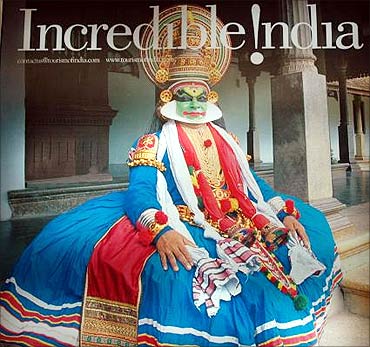

Photographs: Reuters Shahid Javed Burki

A great deal of the excitement that resulted from the fast recovery of China and India from the Great Recession of 2008-09 has begun to dissipate. Both countries raced forward while much of the industrial world continued to languish.

There is now some talk of the possibility of a double-dip recession in both America and Europe and some weakening in large emerging economies. The global economy is not proceeding in the direction in which it was supposed to go.

Even as GDP growth rates diverged in the West and large emerging markets, there was talk of a faster-than-expected realignment of the global economy.

It was expected that the centre of gravity of the global economy would shift from the Atlantic to the Pacific within a decade or two.

. . .

What India must do to keep its economy booming

Photographs: Reuters

Now, both parts of the world economy are hurting, though in different ways. The West is worried about the burden of debt carried by a number of economies, which is not sustainable over the medium term; the emerging economies are concerned about rising price levels.

According to the Bank for International Settlements Germany's gross public debt is 87 per cent of its GDP; Japan's is 213 per cent; Britain's is 89 per cent; and the United States' is 101 per cent.

Debt levels in Greece, Ireland and Portugal are much higher -- high enough to trouble the bond markets, hence the ability of these countries to borrow in order to meet their obligations. But in the West, inflation is not a problem.

In fact the Federal Reserve, the US' central bank, launched a programme called 'quantitative easing' aimed at preventing deflation from further compromising the state of the economy.

. . .

What India must do to keep its economy booming

Photographs: Reuters

The situation in the emerging world is very different. Both China and India are finding it hard to manage rapidly- growing economies without igniting inflation. Both have decided to focus on monetary management as the way for taming price increases.

And both are finding that this cure my not deliver the results they seek. They need deep structural changes to ensure that the momentum of growth is not lost.

For political reasons, both China and India need to have their economies grow at or near 10 per cent a year.

China needs a high growth rate to contain discontent among its workers. The regime has allowed some expression of unhappiness on the part of the working population.

. . .

What India must do to keep its economy booming

Photographs: Reuters

This has resulted in an increase in wages by significant amounts and would change, in quite a dramatic way, the contours of the model of growth the country has followed for several decades. It is unlikely that future growth will come from investments that produce cheap goods for western markets by low paid labour.

In India coalition politics has delayed action on a number of fronts, without which the potential of the economy will not be realised.

If the economy softens, it will have political implications for the governing coalition. India needs growth to address the problem of poverty as well as interstate and interpersonal income distribution disparities.

While China crossed the 10 per cent growth target on several occasions, India remains below that threshold. The recent changes in interest rates ordered by the Reserve Bank of India, India's central bank, have resulted in reducing the rate of investment and, therefore, the rate of future growth in its domestic product.

. . .

What India must do to keep its economy booming

Photographs: Reuters

But it has not succeeded in controlling inflation. Both food and core inflation rates have crossed the levels regarded as economically and politically sustainable. China has used a combination of monetary tightening and administrative controls to tame inflation.

Clearly, both China and India are not succeeding in these endeavours.

What both countries need is a combination of short-term adjustments and long-term structural changes. China needs to prepare itself for the time when it will no longer be an export powerhouse exploiting its low-wage workforce.

The assumption that hundreds of millions of workers in the countryside will be prepared to move to the relatively high-productivity sectors of the economy, thus continuing to contribute to growth, proved unrealistic.

. . .

What India must do to keep its economy booming

Photographs: Reuters

The spread of new information technologies has meant the aspirations of workers in modern sectors could not be separated from those of people who remained in the countryside.

There is now a widespread demand for improvement in the living standards of workers, something which even a tightly controlled political system cannot ignore.

This means a significant restructuring of both the sources of supply and demand in the country. China must begin to refashion its economy to meet rapidly rising domestic demand, and not just continue to provide for Western markets which are now less hungry for cheap Chinese products.

There are somewhat different demands being placed on the Indian economy and the political system. Perhaps taking their cue from the explosion in the Arab streets, which led to the Arab Spring, Indian citizens are also prepared to come out in large numbers and ask for higher-quality governance.

. . .

What India must do to keep its economy booming

Photographs: Reuters

Over time India has developed a political system that has shown that democracy in the developing world need not retard economic progress. It must now move this system forward so that it becomes more accountable to the people.

The country cannot afford to wait for periodic elections to cleanse the system. It must also have the institutional wherewithal to hold those placed in office by elections to satisfy the public demand for cleaner governance.

India also needs to open up its economy further. It was the dramatic opening up in 1991 that engendered the Indian miracle of the last two decades.

But India needs to open up further if it is to take advantage of the rapid changes in the structure of the global economy.

. . .

What India must do to keep its economy booming

Photographs: Reuters

Foreign capital inflows must not be deterred by populist demands that have made it difficult for large retail firms to set up shop in the country and for manufacturing enterprises to acquire land for building new green-field plants.

What the world needs now is a new way of handling problems being confronted by its different parts. Unfortunately, for different reasons, the political establishments in almost all major world economies don't seem equal to the task of managing the needed structural change.

China and India pursued different political models to achieve the same economic result: a high rate of GDP growth. Now that their economies have matured, they will need to pursue different policies to smooth out the wrinkles that have appeared.

The author is a former finance minister of Pakistan.

article