutual funds offers several advantages over other investment options:

Benefits of Investing in Mutual Funds

Investing in mutual funds offers several advantages over other investment options

Diversification

Professional Management

Affordability

Tax Benefits

Tax deductions: Some mutual funds, such as Equity Linked Saving Schemes (ELSS), offer tax benefits under Section 80C of the Income Tax Act.

Takeaway

While the 15 x 15 x 15 rule offers a simplified path, becoming a crorepati requires a well-defined investment plan.

Consult a financial advisor to assess your unique needs and develop a personalised strategy that considers your risk tolerance, investment goals, and time horizon.

Remember, consistent investing, smart asset allocation, and a long-term focus are the key ingredients to achieving your financial dreams.

So, use the 15 x 15 x 15 rule as a stepping stone, but build your own robust investment strategy for a secure and prosperous future!

Ramalingam K, an MBA in Finance, is a Certified Financial Planner. He is the Director and Chief Financial Planner at holisticinvestment, a leading financial planning and wealth management company

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.