| « Back to article | Print this article |

What China will look like in 2015

In its first Global Wealth Report, Credit Suisse Research Institute predicts total wealth in China will experience a huge jump by rising 111 per cent to $35 trillion by 2015, outstripping Japan to become the second highest in the world.

According to the report, China's total household wealth is now the third highest in the world at $16.5 trillion, only behind the United States and Japan which recorded $54.6 trillion and $21.0 trillion respectively.

The report also forecasts global wealth is likely to increase 61 per cent by 2015 to $315 trillion, from the current level of $195 trillion.

There is no doubt that China is now a rising consumer giant.

Click on NEXT to read more...

What China will look like in 2015

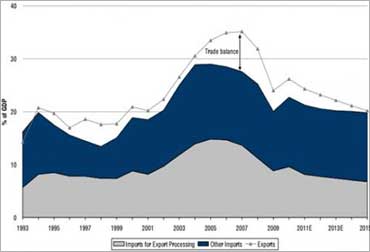

The days of a pure export-driven economy and large trade surplus are gone for good.

In November 2010, exports rose 35 per cent to a record $153.3 billion from November 2009 and imports advanced 38 per cent to an unprecedented $130.4 billion, leaving a $22.9 billion excess.

The surplus was China's fifth this year in excess of $20 billion and compared with October's $27.2 billion.

Source of graphics: CEIC, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

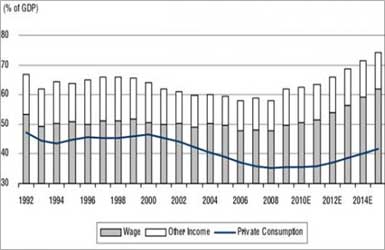

Share of wage income and consumption will rise in China

China will likely see 'strong' increases in salaries in the five years through 2015 as the nation's supply of labour dwindles and consumers begin to spend more and save less, Credit Suisse said in the report.

Wages may increase to be equal to 62 per cent of China's gross domestic product by 2015 from 50.5 per cent in 2009.

Economic growth may be about 9 per cent a year from 2011 through 2015 as wages rise by 19 per cent annually, according to the report.

Source of graphics: CEIC, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

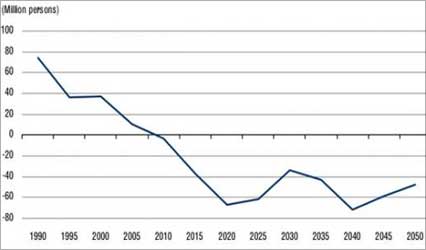

But all's not hunky-dory at the the workshop of the world

Menial labour is not an infinite resource. The supply is shrinking.

Labour unrest in China is more common than you may think.

The country's courts handled more than 280,000 labour disputes in 2008, according to Outlook Weekly.

Almost 670,000 labour-intensive factories shut down in the coastal cities of Guangzhou, Dongguan and Shenzhen, and 25 million migrants lost their jobs.

Source of graphics: CEIC, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

China's Budget position may deteriorate

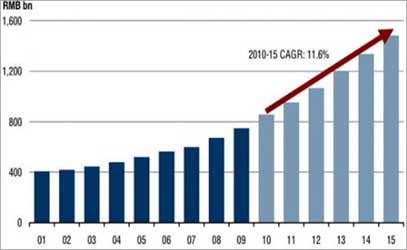

Retail sales in China may more than double to 40.5 trillion yuan ($6.1 trillion) a year in 2015 from 15.7 trillion yuan last year, the Credit Suisse said.

Household incomes may rise to 55.8 trillion yuan in 2015 from 24.2 trillion yuan last year.

Possible risks to the forecasts include an inability of companies in Guangdong province and other coastal regions to maintain profitability as wages increase, the report said.

China's success in boosting incomes and domestic consumption will also depend on the government's ability to bolster spending on social services and to control asset bubbles, such as in the property and stock markets, Credit Suisse said.

