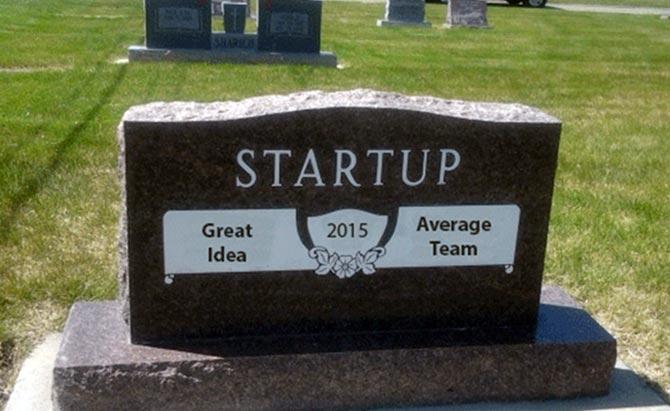

Ignoring your customers, not taking stock of your team's problems early on and failing to adapt to the evolving market are just a few reasons that could lead to the untimely death of your start-up, say experts.

Photograph Courtesy: YourStory.com

Starting your own business is pure excitement.

You are in command, you dream of changing the market and raking in profits along the way.

But soon, reality sets in: a key member of the team wants to move out, cash is drying up and there is no new money in sight, customers are checking out the site but there is little conversion and worse, one of the founders is not getting along with the investors.

If you are an entrepreneur, any or all of these problems can hit you.

Alokananda Chakraborty speaks to four founders about the problems every start-up should anticipate.

The lesson: Be paranoid, but don't let these issues immobilise you. Read on...

Keep a close watch on the market: Ashutosh Lawania, co-founder, Myntra.com

There is a chance that in the initial exuberance you lose sight of market sentiments.

There is a chance that in the initial exuberance you lose sight of market sentiments.

As a business you have to keep a close watch on the market.

Keep looking at not just what is working but also at the failures.

A lot of times investors make investment decisions based on the market sentiment.

So you have to make your plans -- plans to scale, plans to raise money, plans to expand your business -- based on the prevailing investor sentiment vis-a-vis the market.

Keep a strategic outlook and pace your organisation accordingly.

It is easy to close yourself to the idea of change.

Don't get carried away by the initial success of an idea. You have to keep validating your ideas against the plan.

You must be open to change, you must be ready to tweak or make a strategic shift, if the market demands that you do it.

You might find that your idea is not scaling up that well, go figure out why.

You must have done a study or researched the market before launch and drawn the business plan accordingly.

If things don't go according to plan, be ready for change -- it is possible you are trying to move a needle which is not the right needle to start with.

Be open to listening to the investor, listen to the other point of view, look at other geographies to see what works or what doesn't in your market.

You have to anticipate changes in the market behaviour and move in that direction; otherwise someone else will.

Don't let mediocrity set in. You must understand that the final output depends on the team. And the truth is the team's enthusiasm is not enough -- they have to aim high.

The first thing you have to do is create a culture of accountability, make it clear that mediocre work will not be accepted.

Remember you have to build that culture -- so be critical of people, be direct with your feedback, make everyone accountable.

You might be so busy building a product or a service that you end up ignoring corporate culture.

All the things I have mentioned before ultimately tie in with the culture you have inculcated in the organisation.

Establish a distinct culture right from the beginning.

Make sure everyone you hire and take along imbibe that culture, subscribe to it.

It becomes difficult to move the whole organisation in one direction if there is a clash of cultures.

Organisation should have frugal mindset.

There has to be a reason and someone should be accountable for every penny that gets spent in the organisation.

Photo Courtesy: LinkedIn

Don't focus on customer reticence: Harish Iyer, Founder and CEO, Flinnt.com

To figure out the reason for customer reticence, the team often ends up neglecting customer needs: After the initial high from having discovered a product or service related to an unfulfilled need of the customer comes the plateau.

To figure out the reason for customer reticence, the team often ends up neglecting customer needs: After the initial high from having discovered a product or service related to an unfulfilled need of the customer comes the plateau.

The business development team may discover that the enthusiasm for the product is not shared by the customer.

It is important that every time the team faces failure or a lack of customer interest, it turns its focus on customer needs and how the product can be improved to suit the needs.

Don't focus on the customer reticence. You can't change the customer, you can only change the product, the team needs to be constantly reminded about this absolute truth.

You might start small but you have to quickly start thinking big: The users today are used to super-fast Google services, a super smooth WhatsApp and a lightning fast Twitter.

Users expect a similar performance from every technology product or service -- matching that kind of user experience is difficult as the tech biggies are backed by billions of dollars and have million-dollar engineers.

The best thing when you start is to keep the initial offering to a minimum, not try to solve every problem, not overload the service with too many features.

This will enable the start-up to allocate scarce resources to key features and provide a great user experience.

You might lose faith in your offering and grass on the other side might start looking greener: As you struggle to show the proof of traction, there will be individuals, large customers, consultants and advisors who will ask you to tweak the product or features.

