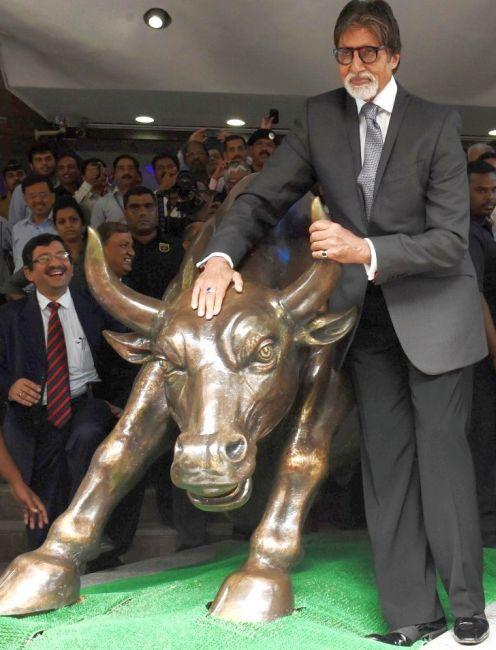

Photographs: Abhijit Mhamunkar/Rediff.com Devangshu Datta

The new Budget seems to have some clear objectives. It encourages the inflow of overseas capital, through the FDI route as well as via the portfolio route through a combination of changes in FDI investment stake ceilings, as well as the clarifications of ambiguities.

It also commits the government to a massive disinvestment programme.

There is a strong focus on energising investments into key infrastructure sectors.

There are some new incentives for corporate investments in general, via tax breaks on capital goods investments, warehousing, etc. Corporate tax rates have not been hiked and that, in itself, is a positive step.

Click NEXT to do more...

Please click here for the Complete Coverage of Budget 2014 -15

This is how Budget will impact sectors and the stock market

Image: Sectors like cement, construction and steel may see a bounce back.Photographs: Reuters

The broad area of infrastructure, and infra-associated industries such as construction, cement, steel, shipbuilding, specialised infra finance institutions, capital goods and power equipment manufacturers, etc., could see bounce backs.

Infra has been a major under-performer through the past three years and a revival of activity could mean the productive use of vast sums now stuck in stalled projects.

Apart from direct financial allocations to the roads sector in particular, and to urban infrastructure, the Budget offers the promise of PPP (public-private-partnership) projects.

These could tap private capital and expertise as they are implemented across ports, airports, gas pipelines, power, etc.

Click NEXT to do more...

Please click here for the Complete Coverage of Budget 2014 -15

This is how Budget will impact sectors and the stock market

Image: Housing sector could get a boost due to tax sops announcement in the Budget.Photographs: Rupak De Chowdhuri/Reuters

It's worth noting that banks' lending to infra projects could reduce problems that arise due to asset-liability mismatches.

They are being allowed to issue bonds for long-term infra projects. Again, we'll have to see how this takes off but the intention is good.

Infra investment trusts get a pass through on tax treatment, which is favourable in theory as well.

Housing could get a boost. There is an enhanced tax break in that the deduction for interest payable on the mortgage of a self-occupied house increases.

Click NEXT to do more...

Please click here for the Complete Coverage of Budget 2014 -15

This is how Budget will impact sectors and the stock market

Image: Retrospective effect of the tax law change has not been removed in the Budget and this could impact the FDI.Photographs: Danish Siddiqui/Reuters

By association, realtors should get more business. Also REITs get pass-through tax treatment, which is favourable in terms of capital gains.

There are significant budgetary allotments for rural housing.

Real estate could therefore, see a bounce - this is another sector which has been in the doldrums.

Unfortunately the retrospective effect of the tax law change has not been removed.

This could hurt the initiative taken to encourage more FDI. Another measure could be very mildly negative in its impact on sentiment.

This is the changed treatment of the Dividend Distribution Tax (DDT) which will now be charged on gross.

If pay-outs are maintained at current levels, this means three per cent more revenue under this head to the government.

Click NEXT to do more...

Please click here for the Complete Coverage of Budget 2014 -15

This is how Budget will impact sectors and the stock market

Image: The net impact of the Budget on the stock market should be positive.Photographs: Reuters

It is very clear that the government will have to enter disinvestment mode with all guns blazing.

It cannot meet the fiscal deficit targets for 2014-15 without substantial disinvestment. However, stake sales will have to judged on a case-by-case basis and it remains to be seen if the primary market can be revived.

PSUs don't, as a rule, prove to be good long-term investments. But trading opportunities could arise.

The net impact of the Budget on the stock market should be positive.

It doesn't do any obvious harm and it might encourage a revival in certain beaten-down sectors.

Expectations were unrealistically high however and there seems to be a correction in progress.

Please click here for the Complete Coverage of Budget 2014 -15

article