| « Back to article | Print this article |

What's wrong with India's economic data?

Farm and factory data collection methods urgently need to be expanded and electronically integrated to provide accurate and meaningful numbers.

Irony by definition is laced with dark humour, but it would be more like black humour when one views data systems in India.

Click NEXT to read more

What's wrong with India's economic data?

Such revisions are quite bizarre and have a deeper implication because such high-frequency data is used for high-frequency monetary policy stances.

What's wrong with India's economic data?

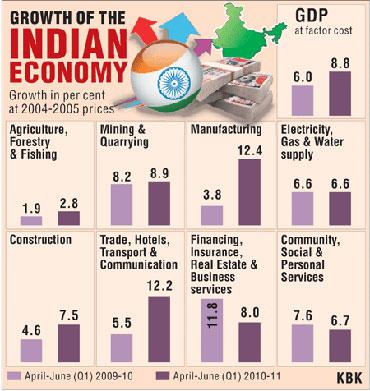

One may recollect that for a long time we had spoken about our base years being anachronistic at 1993-94, and bringing forward the base year to 2004-05 was pragmatic.

Click NEXT to read more

What's wrong with India's economic data?

A statement often made was that there was high volatility in the growth numbers that would be addressed by the new series.

Though having a new series is necessary, the larger issue is whether it addresses the question of volatility. Volatility in the jargon of financial markets economics means the standard deviation of the growth rates.

Click NEXT to read more

What's wrong with India's economic data?

For the WPI series, the annualised volatility was 11.5 per cent and 10.2 per cent respectively.

So there has been improvement in the WPI, but not the IIP.

Curiously, when the same volatility is reckoned on annual data, then the IIP volatility changes from 2.96 per cent to 4.76 per cent and 1.67 per cent to 2.42 per cent for WPI, meaning that the older series fares better!

Click NEXT to read more

What's wrong with India's economic data?

Second, the fluctuations in growth rates will vary based on seasonal trends as well as base year effects. Third, the problem is with our data collections systems and processes.

What are the problems with our data? There are basically two areas that need to be addressed.

Click NEXT to read more

What's wrong with India's economic data?

Agricultural Marketing Research & Information Network (AGMARKNET), the official source of data shows prices within a rather wide range that is not helpful.

Further, the single numbers that are displayed vary significantly from what commodity exchanges like NCDEX collect from the ground level.

Click NEXT to read more

What's wrong with India's economic data?

Further, since farm products are seasonal, they do not enter the mandis every month but are traded widely all the same, which moderates the WPI numbers because they are dependent on the quotes received from mandis.

Click NEXT to read more

What's wrong with India's economic data?

The other pertains to manufactured goods. If one looks at metals, our WPI shows that prices are increasing when globally prices are falling based on World Bank data.

India is a price taker in all metals except iron and steel.Click NEXT to read more

What's wrong with India's economic data?

The problem in manufacturing is exacerbated by the fact that one-third of total manufacturing comes from the unorganised sector where it is difficult to get timely information.

Even for the organised sector, the WPI index for a particular product often does not change for weeks because of non-availability of data after which there is a sudden spike in prices.

Click NEXT to read more

What's wrong with India's economic data?

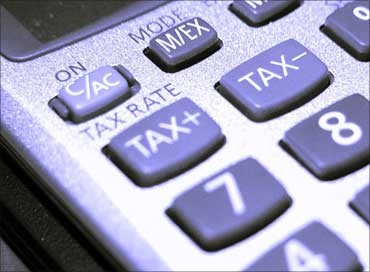

By linking this to tax filing, firms will be compelled to report accurately the true picture.

Admittedly, this is a challenge considering that even unaudited results of firms are not always filed on time.

Click NEXT to read more

What's wrong with India's economic data?

First, we need to move away from providing high-frequency data if we are unable to vouch for its sanctity.

While revisions happen everywhere, changing growth rates by 50 per cent is dangerous for policymakers.

What's wrong with India's economic data?

Third, we need to look at other leading indicators when taking policy decisions based on monetary data that is generally more accurate because it comes from a smaller universe of commercial banks.

Click NEXT to read more

What's wrong with India's economic data?

It would be better to look at cumulative numbers, especially for the real sector.

When we look at annual IIP growth rates, we do not look at March over March, but the average of 12 months over the same of the previous year. This automatically factors in the so-called volatility due to inaccuracies or seasons.

Click NEXT to read more

What's wrong with India's economic data?

While adopting global practices like the Federal Reserve is progressive, other authorities do not have distorted images in the form of inaccurate data like we do.

We will have to wait some more time to reach these levels.

The writer is Chief Economist, CARE Ratings. These views are personal.