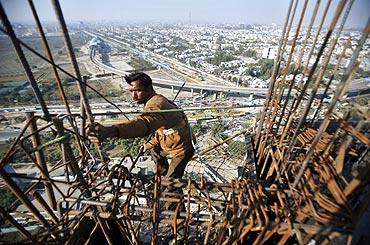

The real estate market in India is heading for what looks like a double dip.

After correcting somewhat from the sharp setback suffered in 2008, with some sectors managing to exceed previous peak prices in 2010, the sector entered 2011 with cautious optimism.

But halfway through the year, the outlook has turned distinctly sombre.

The current economic deceleration is pouring cold water on demand for office space, always driven by the overall economic climate.

The retail segment has yet to absorb the excess supply that has characterised it since the last slowdown.

. . .

But it is the bread and butter affordable-to-middle volume part of the residential segment that has suffered a clear setback with successive policy rate increases raising interest rates and equated monthly installments and the promise of more to come.

Banks, which had already turned cautious about lending to developers on receiving the signal from the banking regulator, are likely to become even more careful.

Private equity, the only hope for cash-strapped developers facing sluggish demand, is unlikely to throw out a lifeline since they do not relish being locked into a medium-term plateau if not trough.

. . .

It's ironic that there is an astronomical unmet demand for livable urban space among all except the very rich, and it is a colossal failure of both the government and developers that an enormous business opportunity, which can make everyone better off, is not being created out of it.

Despite the abolition of the urban land ceiling Act in most parts of the country, there is no perceptible increase in urban land supply which can make possible large additions to affordable housing.

. . .

This is because urban planning is not promoting mixed development sufficiently, nor is urban infrastructure being built keeping in mind transportation links between new residential areas and job centres.

Even under these circumstances, the middle class would pay through the nose for a place to live in the hope of capital gains over time.

But there are dampeners galore. Not satisfied with raising EMIs, banks are turning more cautious in the face of regulatory exhortations to be mindful of rising non-performing asset levels.

. . .

Plus, there is a mountain of anecdotal evidence of how buyers are short-changed by developers.

A Bill to codify customer rights and offer recourse through the creation of a regulator has been hanging fire for a decade.

Developers are opposing it tooth and nail and political leaders are in no hurry to upset them.

Developers have a point when they say that the need to secure multiple sanctions delays projects and adds to costs.

. . .

But the existing crop of developers has got into the business with its eyes open.

It is popularly believed that they are both repositories and launderers of politicians' black money.

Thus, entrenched corruption at the grass roots (those who process the multiple sanctions required) and protection from top are blocking change and reform.

With the central government appearing paralysed by fear of decisive action on such issues, it can only be hoped that some of the more confident and politically secure chief ministers will take the initiative for policy reform.