Photographs: Reuters

Describing the slump in the market early Monday morning as a knee-jerk reaction to the negative global sentiment, experts said the markets will soon bounce back and lots of value buying will happen at lower levels.

Indian stocks witnessed a massive fall on Monday morning as the Sensex lost more than 500 points within minutes of the market opening on concerns over the US losing its top-notch credit rating due to mounting debts.

However, the markets recovered most of the losses by early afternoon trade and the Sensex narrowed its loss to just 58 points at one point of time.

Commenting on the market trends, Geojit BNP Paribas Financial Services Research Head Alex Mathews said, "Fall in the stock market was a knee-jerk reaction to the crisis in the US."

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

"For exporting companies like TCS, Infosys, Wipro, the outlook seems to be negative at the moment in the wake of slowdown in euro zone and uncertainty in the US," he said.

"On the positive side, crude oil prices are falling which is a good news for India. Base metal prices are also declining which too is a positive factor," he added.

For the Indian market, valuations are attractive at the moment. "Our markets are already in the oversold region, so even after a weak opening, it can bounce back when it closes today (Monday). There is a downside, but it is limited," Mathews noted.

"Sentiments are weak at the moment. But, I think a lot of value buying will come at lower level and the market will bounce back soon," CNI Research CMD Kishore P Oswal said.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

Marketmen said that a positive opening in some of the European markets also helped improve the market sentiment back home.

The sharp fall in the market comes after the US lost its 'AAA' credit rating for the first time in history, as rating agency S&P was not convinced with the efforts being made to tackle the country's debt problems.

Some experts also believe that the situation might turn into a boon for the Indian markets in the long term, as India is fundamentally stronger among its peers and attracts more international inward financial flows.

"In case there is any nervousness in the market, as happened in 2004 and 2008, it will be another opportunity for all classes of investors to make aggressive buying," Geojit BNP Paribas Financial Services MD C J George said.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

Plunge in stock market a panic reaction: Basu

Terming the slump in the stock market this morning as a "panic reaction", chief economic advisor Kaushik Basu on Monday said India's growth story remains intact and there was no need of any policy intervention.

"Right now, we don't need any special measures... Should the need arise, the government and the central bank are in a position to step in... But barring the immediate reaction to what is happening now, the India story remains robust," Basu told reporters in New Delhi.

He was reacting after the Sensex lost over 500 points within minutes of opening on Monday on concerns over the US losing its top-notch credit rating from Standards & Poor's. The markets, however, recovered as the day progressed.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

Though the downgrade of the US sovereign rating is a matter of concern, Basu said there was no need for alarm and people should not overreact to the development.

"The global event is a matter of concern, but not a matter of alarm, because the long run story remains more or less intact," he said.

He said the American economy has been facing difficulties for the past many months and hence, the stock market has already factored in the troubles in the US.

"What we are seeing now is a fluctuation... reaction to this (S&P) news. In the long run, I do believe the market trend remains more or less the same and people should not overreact to it," he added.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

If there is a slowdown in the US economy, "which is possible", he said Indian exports could suffer, as America is one of the country's largest trading partners.

"(However) the impact will be short run," Basu said. He further said there are signs of the tectonic plates of the global economy shifting toward the eastern part (China and India) of the world.

"In the next months and in the medium to long run, there will be global capital in search of safe haven... We (India) can become the safe haven that a lot of global capital will be seeking," Basu added.

Late on Friday, global ratings agency S&P downgraded its US sovereign rating to AA+ from AAA, with a negative outlook. This is the first time since 1917 that the US credit rating has been revised.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

This resulted in a bloodbath in the Indian markets in morning trade today, with the Sensex plummeting over 500 points.

There have been fears of slowdown in the US, with the economy clocking a 0.8 per cent growth rate in the first half of 2011.

Ahead of the markets opening this morning, the RBI had said it was closely monitoring global developments and would continuously assess any impact on the rupee, forex liquidity and macroeconomic scenario.

Basu said the S&P downgrade could lead to an increase in borrowing costs in the US and could impact its economic growth going forward.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

"It could make market borrowing costlier in the US, if borrowing becomes costlier in the US by 25 to 50 basis points, it is going to have an impact on the American economy...," Basu said.

Standard & Poor's also cautioned that it could lower the sovereign ratings of countries like India, Japan and Malaysia, which are yet to come out of the economic meltdown of 2008.

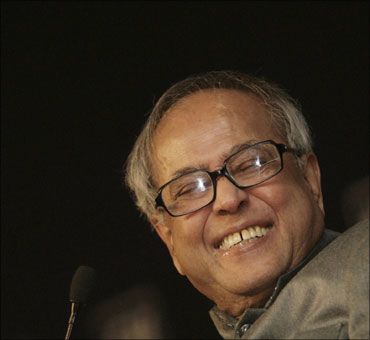

India's fundamentals strong, says Pranab

Seeking to allay fears in the wake of the economic problems in the United States, Finance Minister Pranab Mukherjee on Monday said India's fundamentals are strong and the country is in a better position than other nations to meet the challenge although there could be some impact.

