| « Back to article | Print this article |

Why Jaitley's 1st Budget is impressive on all counts

The Budget contains several measures to allay business concerns about the application of tax policies, notes Rajiv Lall.

Most of the print media commentary that has so far appeared on the Budget has been quite parsimonious in its praise.

Not surprisingly, the Left-leaning opposition is alleging that this Budget does little for the poor. But even among the Modi fans, "disappointing" is an adjective that is being used quite a lot to describe Arun Jaitley's maiden effort. And if equity markets are any indication of the wider reaction to the Budget, then it is fair to say that the Budget has at least received only a lukewarm reception.

This is unfortunate and has perhaps a lot to do with communication and the manner in which the Budget speech was crafted.

There is, however, quite a lot of substance buried in the Budget itself.

And if the Budget is considered in conjunction with other decisions that this government has taken so far, then one can clearly discern the contours of a significant directional change.

My read is that this government wants to be pro-growth and pro-business without being anti-poor.

This is not a United Progressive Alliance (UPA) redux. The UPA felt obliged to put inclusion before anything else.

The emerging difference on economic issues between the National Democratic Alliance (NDA) and UPA is exactly what we would have expected - it is what separates Jagdish Bhagwati from Amartya Sen on the growth versus equity debate.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Why Jaitley's 1st Budget is impressive on all counts

This Budget is quite clearly pro-business: Here are few illustrations.

The Budget contains several measures to allay business concerns about the application of tax policies.

A serious effort has been made to reduce the burden of tax disputes and litigation by expanding access to the advance rulings, enlarging the scope of the Income Tax Settlement Commission and setting up a mechanism for regular consultation with trade and industry to improve clarity of tax legislation.

Although Jaitley may have come across as needlessly churlish by insisting that the government must retain the right to legislate retrospectively, he did make it abundantly clear that this government will not "bring about any change [in tax policy] retroactively which creates a fresh liability".

Second, by raising the limit to 49 per cent for foreign direct investment in both defence and insurance, the Budget should allay concerns about this government's stance towards foreign capital.

Third, the Budget complements already announced measures (such as the introduction of a system of self-declaration) aimed at lightening the burden of the "Inspector Raj".

The finance minister announced the launch of an electronic platform to make business- and investment-related clearances available on a 24x7 single portal and also the launch an "Indian Customs Single Window Project" to allow importers and exporters to lodge their clearance documents at a single point without having to approach multiple agencies.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Why Jaitley's 1st Budget is impressive on all counts

Fourth, the Budget committed meaningful support for MSMEs and entrepreneurship development in the form of a ~10,000 crore-venture fund for start-ups.

These are all concrete indications of this government's focus on making the business climate more welcoming to businesses both big and small, foreign and domestic.

It is also pro-investment and growth: In fact, Jaitley has made it amply clear that he is taking a calculated bet by placing the revival of growth above the goal of formulaic fiscal austerity.

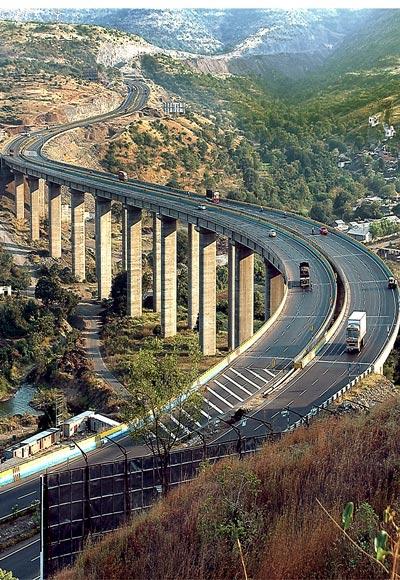

Although he expects to shrink the fiscal deficit this year compared to last, he may not achieve the target of 4.1 per cent. He has quite deliberately raised the allocation for capital expenditures targeting increased budgetary spending on high impact infrastructure.