It is important to remember that any change will require allocation of time, money and human resource, the team will begin to slack off and wait for the new killer feature or tweak.

It is important to keep listening to the customers and keep the product or service evolving.

You might accord more importance to investor requirements under pressure: Focus on your needs not investor requirements.

The media is agog with start-up stories, huge numbers are being thrown around, success stories are hyped.

In the age of hyperbole, it is easy to be deluded into thinking that if your start-up doesn't need a few million dollars your idea is not big enough.

It is important to believe that your big idea may need small investment, you need only customer validation, investor interest is a byproduct not the goal.

Photo Courtesy: LinkedIn

Avoid putting your family money: Supam Maheshwari, CEO and founder, FirstCry.com

Finances can go haywire: Cash flow management is critical to the survival of a small business.

Finances can go haywire: Cash flow management is critical to the survival of a small business.

Some business consume quite amount of cash, so preferably avoid putting your own family money in the game.

Managing three to six month of forward cash flow is critical to scaling up of the venture.

Raising money timely from VC/PE is key as little or no money in the bank can mean your negotiation power is weak.

Also live frugal and build an environment of frugality till business can afford certain basics. Once a frugal culture is developed, everyone understands the essence of money.

The founders/one of the founders might want to exit: This is a very tricky matter.

If you are a venture funded company, then there are clearly defined rules of the game in the document.

Before you sign them, please ensure you cover yourself well enough.

Your founding equity in the company should not go away (like you have to sell it to the company or investors at par value) if you are fired without reason.

Typically all VC/PE are reasonable people but ensure such clauses are worded appropriately.

Investors expect a certain code of conduct, which is not difficult to maintain, therefore arriving at mutually acceptable terms should not be difficult. But you must read the SHA or the shareholder agreement, very carefully.

Good investors may not be easy to impress: This is a very detailed topic.

It varies from business model to entrepreneur, the maturity of business, opportunity size, investor's view point of how they are looking at the landscape.

Typically, angel or Series A funding has no real rules of the game.

First make sure you have a rock solid founding team, a massive sizeable pain that you are trying to solve (market opportunity), very passionate and differentiated path to solve the pain if you are raising Series A or angel round. Believe in yourself and negotiate hard.

Better negotiation also communicates your confidence in the idea.

Do not give more than 25-30 per cent at Series A and this dilution can help you raise anywhere between $ 1 to 10 million depending on the various points stated here.

For a mature played out business model, valuation becomes more scientific with some tools like DCF or discounted cash flow models etc.

Meet with some fellow experienced entrepreneurs, before fund raising to guide you.

At times, it is even wise to hire an investment banker.

Do not send your presentation to all investors in one shot.

You have to ensure that they feel that you are a highly desired/scarce asset, then only you will get value else you will get poor grade investors.

Photograph: Yourstory.com

Get the right mentor: Adhil Shetty, Founder and CEO, BankBazaar.com

Make sure money does not dry up: As a start-up grows rapidly it is difficult to firm handle on the inflow and outflow of cash.

Make sure money does not dry up: As a start-up grows rapidly it is difficult to firm handle on the inflow and outflow of cash.

But you have to do it -- usually in a growing business spending happens fast, and money inflow, whether as sales revenue or new business or new investment, happens slowly.

Also even if company is making profits, there may not be much idle cash because in the growth phase you would be investing most of it back into the business.

The seasonal sales, increasing operational cost and unpredictable expenses make smart cash flow management imperative and if it is not taken up as priority it would put a start-up in a self-invited perilous situation.

Don't get overwhelmed by changes in the industry: The whole online world is changing rapidly and so is the consumer.

The development of technology and infrastructure will make things more challenging and will require one to react faster.

Also one should have a strong product team which is capable of identifying the changing trends as early as possible. That capability would give a start-up more time to react and develop better solutions.

Don't give talent a short shrift: Like every business of every size, getting the right talent at the right time, and then retaining them, is the biggest challenge for start-ups.

It is very important for a start-up to not only ensure the right ecosystem for talent acquisition in place, but to see to it that they grow as professionals in their career.

The workforce today is young and ambitious and it will be difficult to retain them if there is a mismatch between their professional and personal goals or between their own goals and the organisational goal.

Drawing a career path for employees is a good way to retain them.

The short-term solution is to find out their expectation from the job.

If they are looking for a change in the job profile, you should be ready to cross-deploy them.

While focusing on investors, don't overlook the contribution of the mentor: A start-up deals with a lot of unpredictability regularly.

One way to insulate your people for the vagaries of the market is to get the right mentor.

The investor will show the right direction and help remove roadblocks.

A mentor, on the other hand, will help understand work ethics. His/her guidance help establish the right value system, the right attitude.

A right mentor gives unbiased valuable inputs to the company and be harsh at times to show the reality before it's too late.

Photograph: Sreeram Selvaraj