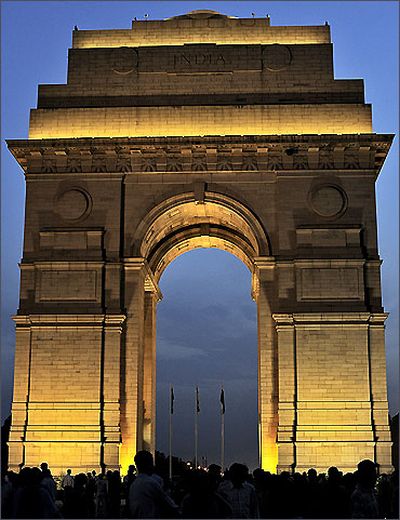

Photographs: Reuters Subir Gokarn

The developments in Iraq are worrying because the outcomes are completely unpredictable at this point.

They say that oil and water don’t mix. Literally true, perhaps, but, speaking metaphorically, they can be an explosive combination.

The mix between the two poses the most significant risk to the Indian economy over the next few months.

It threatens to reignite the drivers of inflation, the fiscal deficit and the current account deficit. At this point, it is still a risk that might abate over the next few weeks, but if this were to happen, it would be entirely due to meteorological or geopolitical factors — clearly outside the control of the Indian government.

At this point, the government’s best course of action is to anticipate worst-case scenarios and put mitigative measures in place.

Please click here for the Complete Coverage of Budget 2014 -15

Please click NEXT for more...

A weak monsoon, Iraq crisis to have some impact on the Budget

Image: Poor monsoon will impact decision making in the Budget.Photographs: Gene Blevins/Reuters

First, let’s look at the consequences of a possible monsoon failure.

The rainfall during June, the first month of the southwest monsoon, was reported as being 45 per cent below normal.

However, the impact of this deficit on agricultural production may not be very significant.

It is the precipitation during July and August that has by far the most significant impact on agriculture and the current indications are that rainfall will intensify over the next few days.

Further, rainfall during successive months is, to use a technical term, not serially correlated.

The underperformance during June does not allow us to predict that rainfall will be deficient during July.

On the other hand, it does not guarantee that rainfall will be normal either, so it’s best to be prepared.

Please click here for the Complete Coverage of Budget 2014 -15

Please click NEXT for more...

A weak monsoon, Iraq crisis to have some impact on the Budget

Image: Cost of vegetables will escalate due to poor monsoon.Photographs: Rupak De Chowdhuri/Reuters

The last really bad monsoon was in 2009.

This came a little over a year after the global food shock of 2007-08, during which food inflation in India was already accelerating and, we now realise, never let up since then.

I think that the 2009 monsoon was a significant contributor to the entrenchment of food inflation, though, of course, other factors were also at play.

The main lesson from that episode, in my view, is that non-cereal food products are most sensitive to deficient monsoons.

The obvious reason for this is that much of the irrigated area is devoted to cereal cultivation (rice, during the monsoon season).

Pulses and oilseeds, in particular, but also coarse grains, are grown in the more rainfall-dependent regions.

Oilseed prices are manageable with imports, given that there is significant international trade in this commodity.

Pulses can also be imported, but the market is relatively thin and prices can surge if the monsoon turns out to be a dud by the first half of July.

If, indeed, this were to happen, sowing activity in the rain-dependent parts of the country will be rolled back, virtually guaranteeing that production of these items will decline or stagnate. Price pressures are inevitable.

Please click here for the Complete Coverage of Budget 2014 -15

Please click NEXT for more...

A weak monsoon, Iraq crisis to have some impact on the Budget

Image: The price of Brent crude surged from a stable $110 or so a barrel to $116 over a few days.Photographs: Reuters

Coming to the oil situation, the developments in Iraq are worrying because the outcomes are completely unpredictable at this point.

Last August, when the Syrian conflict intensified, oil prices surged, not because Syria is a big exporter but because of spillover risks in the region.

The price of Brent crude surged from a stable $110 or so a barrel to $116 over a few days. Given India’s current account situation at the time and the already high level of turbulence in the foreign exchange market, the rupee slid precipitously, approaching 69 to the US dollar.

It recovered somewhat after the situation in Syria stabilised and has since benefited from the very sharp narrowing of the current account deficit.

Iraq represents a different level of risk. Apart from the regional spillovers, it is also a large producer and exporter of oil.

Somewhat surprisingly, despite the intense conflict, oil production doesn’t seem to have been impacted; prices have hardened but certainly not to the extent that might have been expected. T

his is a very reassuring sign, reflecting the fact that the parties now controlling the oilfields realise that they have to keep the crude flowing.

But whether this situation can persist in the face of prolonged conflict is certainly a question.

Please click here for the Complete Coverage of Budget 2014 -15

Please click NEXT for more...

A weak monsoon, Iraq crisis to have some impact on the Budget

Image: If oil prices rise to, say, $120 a barrel and stay there, headline inflation will unquestionably rise.Photographs: Vasily Fedosenko/Reuters

To assess the impact of a more persistent spike in oil prices, we need to look back to 2010-11, when oil prices surged after a period of relative moderation in the immediate aftermath of the 2008 financial crisis.

By this time, both inflation and the fiscal deficit were already at worrying levels and the sharp climb in oil prices in the last couple of months of 2010 clearly aggravated both.

As a result of the surge, the oil subsidy bill mushroomed and energy prices added to the inflationary pressures already being exerted by food.

The combination proved to be deadly, even as demand pressures eased with the slowdown in growth in 2011-12.

Oil prices stabilised in the $100-110 range for Brent crude around the middle of 2010 and, barring a few surges, mostly upward but occasionally downward, since then, have remained there.

The worst-case scenario emerging from the Iraq developments is a surge from these levels, which persists for at least a few months, if not longer.

If prices rise to, say, $120 a barrel and stay there, headline inflation will unquestionably rise.

It will take significantly larger hikes in administered prices to curb the subsidy bill, which will have political implications. And the current account deficit, comfortable for now, will once again come under stress.

Please click here for the Complete Coverage of Budget 2014 -15

Please click NEXT for more...

A weak monsoon, Iraq crisis to have some impact on the Budget

Image: On the agricultural front, some incentives for farmers in irrigated areas to produce crops other than cereals should be considered in the Budget.Photographs: Reuters

Obviously, the government cannot avert the worst-case scenarios if they were to materialise.

But a few steps need to be taken to buffer the economy against the risk.

On the agricultural front, some incentives for farmers in irrigated areas to produce crops other than cereals should be considered. Also, avenues to increase imports of, say, pulses, over the next few months need to be explored quickly.

Fiscally, accelerating the closure of the subsidy gap should be a priority.

The finance minister would do well to announce an overall cap on subsidies in his first Budget, providing some reassurance that an explosive situation will not recur.

On the current account, the temptation to quickly do away with restrictions on gold imports – difficult as this may be to do – needs to be resisted for some more time. Also, a huge push to increase domestic coal production must be provided.

The bottom line is that domestic fragility greatly exacerbates the impact of global shocks. Short-term measures must be complemented with structural responses to this fragility.

Please click here for the Complete Coverage of Budget 2014 -15

article