Photographs: Reuters

Billionaire brothers Mukesh and Anil Ambani are taking a big hit on their wealth due to a slew of controversies and alleged scams, but the money put in by public investors in their companies is no less affected.

For every Rs 5 lost by the two siblings in the past one year, approximately Rs 4 have been eroded from the coffers of their public investors also on an average, according to an analysis.

Once touted as India's poster boys for wealth creation, the two Ambani siblings have together lost an estimated $15 billion in past one year from their wealth derived from the value of promoter shares in their respective group companies.

. . .

Ambanis lost $15 billion in a year; so did investors

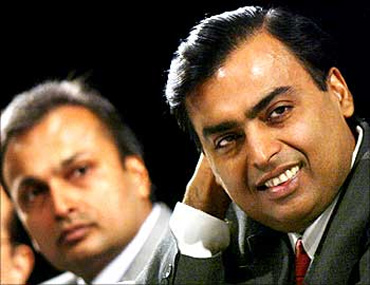

Image: R-ADAG chairman Anil Ambani.Photographs: Reuters

In the same time period, public shareholders of the two groups have collectively lost more than $12 billion, which is approximately 85 per cent of the promoters' loss.

Separately, the loss for public investors in Mukesh Ambani group is larger than that of promoters, but the total loss is greater for promoters in the Anil Ambani group.

In the past one year, the promoters' stock market wealth has fallen by nearly $6.7 billion in the Mukesh Ambani group as against a loss of $8.3 billion for public shareholders.

. . .

Ambanis lost $15 billion in a year; so did investors

Image: RIL chairman Mukesh Ambani.Photographs: Reuters

On the other hand, the promoters have lost $8.2 billion in Anil Ambani group, as against a loss of $4.5 billion for non-promoter or public shareholders. The promoter holding is generally higher in Anil Ambani group companies, which has led to bigger loss for promoters.

The value of promoter shares in family-promoted firms, including that of the two Reliance groups, are widely considered as the personal wealth of the main promoter in numerous rich lists such as those compiled by Forbes magazine.

The valuations of the two Reliance groups have taken a big hit in the recent past amid concerns over their alleged involvement in certain irregularities such as those in the telecom spectrum allocation and the costs associated with exploration of certain gas fields.

. . .

Ambanis lost $15 billion in a year; so did investors

Photographs: Reuters

Mukesh Ambani was ranked as the second richest Indian by Forbes magazine in March this year, with a net worth of $27 billion. In the same list, younger brother Anil was ranked eighth, with a net worth of $8.8 billion.

Mukesh was India's richest ($29 billion) and Anil was third richest ($13.7 billion) a year earlier in March, 2010.

Amid falling market values of their groups, the networths of both the brothers have come down sharply from the peaks seen in March 2008 on Forbes' annual rich list.

. . .

Ambanis lost $15 billion in a year; so did investors

Photographs: Reuters

At that time, Forbes put Mukesh's net worth at $43 billion, while that of Anil was close behind at $42 billion, ranking them as the two richest Indians in the world.

While the fall in market values of the two groups was mostly in line with the broader market trends till mid-2010, allegations of various controversies and scams have hit them harder thereafter.

The combined market value of both the groups have plunged by nearly Rs 122,000 crore (Rs 1,220 billion), about $28 billion, in past one year to Rs 365,000 crore (Rs 3,650 billion) at present.

article