Source of graphics: MOF, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

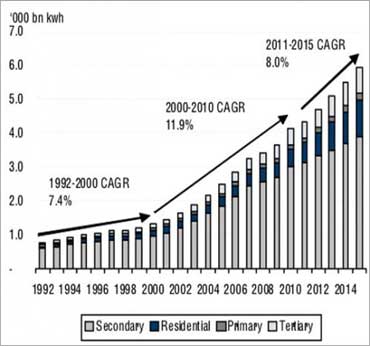

Electricity consumption will go through the roof

In a report on the electricity industry's development in the 12th Five-year programme period (2011-2015), the China Electricity Council said electricity consumption this year will reach 4.17 trillion kWh and increase to 6.27 trillion kWh by 2015.

Source of graphics: CEIC, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

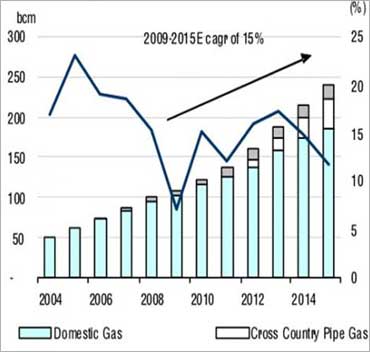

Gas supply set to rise

China's demand for natural gas will exceed its supply by 35 per cent in 2011.

China's demand for natural gas will maintain rapid growth in the coming decade, and its annual consumption will exceed 150 billion cubic meters by 2015 and 200 billion cubic meters by 2018.

The country's demand for natural gas has outstripped its supply since 2008.

It is estimated that China's energy supply-demand gap will increase from 38 billion cubic meters in 2015 to 110 billion cubic meters in 2021.

Source of graphics: CEIC, China NBS, industry data, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

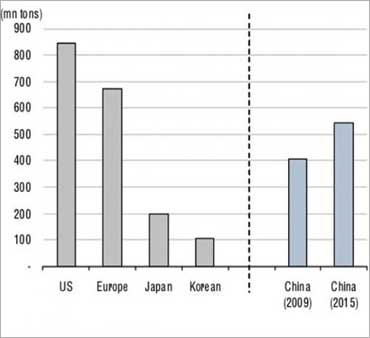

China has a long way to go

China's ability to provide for its own needs is limited by the fact that its proven oil reserves are small in relation to its consumption.

At current production rates they are likely to last for less than two decades.

Though during the 1970s and 1980s China was a net oil exporter, it became a net oil importer in 1993 and is growingly dependent on foreign oil.

Source of graphics: BP statistics, industry data, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

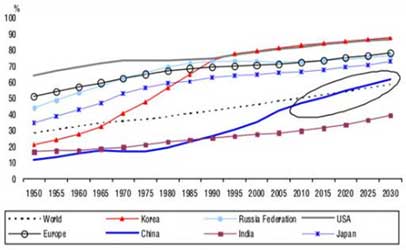

China is urbanising, and fast

Paced by strong economic growth, China's leading megapolises are also evolving very fast.

The urbanisation that took almost a century in the West is occurring in a decade or two in China.

In 1979, Shenzhen was still a poor fishing village with some 20,000 inhabitants.

In 2009, it had a population of 9 million, and income per capita exceeded $13,600, only $3,000 less than in Taiwan or South Korea.

Now Shenzhen plans to achieve an average GDP per capita of $20,000 by 2015.

Yet, despite these colossal shifts, China's urbaniszation still has a long way to go.

Today, US' urban share of the population is more than 80 per cent, whereas China's remains less than 50 per cent.

Source of graphics: United Nations (World Urbanisation Prospects - The 2009 Revision Population Database).

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

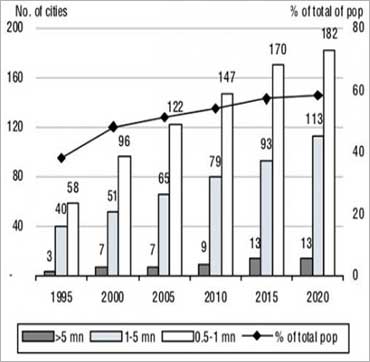

But by 2020, urbanisation will begin to slow

China's urbanisation pace has accelerated rapidly, from 10.6 per cent in 1949 to 46.59 per cent in 2009; the number of cities grew from 132 at the beginning of 1949 to 655 by 2009.