Mukherjee said the country could see faster and greater foreign institutional investor (FII) inflows unlike after 2008 meltdown in view of the higher returns that global investors could get in India and that implementation of pending reforms could be fast tracked.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

"The recent developments in the US and the Eurozone have injected certain uncertainty in global markets. These developments could have some impact on India. But as India's growth story is intact and its fundamentals strong, we are in a better position than many other nations to manage the challenge," Mukherjee told reporters outside Parliament House.

He said there could be "some impact" on capital and trade flows "but as India's growth story is strong we could see FIIs viewing India as an attractive investment destination even if there is any temporary outflow".

Mukherjee asserted that India's institutions are strong and "we are prepared to address any concern that may arise on account of the present situation".

Mukherjee's observations, sounding a note of optimism, came amidst a sharp fall in the stock markets apparently in view of the downgrading of the US economy by Standard and Poor's.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

Insisting that India's economic fundamentals are sound, the minister said the government would also focus on encouraging greater domestic consumption and giving greater impetus to the drivers of domestic growth.

"The government will fast track the implementation of pending reforms and keep a close eye on international developments," Mukherjee said.

He said softening of the international commodity prices, especially fuel oil, will help check inflationary pressures in the economy.

"It will also help in maintaining the fiscal balance for the year 2011-12," he said.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

Mukherjee also mentioned about the steps being taken by the Reserve Bank of India to deal with the problem.

"The most important part of the RBI statement is that in the immediate future the Reserve Bank priority is to ensure that adequate rupee and foreign exchange liquidity are maintained in domestic markets to prevent excessive volatility in the interest rates and exchange rates," he said, adding, "this is very much reassuring".

The finance minister also spelt out views expressed by G-20 finance ministers and central bank governors.

"We, the finance ministers and central bank governors of G-20, affirm our commitment to take all necessary initiative in a coordinated way to support financial stability and to foster stronger economic growth in a spirit of cooperation and confidence...

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

"We will remain in close contact throughout the coming week and cooperate as appropriate, ready to take action to ensure financial stability and liquidity in financial markets."

"Moreover, we will continue to work intensively to achieve concrete results in support of strong, sustainable and balanced growth in the context of G-20 framework on growth," the finance minister said.

Indian eco domestically driven; markets will stabilise: Montek

Planning Commission Deputy Chairman Montek Singh Ahluwalia on Monday said Indian economy is mostly driven by domestic factors and markets here will stabilise in the short-run, despite the recent meltdown on account of the US downgrade.

"The high growth of Indian economy is largely driven by internal factors. I feel the market will stabilise in the short-run. I don't expect to see a big negative impact but we have to watch the situation," Ahluwalia told PTI.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

"The impact on India depends on what happens in the world. If there is financial instability (globally), there will be some impact," he added.

Ahluwalia said the downgrade of the US' long-term sovereign ratings by S&P -- which has happened for the first time since 1917 when the US was first given a rating -- was not unexpected.

"The S&P downgrade of the US debt was in some sense expected because fiscal unsustainability issue of the US has been known for some time. There are similar problems in many European countries," Ahluwalia said.

The Plan panel chief said there will be some short-term instability in the markets.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

"But world leaders are quite aware that they should try to contain this instability," he said.

Asked about the impact on India, Ahluwalia said that if there is financial instability globally, it will affect the Indian economy to some extent.

"Industrialised countries' growth rate is less than it should otherwise be," he said.

Regarding the downgrade rating which has come under criticism in certain quarters, Ahluwalia said: "I think the key issue is that S&P seems to be under the impression that US is not going to be in a situation to deal with fiscal unsustainability issue. I don't think that is a fair conclusion to reach based on what we know today."

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

"They (US) may not be doing something today but the real question is that over the next few years can they bring this under control and I am hopeful that they can."

Earlier in the day, Ahluwalia told a private news channel that almost all the industrialised nations have problems and the world economy was definitely looking weaker than what it looked about six months ago.

"We definitely get adversely affected if the rest of the world slows down... only saving grace is that commodity market is not affected," he told news channel CNBC-TV18.

"Generally my feeling is anything that unsettles global economy is a bad news," Ahluwalia said, while urging the global leaders and policymakers to make a concerted effort to take corrective steps.

. . .

Slump is knee-jerk reaction, stocks will bounce back: Experts

Photographs: Reuters

He also said the focus on the fiscal deficit abroad will actually translate into much greater scrutiny and the people would more interested in looking at India's fiscal deficit position also.

US crisis may hit exports and capital flows: Rangarajan

The Prime Minister's Economic Advisory Council chairman C Rangarajan on Monday said the downgrade of the US sovereign rating will negatively impact exports and moderate capital flows into the country.

"More than the downgrade, what will be the impact for the rest of the world will be the slow pace of recovery in the US," he said in a statement.

"In the first half of the current calendar year, the growth rate in the United States was 1.5 per cent. Perhaps for the year as a whole, other growth rates may not be much higher than that. That's a very, very slow pace of recovery and that has implications for the world in terms of capital flows, in terms of trade flow," he said.

article