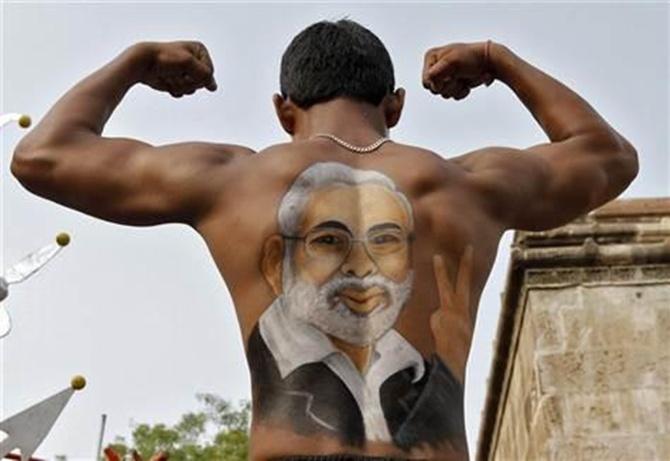

Photographs: Adnan Abidi/Reuters Rajesh Kumar Singh in New Delhi

Indian economic data on Thursday is likely to offer some cheer for Prime Minister Narendra Modi by showing a pick-up in industrial activity and easing inflation.

Modi has listed fighting inflation, particularly food inflation, as his topmost priority.

He aims to win the battle by improving supplies of food and clamping down on ‘hoarders’.

Output from mines, utilities and factories is expected to have expanded 1.9 per cent in April from a year earlier after falling 0.5 per cent the previous month, according to a Reuters poll of economists, because of a recovery in the infrastructure sector Modi sees as key to a wider revival.

Cooler food prices probably helped ease consumer price inflation to 8.4 per cent in May from a three-month high of 8.59 per cent April, the poll showed.

. . .

Why the latest economic data is sure to make Modi happy

Image: A labourer carries a packed basket of vegetables as a vendor waits for customers at his vegetables stall at a market in Kolkata May 14, 2012.Photographs: Rupak De Chowdhuri/Reuters

The statistics ministry is due to release industrial production and consumer inflation data at 1200 GMT.

Consumer inflation has been averaging nearly 10 per cent for the past two years even though economic growth has been stuck below five per cent, marking the longest slowdown in more than a quarter of a century.

Promises to break the spell of weak growth and high inflation helped Modi to a victory last month that gave his party the strongest parliamentary majority in 30 years.

A slumping industrial performance is at the heart of India's growth struggle.

Output contracted 0.1 per cent in the fiscal year that ended in March. It has eased in four of the past six months.

. . .

Why the latest economic data is sure to make Modi happy

Image: Modi's government is looking to revive the economy through higher investment in infrastructure.Photographs: Reuters

Radhika Rao, economist at DBS Bank, said a revival in manufacturing and investment would have broad multiplier effects across the economy, but cautioned that an expected shortfall in monsoon rains could impact both demand and inflation.

"In the short term, the likelihood of a weak southwest monsoon is an important risk for growth this year and likely an initial challenge for the new administration," Rao said.

Infrastructure drive

Modi's government is looking to revive the economy through higher investment in infrastructure, which it hopes will boost demand in sectors such as cement, steel and power.

He is also aiming to simplify approvals for projects to kick-start capital investments.

. . .

Why the latest economic data is sure to make Modi happy

Image: The economic slowdown is taking a toll on public finances.Photographs: Reuters

The economic slowdown is taking a toll on public finances.

The federal tax-to-GDP ratio has slipped to 10.2 per cent from a peak of 12.5 per cent in 2007/08, leaving the government having to resort to more rupee bond sales to fund spending commitments.

Higher investment spending without adjustments in wasteful public expenditure would make it tougher to trim the fiscal deficit to a targeted 4.1 per cent of GDP this fiscal year, resulting in a heavy bond supply and increased cost of credit for corporates.

This could worsen India's struggle with persistently high inflation -- on top of the forecasts of below-average monsoon rains.

The poll showed wholesale price inflation rose to 5.4 per cent last month, 0.2 percentage points higher than in April.

The data is due on June 16 at 0300 GMT.

. . .

Why the latest economic data is sure to make Modi happy

Image: Expectations of an economic turnaround after Modi's victory have brought in copious capital inflows, sending the total value of the Indian stock market over $1.5 trillion for the first time.Photographs: Reuters

The government has stockpiled staples such as rice, wheat and sugar from bumper harvests in the last few years but it has limited means to control jumps in the cost of fruits and vegetables that have the largest impact on food inflation.

Expectations of an economic turnaround after Modi's victory, however, have brought in copious capital inflows, sending the total value of the Indian stock market over $1.5 trillion for the first time.

Other recent data also gives some hope for a revival. Merchandise exports posted their fastest growth in six months in May.

The services sector expanded for the first time in nearly a year last month.

Improving consumer sentiment helped car sales post their first annual growth in three months in May.

article