| « Back to article | Print this article |

2010: A year of tiffs, truces and tantalising corporate tales

An eclectic mix of Radias, Ambanis and Akulas hogged the headlines this year, with many an unfolding plot promising eventful corporate tales in 2011.

An eclectic mix of Radias, Ambanis and Akulas hogged the headlines this year, with many an unfolding plot promising eventful corporate tales in 2011. Whether it is the fallout of Niira Radia's lobbying prowess, or billionaires Mukesh and Anil Ambani calling a truce, or Vikram Akula pushing microfinance into the limelight, every happening blazed new trails for corporate India.

Not just them, many other well-known names, including industrialist Ratan Tata, telecom czar Sunil Mittal, IT stalwarts Narayana Murthy and Azim Premji, regulators D Subbarao and C B Bhave and Citigroup head honcho Vikram Pandit, grabbed attention for diverse reasons.

Click NEXT to read on...

2010: A year of tiffs, truces and tantalising corporate tales

A set of leaked phone conversations of corporate lobbyist Niira Radia sparked an acerbic chain of events, which not only claimed A Raja's telecom ministership, but also paralysed Parliament for 23 straight days.

A set of leaked phone conversations of corporate lobbyist Niira Radia sparked an acerbic chain of events, which not only claimed A Raja's telecom ministership, but also paralysed Parliament for 23 straight days. The leaks, coupled with the CAG's critical report on 2G spectrum allocation, is now haunting many well-known and little-known people and organisations.

Click NEXT to read on...

2010: A year of tiffs, truces and tantalising corporate tales

Bringing an end to their bitter and prolonged corporate battle, the Ambani brothers in May this year agreed to end their dispute and scrap all existing non-compete agreements executed in January, 2006, when the Reliance empire was split between them.

Click NEXT to read on...

2010: A year of tiffs, truces and tantalising corporate tales

From the Tata Group's plans to find a successor for him to being dragged into the raging 2G spectrum allocation controversy, Ratan Tata has been constantly in the news this year as well.

From the Tata Group's plans to find a successor for him to being dragged into the raging 2G spectrum allocation controversy, Ratan Tata has been constantly in the news this year as well. Narayana Murthy also came into limelight after Infosys kicked off the succession plan process for the software exporter's chief mentor.

Click NEXT to read on...

2010: A year of tiffs, truces and tantalising corporate tales

Telecom czar Sunil Mittal finally realised his dream of making a much-fancied African foray after failing in previous attempts to strike a deal with South African major MTN.

Telecom czar Sunil Mittal finally realised his dream of making a much-fancied African foray after failing in previous attempts to strike a deal with South African major MTN. Bharti Airtel snapped up the Africa operations of Kuwait-based Zain in a $10.7 billion deal this year, expanding the firm's presence in fast growing markets.

Click NEXT to read on...

2010: A year of tiffs, truces and tantalising corporate tales

The joy of a bombastic nearly $350 million initial public offering was short-lived for SKS Microfinance and its founder, Vikram Akula.

The joy of a bombastic nearly $350 million initial public offering was short-lived for SKS Microfinance and its founder, Vikram Akula. After the corporate governance issue, when its CEO Suresh Gurmani was suddenly sacked in October, high interest rates and Andhra Pradesh government's move to regulate microfinance sector added to the woes of Akula.

Click NEXT to read on...

2010: A year of tiffs, truces and tantalising corporate tales

Continuing his philanthropic activities, Azim Premji transferred Wipro shares worth about $2 billion to fund various education programmes.

Furthermore, regulatory tussles and concerns about autonomy saw the country's two high-profile regulatory chiefs -- Reserve Bank of India Governor Subbarao and market regulator SEBI chief Bhave -- cornering headlines.

Click NEXT to read on...

2010: A year of tiffs, truces and tantalising corporate tales

When it comes to riding out a financial tsunami and then prospering from the very ashes, possibly there cannot be a better illustration than Citigroup chief Vikram Pandit. At the helm of Citi for little over three years, Pandit has not only shored up the behemoth from the verge of failure, but has also freed it from the US government shadow after paying back bailout funds this month.

When it comes to riding out a financial tsunami and then prospering from the very ashes, possibly there cannot be a better illustration than Citigroup chief Vikram Pandit. At the helm of Citi for little over three years, Pandit has not only shored up the behemoth from the verge of failure, but has also freed it from the US government shadow after paying back bailout funds this month. Click NEXT to read on

2010: A year of tiffs, truces and tantalising corporate tales

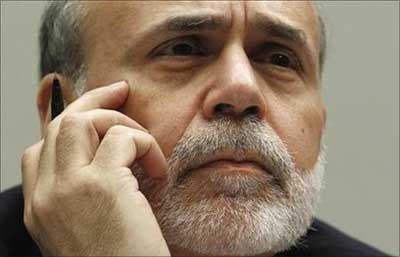

When it comes to the global economy and business in 2010, names such as former BP chief Tony Hayward, US Federal Reserve Chairman Ben Bernanke and former Hewlett-Packard chief Mark Hurd cannot be missed.

A devastating Mexican Gulf oil spill in April that battered British energy giant BP also cost Hayward his position. He was largely blamed for the disaster.Click NEXT to read on

2010: A year of tiffs, truces and tantalising corporate tales

The kingpin behind the turnaround at HP, Mark Hurd made an unceremonious exit from the technology major on charges of unethical business practices.

The kingpin behind the turnaround at HP, Mark Hurd made an unceremonious exit from the technology major on charges of unethical business practices. Battling a sluggish American economy, Bernanke has been aggressively pursuing a loose monetary approach and huge stimulus measures.

These moves have attracted international criticism, as many feel such actions devalue the US dollar, which in turn could increase global trade imbalances. As 2010 comes to a close, these and many other newsmakers offer food for thought in the New Year.

Click NEXT to read on