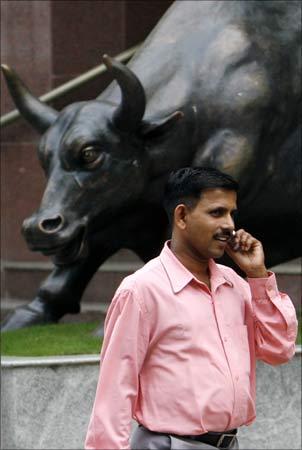

Photographs: Reuters Umang Papneja

Mid-cap, cyclicals and PSU stocks are expected to do well over the next few years.

The rapidity of equity upsides, especially in a revival story, can surprise most market participants.

Opportunistic investors have already started increasing their allocations, as there are encouraging signs of economic recovery on the horizon.

This was clearly visible in increase in gross and net inflows into equity Mutual Funds in the month of May and also June till date.

Smart investors are finding that the risk-reward balance is tilted in favour of significant upside potential versus limited downside risks from this level, and accordingly increase their current allocation to equity.

Eventually, what is the 'correct' allocation to equity is a question each investor must answer for herself/himself. However, the following broad principles mentioned above could help investors in taking a decision about equity investing.

…

Please click here for the Complete Coverage of Budget 2014 -15

How to make money from stocks

Photographs: Reuters

Mid-caps expected to re-rate

Good quality mid or small-cap companies are highly geared to an economic recovery.

A revival in economic growth usually leads to a sharp increase in their sales/earnings.

An increase in sales/earnings growth is typically accompanied by a re-rating in the valuation multiples.

The multiplier effect of a sharp increase in sales/earnings and re-rating of the valuation multiple leads to significant run up in the prices of mid-cap stocks.

It is not surprising that mid-caps have outperformed large caps in periods of steady economic growth. In the bull market from 2003-07 the CNX Midcap delivered a CAGR of 55 per cent against a CAGR of 41 per cent of Nifty.

…

Please click here for the Complete Coverage of Budget 2014 -15

How to make money from stocks

Photographs: Reuters

Cyclicals do well in a recovery

History has shown that cyclical stocks (capital goods, metals, banking, infrastructure, etc) are some of the best performing stocks in an up-cycle, owing to the expansion in earnings as well as re-rating of the P/E (Price-Earnings multiple).

Most of the cyclicals have witnessed earnings drop of 40 per cent to 60 per cent from their peaks and their valuation ratios are at the lower end of their trading bands.

…

Please click here for the Complete Coverage of Budget 2014 -15

How to make money from stocks

Photographs: Reuters

PSUs - future jewels

Public Sector Undertaking (PSU) reforms are likely to be among the first tasks for the newly installed Modi Government, given the new Prime Minister's track record in his home state of Gujarat.

The knock-on effect on the economy can be significant, since many PSUs operate in segments of vital national importance. PSUs lagged the wider equity market both in terms of net profit growth and stock price performance.

Net profit CAGR of 81 listed Central PSUs was 12.5 per cent in the last decade (FY03-FY13) versus 19.2 per cent for BSE100 companies.

Net profit CAGR of 52 listed non-banking PSUs was even lower at 9.8 per cent CAGR over the past 10 years. This is expected to change for the better and PSUs could become a larger part of total market capitalisation in the future.

…

Please click here for the Complete Coverage of Budget 2014 -15

How to make money from stocks

Photographs: Reuters

The above three themes are expected to do well, but investing cent percent across them may not be prudent.

Investors should take a diversified approach across sectors but should have overweight positions in these.

While investing in Mutual Funds, one can allocate to schemes which are positioned for an economic recovery.

The other decision revolves around how much equity allocation is ideal at this time. Just as investors may have been over invested in equity at the peak of the cycle in 2007, they are probably under-invested now.

Investors need to consider the following while taking a re-look at their equity allocation.

…

Please click here for the Complete Coverage of Budget 2014 -15

How to make money from stocks

Photographs: Reuters

Long-term capital appreciation

Investors allocate funds to equity for long-term appreciation of capital.

Though 'balanced' investors traditionally invest approximately 45 per cent - 55 per cent of their portfolio in equities, given the current scenario, most of their portfolios seem to have only between 10 per cent - 20 per cent allocation.

A similar story seems to be playing out across other classes of investors, such as conservative, aggressive, and so on.

Hence, it is time investors start taking steps towards reaching their long-term allocation.

…

Please click here for the Complete Coverage of Budget 2014 -15

How to make money from stocks

Photographs: Reuters

The way ahead

India's new government is well-positioned to pursue reforms and there would be a strong rebound in the economic growth going forward.

India's growth potential was constrained by a number of factors linked to the socialist and centralised control model that the country had adopted all these years.

Now it is safe to assume that the policy environment will turn progressive and conducive and that will drive a turnaround in business sentiment and investment cycle.

With a decisive mandate, the NDA government can implement strong reforms and get the economy again back on track, which will attract additional inflows into equities.

…

Please click here for the Complete Coverage of Budget 2014 -15

How to make money from stocks

Photographs: Reuters

In 2012 and 2013, inflows from Foreign Institutional Investors averaged $22 billion annually, and in 2014, till date, we have received around $10 billion.

This number can significantly rise, as it is still around the same run-rate of the last two years.

Further, domestic household savings have dipped from 7.3 per cent in FY08 to a dismal 0.5 per cent in FY13. Both domestic investors and FIIs are expected to increase allocations over time.

Please click here for the Complete Coverage of Budget 2014 -15

The author is chief investment officer, IIFL Private Wealth Management.

article