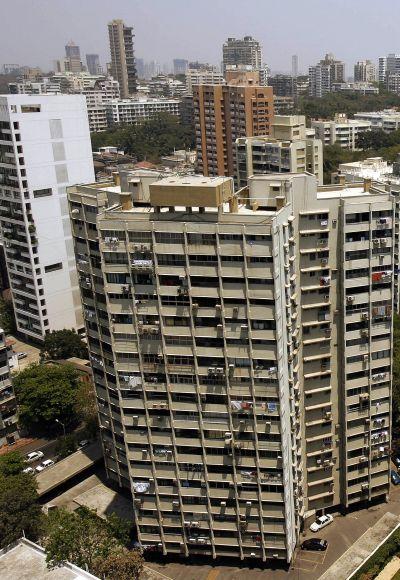

This includes significantly higher spending on roads (expressways and rural roads); more for network expansion of the railways; allocations for low-cost housing, the development of "smart cities" and urban regeneration; allocations for industrial corridors; and support for irrigation, watershed development and the expansion of warehousing capacity for agricultural commodities.

Overall, the Budget provides for nearly 19 per cent growth in capital spending.

In addition, Jaitley has managed to push through the introduction of Real Estate Investment Trusts and Infrastructure Investment Trusts that have never previously found favour with a rigid Central Board of Direct Taxes establishment reluctant to allow tax pass-through status for investors.

These two instruments should allow real estate and infrastructure companies to attract new pools of much-needed equity capital to strengthen their balance sheets and free up resources for investment in new asset creation and growth.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Why Jaitley's 1st Budget is impressive on all counts

And is hardly anti-poor: Contrary to the expectations of many, MNREGA was not scaled back. Instead, the scheme is to be redesigned so that it is more systematically linked to supporting jobs that lead to asset creation. Nor has the Budget cut back on most of the other social schemes of the UPA government, including those focused on livelihood development, health, education and the welfare of the SC and STs.

So is the Budget fiscally irresponsible? I don't think so. This government has, in fact, signalled greater discipline on subsidies of various kinds and a reversal in the trend of declining quality of government spending.

The hike in passenger railway fares announced by the minister of railways was significant in this regard. Along similar lines, the Budget is restrained on the expansion in outlays on account of subsidies, some of which is mandated by legislation introduced during the UPA's tenure.

The NDA Budget projects only a modest 2.4 per cent increase in total outlays on account of food, petroleum and fertiliser subsidies this year, compared to the revised estimates for FY14.

Overall, Jaitley expects to drive the share of major subsidies in total spending down to 14 per cent this fiscal from 15.4 per cent in FY 14 and increase the share of capital spending up to nearly 13 per cent from 12 per cent last year.

Notwithstanding the above, the Budget was not radical enough for the "disappointment brigade".

The critique is that it does not herald any big-ticket reforms. I would urge these commentators to look more carefully. The Budget moots important reforms in at least four key areas.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Why Jaitley's 1st Budget is impressive on all counts

First, is the area of expenditure policy. The Budget builds on the prime minister's unambiguous endorsement for the Aadhaar scheme, for the roll-out of cash benefit transfer schemes, and for the goal of improving the targeting of anti-poverty programmes.

In his speech, Jaitley promised an "overhaul of the subsidy regime" for food and petroleum with the help of an Expenditure Management Commission tasked with looking into various aspects of expenditure reforms within this fiscal year.

He also promised the formulation of a new urea policy and reform of the Food Corporation of India.

Second, he has delivered a significant shift in control over Plan expenditures from the central government to the states.

This should help him build goodwill with state governments for the expeditious introduction of the Goods and Services Tax.

Third, he has signalled the government's commitment to create a national market for agricultural commodities by working with the states to re-orient their respective agricultural produce market committee Acts.

And fourth, a slew of important reform initiatives have been launched for the financial sector.

The government will support the recapitalisation and strengthening of public sector banks by diluting its stake in them and exploring ways to enhance their autonomy and accountability.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Why Jaitley's 1st Budget is impressive on all counts

Tough measures (such as the elimination of the preferential tax treatment for debt mutual funds) have been introduced to attract more savings into bank deposits.

Creative steps have been taken to support long-term financing for infrastructure, and important impetus has been given to the recommendations of the Financial Sector Legislative Reforms Commission for the modernisation and rationalisation of the sector's regulatory framework.

This is an impressive agenda. To be sure, there is still a lot of work to be done and details to be fleshed out.

But there is undoubtedly enough here to convince us that what we are seeing is a welcome and purposeful change in direction.

(Rajiv Lall is executive chairman, IDFC)

Please click here for the Complete Coverage of Budget 2014 -15