| « Back to article | Print this article |

Why commerce ministry was upset with the Budget

The commerce ministry saw many of its major proposals watered down in Budget 2011-12.

Far from being a goody bag, as the commerce and industry ministry would have expected, Budget 2011-12 turned out to be quite a disappointment for the ministry.

The Ministry of Commerce and Industry had pinned ambitious hopes on the Budget. But the finance ministry largely failed to live up to its expectations, even watered down some of the demands made by it.

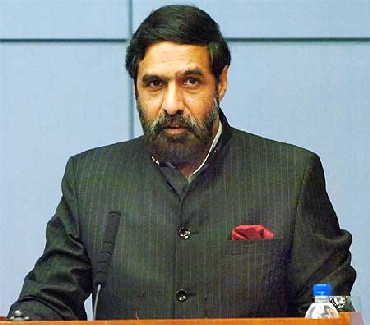

On the contrary, much to the "surprise" of Commerce Minister Anand Sharma, Finance Minister Pranab Mukherjee imposed minimum alternate tax (MAT) on special economic zones (SEZ).

Besides, the Budget announced some measures that were likely to hit exports from India.

Click NEXT to read more...

Why commerce ministry was upset with the Budget

According to a senior commerce ministry official, the Budget sought to withdraw some significant stimulus measures "in a clandestine manner", which would affect exports and lead to impediments in efforts to achieve $450 billion worth of exports by 2013-14, from around $250 billion at present.

The Budget withdrew interest subvention scheme on handicrafts, carpets, handlooms and small & medium enterprises, which had faced the greatest deceleration during the global economic slowdown and had just about begun to look up.

The finance ministry also turned down the proposal to extend tax benefits under Sections 10A and 10B.

Click NEXT to read more...

Why commerce ministry was upset with the Budget

In a major blow to textile exporters, the finance ministry imposed 10 per cent excise duty on branded garments and made-ups and brought these under a compulsory duty regime.

It also imposed an additional one per cent excise on branded gold items. Therefore, textile exporters come under the Cenvat cycle, which was optional earlier.

Some of the important recommendations of the commerce ministry that were turned down in the Budget relate to amendment in Section 10B (3) to permit income tax in case realisation of payment within 12 months (according to RBI guidelines), allowing weighted average deduction on research & development in computing MAT and introduction of presumptive tax in the gems & jewellery sector.

Click NEXT to read more...

Why commerce ministry was upset with the Budget

Besides, the Budget also ignored proposals such as reduction of import duty on coffee plantation mechanism, introduction of presumptive tax in the gems & jewellery sector and lowering Customs duty on filter paper, multi-wall paper and nylon cloth for tea bags.

However, there also were a few positive measures that were hailed by exporters. These include simplification of mechanism for service tax refund.

Besides, some specific measures were announced for the sectors that employ large number of people and those that had been enjoying fiscal benefits.

A scheme for self-assessment by exporters and importers will be introduced in Customs, while the department will verify some cases.

Click NEXT to read more...

Why commerce ministry was upset with the Budget

For the leather sector, the finance ministry approved the creation of seven mega clusters and allowed enzyme-based preparation for pre-tanning complete exemption from basic excise duty.

For the gems & jewellery sector, the government gave an additional Rs 500 crore (Rs 5 billion), proposed to be provided under the National Skill Development Fund.

The engineering and electronics sectors turned out to be a major beneficiary in the Budget. The government offered the sectors a plethora of incentives to boost export and import.

Import duties were lowered on hybrid automobiles, farm equipment, air-conditioning units used for farming (including cold storages). Excise duties on LED lights and solar lanterns were also brought down.

Click NEXT to read more...

Why commerce ministry was upset with the Budget

In addition to these, concessions available to parts, components and accessories for manufacture of mobile handsets were extended till March 31, 2012.

To encourage handicraft exports, which had witnessed a slump in the wake of the global meltdown, the government proposed setting up a cluster in Jodhpur.

This would have some tax benefits. In the textile sector, it slashed Customs duty on raw silk from 30 per cent to 5 per cent.

In agriculture and primary products category, cold chain equipment and agricultural machinery were provided excise duty relief while the basic Customs duty on farm machinery was reduced.