However, the world average urbanisation ratio is 50 per cent, and in developed countries 85 per cent, and China's urbanisation still lags behind the industrial development.

Source of graphics: United Nations (World Urbanisation Prospects - The 2009 Revision Population Database).

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

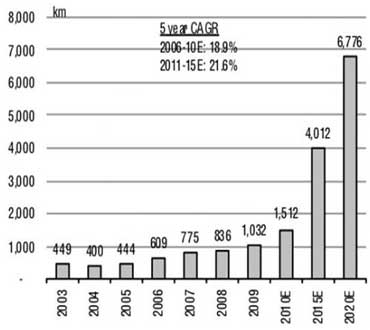

In terms of infrastructure, watch growth of the country's subways

The Beijing Subway's first line opened in 1971, and the network now has 13 lines, 172 stations and 336 km (209 miles) of tracks in operation.

It is the oldest subway in mainland China, and the second in length and ridership after the Shanghai Metro.

On December 30, 2010, Lines 15, Changping, Fangshan, Yizhuang and Daxing opened for operation.

Despite this rapid expansion, the existing network cannot adequately meet the city's mass transit needs and extensive expansion plans call for over 700 km (430 mi) of track in operation by 2015.

Source of graphics: China City Construction Year Books, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

China's highway operating length will continue to grow

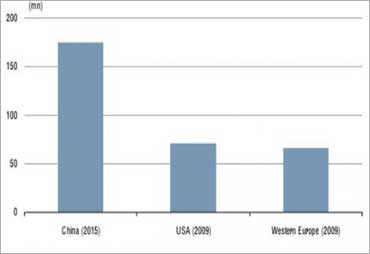

China reported 65,000 kilometers of highways designed for fast traffic by the end of 2009, second only to the United States.

China opened 4,719 kilometers of expressways in 2009 and launched construction of 16,000 kilometers of expressways last year as a result of increased investment in infrastructure.

By 2020, China will establish a national highway network, totaling 100,000 kilometers.

China has maintained its second place in the world in terms of expressway lengths since 2001.

Source of graphics: Company date, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

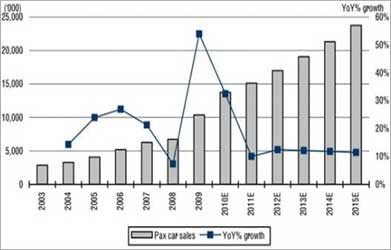

What China will look like in 2015

Car sales growth to stabilise

According to a Financial Times report, China's automotive market, the largest in the world, is expected to grow strongly this year in spite of Beijing's decision to phase out some tax incentives and restrict new car sales.

However, most experts feel, phasing out of tax incentives may hit carmakers' profits but not sales -- because carmakers may cut prices to compensate for higher taxes, the FT reported.

Source of graphics: CEIC, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

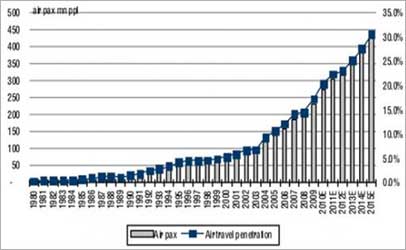

What China will look like in 2015

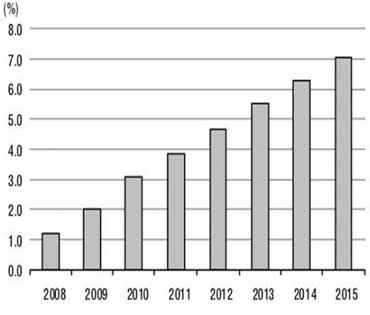

China's air travel penetration will continue to rise

China's air traffic has been a bright spot in the global airline industry, benefitting domestic airlines such as Air China.

