Crorepatis' income rose by a staggering 40% between 2015-2016 and 2017-2018.

Abhishek Waghmare reports.

Illustration: Uttam Ghosh/Rediff.com

During the first three years of the Narendra Damodardas Modi government at the Centre, the income of the country's super-rich has grown at a much faster pace than that of those not-so-affluent, show recent income-tax data released by the Central Board of Direct Taxes.

The total income accruing to individuals earning more than Rs 10 million (or the crorepatis) rose by a staggering 40 per cent between assessment years (AY) 2015-2016 and 2017-2018.

By comparison, the total income of those earning less than 250,000 per year contracted by 40 per cent during the same period.

The total income of individuals in the first taxable slab -- those earning between Rs 250,000 and Rs 500,000 annually -- grew by 21 per cent, the data showed.

The crorepatis' income as a proportion of overall income across all slabs increased from 7.2 per cent in AY 2015-2016 to 7.8 per cent in AY 2017-2018.

At the other end of the spectrum, the share of the combines income of those earning less than Rs 500,00 declined from 41 per cent to 34.5 per cent during the same period.

Tax assessment is typically done in the year that follows.

For instance, I-T returns filed and assessed in AY 2017-2018 pertain to incomes earned in financial year 2016-2017.

The period from AY 2015-2016 to AY 2017-2018 very closely captures the first three years of the National Democratic Alliance government led by Narendra Damodardas Modi.

It must be noted that while the data on direct taxes capture some traits about incomes in the formal sector, they do not provide a comprehensive picture of the economy, since the informal sector provides most of the jobs in India.

However, these numbers do provide an insight into the changing income distribution and the level of inequality in India.

This analysis is based only on data for income-tax filers, not all taxpayers.

Now, at an aggregate level, the number of I-T returns filed by individuals rose by 15 per cent between AY 2015-2016 and AY 2017-2018, while the total gross income grew by 32 per cent.

But the trend of I-T returns filed across income slabs sheds some light on the inequality between lower and higher income levels.

At the granular level, the rise in incomes and returns filed is much higher among higher incomes slabs than that among lower income slabs.

"There could be multiple reasons for this. Either low-paying regular salaried jobs are reducing or higher nominal wage growth is pushing people into higher income slabs. One also has to examine whether the tendency to file taxes at lower income levels has declined or not," said an analyst.

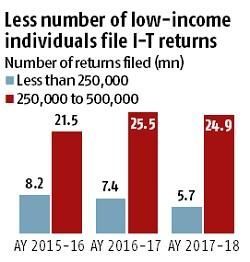

The number of returns filed in the lowest slab (those with incomes of less than Rs 250,000) declined in absolute terms from 8.2 million in AY 2015-2016 to 5.7 million in AY 2017-2018 -- a decline of 30 per cent in two years.

In the next income slab (Rs 250,000 to Rs 500,000), the number of returns filed increased 16 per cent in two years, but surprisingly it showed a marginal dip of about 2 per cent from AY 2016-2017 to AY 2017-2018.

In all the higher slabs, the number of returns filed has risen by 16-46 per cent in the period.

This is suggestive of wage inflation with no jobs, says Pronab Sen, former chief statistician of India.

"It suggests that people's salaries are rising faster than the rate of new job creation," he added.

If we go a bit backwards in time, the number of I-T return filers at the lowest slab has been declining at least since AY 2013-2014.

"There seems to be an increasing tendency not to file returns at lower slabs, primarily since in the case of salaried individuals tax is mostly deducted at source. As for the lowest slab, people do not file returns since they think they do not need to pay tax anyway," noted a former CBDT member who did not wish to be named.

Now, total incomes declared in each slab divided by the number of people who filed those returns gives us the average individual income in that particular slab.

Average income of an Indian crorepati rose about 4 per cent from Rs 25.8 million per year to Rs 26.8 million a year in two years.

The income of an average person in the first taxable slab also grew at a rate near 4 per cent, but in absolute terms that increased her average incomemarginally from Rs 340,000 a year to Rs 355,000 a year.

This hardly even covers the impact of inflation.

For a person in the lowest income slab, the average annual income actually declined from Rs 180,000 per year in AY 2015-2016 to Rs 160,000 per year in AY 2017-2018.

A reduction in average annual income to the tune of Rs 20,000 at the lowest slab, while an incremental income of Rs 1 million added to the average crorepati income in two years, seems to explain the enormity of India's income skew.

- Those earning less than Rs 250,000.

- Those earning between Rs 250,000 and Rs 500,000.

- Those earning between Rs 500,000 and Rs 1 million.

- Those earning between Rs 1 million and Rs 5 million.

- Those earning between Rs 5 million and Rs 10 million.

- And those earning Rs 10 million or more -- the crorepatis.

© 2025

© 2025