| « Back to article | Print this article |

What made former Sebi chief successful?

How was C B Bhave as the Sebi chief?

Chandrasekhar Bhaskar Bhave has always tried to avoid controversy, but that's something that has followed him like a shadow in the last three years of his professional career.

So, as he hangs up his boots as chairman of the Securities & Exchange Board of India on Thursday, he will see 'controversy' as a common thread running through his tenure.

Eyebrows were raised when he was moved from the National Securities Depository Ltd to head Sebi. Reason: NSDL was involved in a legal battle with Sebi itself.

Although he recused himself from the proceedings, there was a fair amount of flak when Sebi decided to quash the NSDL committee report.

Click NEXT to read further. . .

What made former Sebi chief successful?

In the last few of months of his tenure, he took on powerful corporate houses -- served a second showcause notice on Mukesh Ambani's Reliance Industries; investigated the Anil Ambani group and gave it a consent order at Rs 50 crore (Rs 500 million); refused to give permission to Jignesh Shah's MCX-SX to operate (the matter is in the Bombay High Court).

Besides, he consistently made fund raising difficult for Subroto Roy's Sahara Group.

He courted controversy also when he banned entry load on mutual funds, and took on the Insurance Regulatory and Development Authority (Irda) over unit-linked insurance plans.

The result: Ulips have become much cheaper.

Also, crores of investor money has been saved by the ban on entry load.

Click NEXT to read further. . .

What made former Sebi chief successful?

Sebi also had a run-in with the Forward Markets Commission when it allowed the National Stock Exchange to launch futures on gold exchange traded funds.

FMC managed to stay the launch of the gold-linked product.

Interestingly, during his tenure, the stock market went through an entire cycle.

That is, when he took over in February 2008, the Bombay Stock Exchange's benchmark Sensitive Index, or Sensex, was hovering around 18,000.

It is at the same level now.

There was a sharp dip to 8,000 and spike to 21,000 over the period.

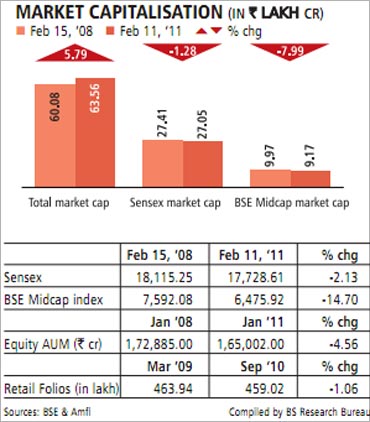

Given the high volatility, the share of retail investors has fallen sharply during his tenure. In the last three years, their share in total market capitalisation has declined.

Even the mid-cap segment, where retail investors' participation has been traditionally higher, is down 14 per cent. (See table on market performance during his tenure).

Click NEXT to read further. . .

What made former Sebi chief successful?

But, it was not because of lack of effort from Sebi.

The investment limit for retail investors was doubled -- from Rs 100,000 to Rs 200,000, application supported by blocked amounts was introduced, listing time of initial public offers was reduced, and 100 per cent payment for institutional investors at the time of investing in an IPO was allowed.

Despite these measures, investors shied away from the market because of heavy losses incurred in the IPOs after listing.

Among other measures, he extended the validity of the Sebi observation letter to one year, from the three months earlier, thereby giving companies more time to launch IPOs.

Click NEXT to read further. . .

What made former Sebi chief successful?

He also gave companies the flexibility to announce the price band two days before the opening of an issue.

The concept of anchor investors was introduced for public issues.

He also fulfilled a long-standing demand of the market by approving physical settlement in the equity derivatives segment.

The agenda papers of Sebi board meetings were also made available on the website.

Click NEXT to read further. . .

What made former Sebi chief successful?

At a time when over-the-counter currency derivatives market commanded a volume in excess of $15 billion, Sebi decided to launch those on the exchange platform, providing transparent pricing and zero counter-party risk. Market participants instantly embraced the new instrument.

Sebi then moved a step forward by allowing futures contracts in euro, yen and pound sterling.

The regulator finally topped it by allowing rupee-dollar options. Bhave also tried to infuse fresh life into exchange-traded interest rate futures, but failed.

Click NEXT to read further. . .

What made former Sebi chief successful?

Unfinished agenda

The MCX-SX matter is still pending in the Bombay High Court.

It will be interesting to see if there will be any change in the regulator's stand after the new chairman takes over.

The ongoing legal tussle has been marked with allegations against Bhave and some other Sebi officials for favouring NSE.

While Bhave did constitute a panel under former presiding officer of Securities Appellate Tribunal, C Achuthan, to overhaul the country's takeover regulations, the final decision is yet to be taken.

The panel, formed in September 2009, submitted its report in July 2010. The Sebi board has deliberated on the issue in the last two meetings, but chose not to take a decision.

Apparently, the government is yet to decide on some of the recommendations proposed by the Achuthan Committee.

Click NEXT to read further. . .

What made former Sebi chief successful?

| TIMELINE |

| Feb '08 C B Bhave appointed seventh chairman of Sebi |

| Mar '08 Sebi constitutes committee to look into NSDL issue |

| May '08 Sebi introduces Asba mechanism for public/rights issues |

| May '08 Exchange-traded currency derivatives get regulatory nod |

| Oct '09 Sebi revokes ban on participatory notes |

| Jan '09 Promoters directed to disclose pledging details |

| Jun '09 Ban on entry load, anchor investors allowed in IPOs |

| Sep '09 Achuthan-led panel formed to review takeover norms |

| Nov '09 NSDL committee orders declared null and void |

| Feb '10 A committee was set up under Bimal Jalan |

| Mar '10 Physical settlement in equity derivatives allowed |

| Apr '10 Initial public offer timeline reduced to 12 days |

| Sep '10 MCX-SX barred from launching full-fledged bourse |

| Oct '10 Retail investment limit in IPO doubled to Rs 2 lakh |

| Jan '11 Rs 50-crore consent order against Anil Ambani, R-Infra and R-Power |

| Feb '11 Asba made mandatory for qualified institutional buyers |

| Feb '11 Sebi sends another showcause notice to RIL |

Click NEXT to read further. . .

What made former Sebi chief successful?

The Bimal Jalan report, which again was the epicentre of a major controversy, will also figure in the unfinished agenda. The report was submitted to Sebi in November 2010.

It has attracted mixed reactions from industry participants since then.

Another long forgotten issue is of the CORE Committee recommendations, which called for a rise in the networth criteria for brokers, mutual funds and various other market participants.

The report was made public in May 2010 and has not seen any progress since then.

Click NEXT to read further. . .

What made former Sebi chief successful?

In its last board meeting, the market regulator recommended to the corporate affairs ministry that it "suitably amend" the Companies Bill, 2009, "to disallow interested shareholders from voting on the special resolution of prescribed related-party transaction".

In 1994, when the first chairman of Sebi and Bhave's mentor, G V Ramakrishna, retired, stock brokers celebrated. Seventeen years later, when the prot g is retiring, the mutual fund industry and many corporate players would be raising a toast. At the same time, however, many others would miss him dearly.

His impartiality would be Bhave's legacy.