Foreign aircraft makers like Airbus and Bombardier hope to tap this huge market.

China Eastern Airlines, the country's third-most valuable airline, expects its 2010 net profit to be around 10 times that of 2009 due to brisk air travel in China.

Source of graphics: Company data, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

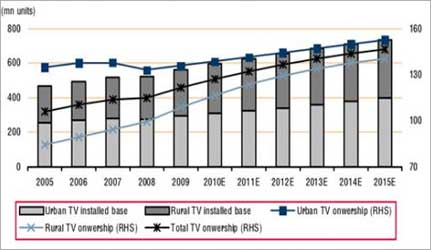

What China will look like in 2015

TV viewing is changing

China's consumer is now replacing CRT TV's with LCDs, and that will continue.

China will be the largest LCD TV market in the world by 2013.

Source of graphics: Statistics Yearbook, DisplaySearch, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

Both business and consumer spending will drive PC purchases

Personal computer sales in China will likely grow 20 per cent in 2011 to 60 million units from an expected 50 million units in 2010.

The projected growth rate will mean China's PC market will be on par with that of the United States in terms of size by 2011.

Source of graphics: Gartner, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

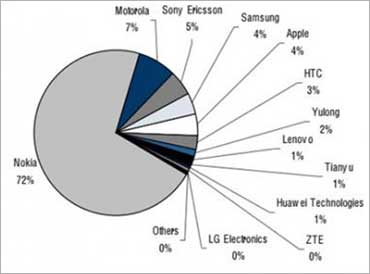

Smartphones: Potential for growth, particularly for HTC and Samsung

Despite all the hype, Android is still small among different smartphone platform in China.

However, HTC, Motorola, Samsung, and Chinese local phone markets, such as Lenovo, Huawei, ZTE, Meizu, Coolpad have all launched their version of Andriod phones.

Android phones are selling at RMB 1000 (about US$140) a piece in Shenzhen. Many expected next year, Android phones will flood the China market.

Surprisingly, there are more Blackberry than Android phones in China.

As of Apple's iPhone, experts believe it will remain a niche market for high end users in China. Its price, about RMB5000, is too high for the common white collars.

Experts believe Nokia's Symbian platform will remain a significant player, if not the largest.

Window mobile is seen to capture certain portion of the high end market.

Source of graphics: Gartner, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

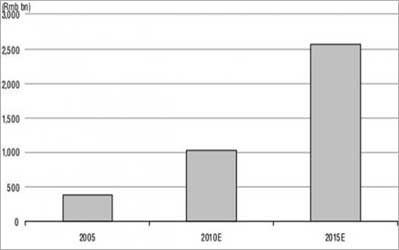

E-commerce

China's e-commerce market will surge through 2015, due to greater selection and more consumers being able to access the market.

The growth of e-commerce is accelerating in China, as the country has the largest number of Internet users in the world.

E-commerce in China is led by the dominant online marketplace Taobao of Alibaba Group.

Recently, US chain Wal-Mart has invested in Chinese e-commerce consumer electronics seller 360buy.com.

Phishing websites or fake websites, which attempt to acquire private and confidential information from online users, have seen a big surge.

Source of graphics: iResearch, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

Tobacco: Huge, growing market in China

China National Tobacco Corporation is by sales the largest single manufacturer of tobacco products in the world.

It boasts a virtual monopoly in the People's Republic of China, which accounts for roughly 30 per cent of the world's total consumption of cigarettes.

Source of graphics: Huaboa, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.

Click on NEXT to read more...

What China will look like in 2015

Healthcare

Emerging markets are set to contribute 70 per cent of pharmaceutical growth by 2015 and China will invest pound 125 billion supporting healthcare reforms by 2011.

Pharmaceutical consumption growth also outstrips per-capita GDP growth.

Chinese GDP has grown around 10 per cent in recent years whilst pharmaceutical spend growth has been 25 per cent to 30 per cent per year.

Source of graphics: MOH, Credit Suisse estimates.

Image: Credit Suisse.

Source: Credit Suisse.