| « Back to article | Print this article |

Which stocks should you invest in?

Twenty eight-year-old Ashish Puri is confused between the infrastructure and the consumption theme.

He has been looking for investment guidance, but the more he reads, the more confused he gets.

"Some recommend consumption-related stocks, while others support the infrastructure ones. I am unable to decide," says the Allahabad resident.

According to Ajay Parmar, head-institution, Emkay Global Financial Services, infrastructure has a lesser returns ratio than consumption. And, with markets expected to be rangebound for the next three-six months, the India consumption story will serve investors better.

Which stocks should you invest in?

In the last one year, SBI has given 29 per cent returns, while Maruti hasn't had a great run, with a negative two per cent return.

But the outlook on Maruti is good, despite concerns on rising input costs on the back of high commodity prices, which will affect margins.

Add to it the rise in fuel prices and a steady increase in interest rates. Lalit Thakkar, managing director-institution, Angel Stock Broking, says these are short-term blips, as the large middle class population is increasingly moving from two-wheelers to four-wheelers, and the small car maker is gaining.

Click NEXT to read more...

Which stocks should you invest in?

And, credit and deposit have enough room to grow another seven-eight per cent. Not to forget both these companies are market leaders.

The key risk for SBI is its higher pension liability (analysts peg it at Rs. 8,000-10,000 crore), and maintaining the net interest margin at 3.6 per cent (as that in the third quarter) is a big challenge.

The good part is that the banking regulator has relaxed the provision coverage ratio for the bank.

Thakkar favours the tyre market as these companies are investing huge amounts for a new design of radial tyres.

Click NEXT to read more...

Which stocks should you invest in?

"Investors who do not need the money in the short term can invest up to 70 per cent of their holding in these stocks," adds Thakkar.

You need an investment horizon of at least one year for an average of 12-15 per cent returns annually.

Experienced investors could buy a small portion of midcap stocks. Among fast-moving consumer goods, the real consumption stocks, Parmar recommends Jubilant Foodworks, Marico and Nestle.

Till now, only Nestle has declared its fourth quarter results and the big positive is that the company has maintained its profitability.

Click NEXT to read more...

Which stocks should you invest in?

"Companies across the industry have increased prices to manage escalating raw material costs, but the price rise has been passed on in a very measured manner," adds Parmar.

High inflation and commodity prices are the biggest concerns here. He advises you to take up to 10 per cent exposure to these stocks.

Parmar favours Jubilant Foodworks, on the back of a whopping 97 per cent return in the last year.

Click NEXT to read more...

Which stocks should you invest in?

You can take two-three per cent exposure for two years. He expects the stock price to increase by 40 per cent in another two years to Rs 1,450, compared to Rs 1,011 today.

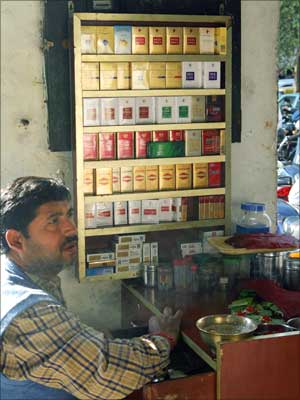

But Baliga's favourite is ITC.

"The company is across various businesses from FMCG to agriculture. Importantly, it is sitting on a lot of cash," he says.

The concerns are dwindling sales, but that is priced in. Also, cigarettes are expected to boost the growth.

Click NEXT to read more...

Which stocks should you invest in?

Analysts are also positive on the investment theme, but only if you have five-seven years horizon.

They are bullish on infrastructure and Larsen & Toubro (annual returns = six per cent) is the top pick.

A word of caution: When investing in stocks, retail investors should stick to the largecaps, as these are less volatile and safer as compared to smaller stocks.