Photographs: Arko Datta/Reuters Yati Himatsingka and Rafael Nam in Bangalore and Mumbai

The BSE Sensex will only manage a 4 per cent gain in 2013, held back ahead of an election in the first half of next year, but the Mumbai market hasn't got far to go after that to reach a record high, a Reuters poll found.

The median of 19 strategists and brokerages polled Oct 1 - 8 put the benchmark BSE Sensex at 20,286 by the end of the year, just 1.5 per cent higher than Tuesday's close of 19,983.61 but lower than 21,000 expected in a June poll.

That consensus points to a disappointing performance for Indian stocks, which rallied over 25 per cent last year.

…

Why elections are a big risk for stock market

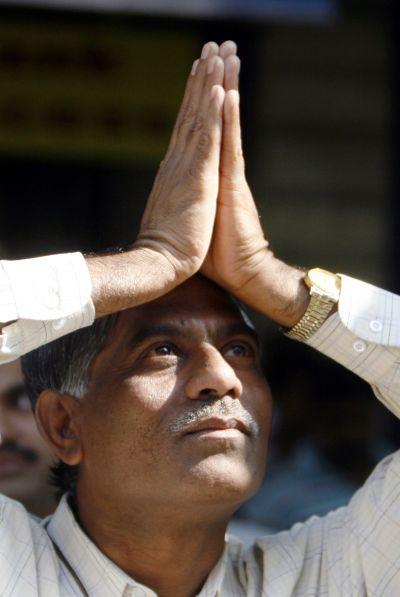

Image: An Indian broker reacts while trading at a stock brokerage firm in Mumbai.Photographs: Arko Datta/Reuters

However, the ever-bullish analysts predicted the Sensex to eclipse the January 2008 life high of 21,206 by June next year - just like they have done in the last three polls when forecasting beyond six months.

A strong majority - 10 of 12 participants who answered an extra question - said general elections due by May next year posed the biggest risk to that outlook for the index in 2014.

"(The) key risk to our year-end targets will be the result of national elections, which has the potential to be a make-or-break event," said Sundar Subramoney, deputy head of research at Almondz Global Securities.

…

Why elections are a big risk for stock market

Image: Stock brokers trade in a brokerage firm in Kolkata.Photographs: Jayanta Shaw/Reuters

Uncertainty about the outcome this time is particularly high, prompting investors and businesses to hold back decisions as there are no clear favourites among leading parties to win a majority when India's 1.2 billion population votes.

Prime Minister Manmohan Singh's government has been weakened by years of fractious coalition rule and has struggled to push through reforms in the labour market, taxation system and financial markets owing to lack of consensus.

…

Why elections are a big risk for stock market

Image: A stock broker looks at a terminal while trading at a stock brokerage firm in Mumbai.Photographs: Arko Datta/Reuters

The resulting policy paralysis has pushed India's annual economic growth to a decade low of 5 per cent in the fiscal year that ended in March.

"There is no fiscal policy as such, they are just trying to de-clog investment pipelines and this will have incremental benefits," said P. Phani Shekar, fund manager at Angel Broking.

"But to bring in the rest of the business, (investors) need to have business confidence and it will not come when there are elections six months down the line."

…

Why elections are a big risk for stock market

Image: U.S. Federal Reserve Board Chairman Ben Bernanke holds a news conference following the Fed's two-day Federal Open Market Committee.Photographs: Gary Cameron/Reuters

To add to the woes, a ballooning current account deficit prompted overseas investors to flee Indian shores when the US Federal Reserve hinted back in May at trimming its bond purchases, although it has since delayed any such action.

The outflows drove the Indian rupee to new record lows, falling almost 20 per cent at one point in May, and battered stocks.

Measured in dollar terms, the BSE Sensex is the second worst performer this year after Indonesia among the stock indexes tracked by Thomson Reuters, with a 8.5 per cent fall.

…

Why elections are a big risk for stock market

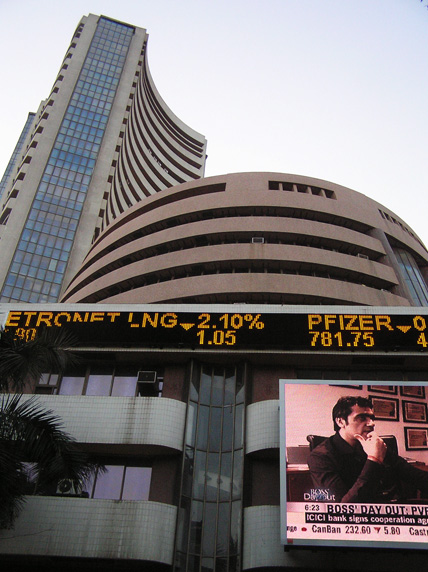

Image: Bombay Stock Exchange.Photographs: Elroy Serrao/Wikimedia Commons

Still, despite selling through the summer, foreign institutional investors (FIIs) remain net buyers of $13.8 billion so far this year compared with $24.4 billion in the previous year, according to regulatory data.

Strategists in the poll almost unanimously agreed that FIIs, a vital source of inflows in markets, will continue to buy Indian stocks for the rest of this year.

(Polling by Hari Kishan; Additional reporting by Ashrith Rao Doddi)

article