| « Back to article | Print this article |

With Rajan at Mint Road, 'all options are on the table'

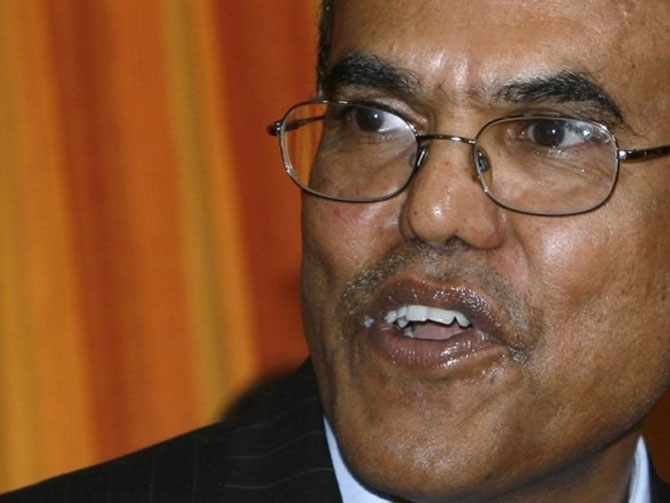

These were the words of Chief Economic Advisor Raghuram Rajan as he emerged out of a meeting with global banks on July 12 to discuss the possibility of floating sovereign bonds. The rupee ended its losing streak and appreciated by 11 paise to close at a two-week high of 59.56 against a dollar.

Just when talk of dollar-denominated bonds were gaining momentum, the hopes were dashed by Reserve Bank of India (RBI) Governor D Subbarao who opined that a sovereign bond was a bad idea in the prevailing economic situation, sending the rupee to a three-week low of 60.47 against the dollar on July 30.

In the last six weeks, a lot was said on the issue and finally it emerged the government was considering only quasi-sovereign bonds at the moment. However, on August 22, Finance Minister P Chidambaram rekindled the hopes of sovereign and non-resident Indian bonds saying “all options are on the table”.

Rajan, the governor-to-be, has always considered sovereign bonds as one option to finance the widening current account deficit (CAD). A change of guard at Mint Road on September 5 might reflect this new thinking at RBI, which is considered orthodox in its approach on such issues.

Click on NEXT for more...

With Rajan at Mint Road, 'all options are on the table'

Officials, however, said one person’s thinking might not change the views of the institution. If the government decides to go for a sovereign bond issue, Subbarao’s exit from the RBI might make things little easier. However, Rajan will have a tough task in convincing the old brass at the central bank.

“RBI is opposed to sovereign bonds. The new governor may have different views but that is the stand taken by the central bank,” said an official who did not wish to be identified.

People in the know said the finance ministry was itself divided on the merits of a sovereign bond at this hour. The old school, which is perhaps in the majority, shares Subbarao’s views that it could impact financial stability and send a signal that India was in crisis.

Economic Affairs Secretary Arvind Mayaram also ruled out sovereign bonds in a conference call with investors on Tuesday. “If you do a sovereign bond or non resident Indian bond today it will create greater panic because that is not needed today. We have to channelise quasi bonds. We must have adequate foreign exchange into the country. It doesn’t matter where it comes from,” he had reasoned.

Click on NEXT for more...

With Rajan at Mint Road, 'all options are on the table'

In response to a similar query two days later on Thursday, his boss, Chidambaram, said such bonds were not ruled out and which option would be exercised and at what time was a matter of judgment.

The rupee again ended its losing streak and posted its biggest single day gain in about a year, to close at 63.20 against a dollar on Friday.

The views on sovereign bonds are so diverse that even the bankers invited by Rajan could not unanimously speak on the issue.

But the finance minister, perhaps, cannot rule it out completely because, according to another view, it would send a signal to investors that the government would run out of options if RBI’s measures to contain rupee volatility fail to work.

Power Finance Corporation, India Infrastructure Company Ltd, and India Railway Finance Corporation will go for quasi-sovereign bonds to fund long-term infrastructure needs this year. This is likely to fetch $4 billion with another $4 billion coming from external commercial borrowings by oil public sector units.

Click on NEXT for more...

With Rajan at Mint Road, 'all options are on the table'

The government has never issued sovereign bonds directly. India Development Bond in 1991 was a quasi-sovereign bond, whereas Resurgent India Bond in 1998 and Millennium India Deposit in 2000 were NRI bonds. Banks raised $1.6 billion, $4.8 billion and $5.5 billion, respectively from these bonds.

| The sovereign bond saga |

Jul 12: ‘All options are on the table, including sovereign bonds’ Jul 30: ‘Time not right, it will compromise financial stability’ Jul 31: ‘RBI's views deserve weight but quasi sovereign bonds possible’ Aug 20: ‘Sovereign bond not needed, will create Aug 22: ‘Nothing off the table; timing is a matter of judgement by government’ |