Good news! Goldman upgrades India rating

Last updated on: August 8, 2011 17:55 IST

Image: India rising.

Citing expected improvement in macroeconomic situation, Goldman Sachs on Monday upgraded India's rating to 'market weight', indicating bullishness in the short-term.

After maintaining an 'under weight' status on India for one year now, Goldman Sachs also cited lower oil prices and government's push for policy reforms for the upgrade.

"We upgrade India after a year at under weight, on a turn in the macro cycle, oil prices, valuation, and policy reform," it said in a research note.

Good news! Goldman upgrades India rating

Image: Reuters.

The upgrade comes at a time when there are rising fears of domestic economic slowdown amid escalating debt turmoil in the US and Europe.

However, Goldman expects the Indian economy to grow 7.3 per cent in the current fiscal, lower than the earlier projection of 7.5 per cent expansion. The Reserve Bank of India has forecast 8 per cent growth in 2011-12.

Good news! Goldman upgrades India rating

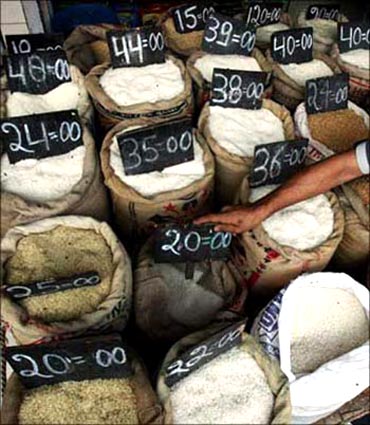

Image: Inflation rises in India.

Global economic uncertainty apart, India is grappling with high prices with headline inflation touching 9.44 per cent in June.

To tame rising prices, the apex bank had hiked key policy rates eleven times March 2010.

Goldman Sachs noted that Reserve Bank of India's latest move to raise repo rate by 50 basis points was a clear sign in that it is vigilant in bringing down inflation expectations.

Good news! Goldman upgrades India rating

Image: Reuters.

"Despite the near-term weakness, we believe the policy tightening was a necessary step to reigning in inflation expectations and will ultimately serve as a net positive for the Indian equity market on a medium to longer term horizon," the research note said.

According to Goldman Sachs, core inflation is expected to taper off "in the autumn months... believe the equity market will already start to discount a moderation in inflation".

Good news! Goldman upgrades India rating

Image: Reuters.

Goldman Sachs noted the current correlation between oil and Indian equities is relatively low and positive, suggesting that current oil price movements are not weighing on investor sentiment with regards to India.

"In short, we believe India's current valuation appropriately reflects the potential growth slowdown that may ensue given the recent tightening measures."History suggests that at current valuation levels, India may moderately outperform the region on a 6-month basis," it added.

Good news! Goldman upgrades India rating

Image: World Trade Centre, Mumbai.

Photographs: Reuters.

Regarding policy reforms, Goldman Sachs said that over past few months, there has been some encouraging development on the political front in India even as it cautioned that much remains to be done.

The research noted cited steps such as market regulator Sebi's move to raise investment limit for foreign investors in the domestic corporate bond market to $40 billion and partial deregulation of petrol prices.

article