| « Back to article | Print this article |

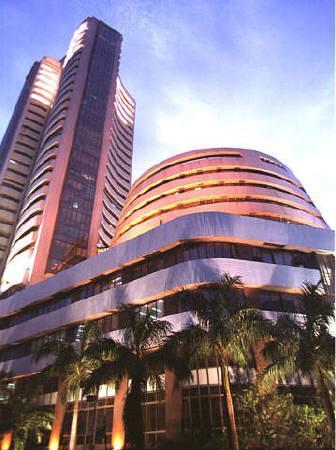

BSE launches Islamic index; what is it?

The Bombay Stock Exchange, in collaboration with the Taqwaa Advisory and Shariah Investment Solutions -- Tasis -- has launched an Islamic index in a bid to woo more investors from India and overseas.

The new index -- BSE Tasis Shariah 50 -- was formed using the guidelines of the Islamic investment code and upon the advice of a Shariah advisory board.

The index allows investors to trade in the stock markets without violating the Islamic code on investment and finance.

The National Stock Exchange already has an Islamic index that is linked to Standard and Poor's Shariah-compliant index.

The BSE TASIS Shariah 50 index consists of the 50 largest and most liquid Shariah compliant stocks within the BSE 500.

Some of the major stocks that are part of the BSE Tasis Shariah 50 include Tata Consultancy Services, Maruti Suzuki, Bharti Airtel, Reliance Industries Ltd, etc.

Click NEXT to read on . . .

BSE launches Islamic index; what is it?

Tasis employs a strict, proprietary screening process their access to and deep local knowledge of listed Indian companies to ensure that all stocks included within the Shariah 50 are strictly compliant with Islamic Shariah law.

Tasis has adopted financial screening norms that are more conservative than its peers, making the product ideal for Islamic investors seeking investments that adhere to the strict, conservative Shariah compliance norms.

Additionally, the Shariah 50 is the first Shariah compliant equity index in India to be publically disseminated on a real-time basis, providing a new tool for use by Islamic and other socially responsible investors to track the performance of India's largest and most liquid Shariah compliant stocks.

Click NEXT to read on . . .

BSE launches Islamic index; what is it?

The index can be licensed for the construction of Shariah compliant financial products including mutual funds, ETFs, and structured products.

The Shariah 50 is also India's first equity index to employ index constituent weight capping. Index constituent weights are capped at 8% at rebalancing, in an effort to increase the diversification within the index and ensure greater compliance with international regulatory and statutory investment guidelines.

Shariah screening process

BSE has partnered with Tasis, the premier Indian Shariah advisory firm to ensure that all stocks included in the BSE Tasis Shariah 50 meet the strictest possible Shariah compliance norms.

Screening includes:

Business screening: Ensures that companies selected are in businesses that do not harm society per Shariah law.

Interest activity screening: Ensures that companies involved in interest-bearing activities are within Shariah tolerance levels.

Click NEXT to read on . . .

BSE launches Islamic index; what is it?

1) What is Shariah compliance?

Islamic law does not permit investors to invest in companies that derive significant benefit from interest or the sale of other goods/services deemed sinful within the Islamic faith (e.g. alcohol, tobacco, firearms, etc.)

Shariah compliant companies included in the BSE Tasis Shariah 50 have been screened by Tasis, to ensure compliance with Islamic canonical law.

2) What is the benefit of a Shariah compliant index?

Shariah compliant indices can be used to construct Socially Responsible Investment (SRI) products that are attractive to investors who do not wish to invest in stocks of companies that engage in activities that they deem to be against their beliefs.

These products are particularly attractive to Islamic investors, as these instruments allow followers of the Islamic faith to invest without violating their religious principles.

Several prominent studies in recent years have identified the fact that Muslim participation in India's financial system is minimal. The Sachar Committee Report (2006) found that nearly 50 per cent of India's Muslim population was excluded from the formal financial sector.

The creation of the index will help promote financial inclusion of the Muslim population in India and attract investment flows from international funds that must adhere to Shariah norms.

Click NEXT to read on . . .

BSE launches Islamic index; what is it?

3) How are stocks screened for Shariah compliance?

Stocks are screened for Shariah compliance by Tasis using a conservative approach which screens for business activities that are non-Shariah compliant and for compliance measures meant to eliminate companies that benefit substantially from interest-bearing activities.

4) How often are stocks reviewed for compliance?

Stocks are reviewed monthly for Shariah compliance.

5) How has the Shariah 50 performed historically?

Extremely well. The Shariah 50 has outperformed the Sensex by nearly 25% and the BSE 500 by over 30% over our back-test horizon (beginning 1/1/08).

Over this period, annualized volatility for the Shariah 50 was also less than both SENSEX and the BSE 500 by nearly 5 percentage points.

6) How often are modifications made to the index?

Stocks are screened monthly for Shariah compliance at which time non-compliant stocks will be removed from the index. On a quarterly basis, stocks will be added to bring the index constituent count back to 50.

Click NEXT to read on . . .

BSE launches Islamic index; what is it?

7) Why are stock weights capped at 8%? How often does this capping occur?

The Shariah 50 is the first Indian index to utilise stock-level capping, which increases diversification and makes related products more attractive to international investors subject to regulatory and statutory diversification requirements.

9) I am not a Muslim. Is the Shariah 50 index of any use to me?

Yes. Socially responsible investors of any faith may find this index and related investment products useful as companies deemed to be socially harmful are removed from the index.

8) Where can I learn more about Tasis?

To learn more about our Shariah advisory partner, Tasis, and to download a report on the state of the Islamic finance industry in India, please visit: Tasis Website: www.tasis.in