Photographs: Reuters

Finance Minister Arun Jaitley on Thursday doled out income tax sops by raising threshold exemption and investment limits by Rs 50,000, raised duties on cigarettes, tobacco, pan-masala and aerated drinks, widened service tax base and announced measures to spur growth manufacturing and revive investor confidence.

Without tinkering with the tax rates and allowing continuing 3 per cent education cess on all tax payers, he provided encouraging signals for domestic and foreign investors offering not to "ordinarily" bring about any tax change retrospectively which creates a fresh liability.

Speaking to PTI after presenting his maiden budget in Parliament, he ruled out resorting to retrospective taxation and said "ordinarily we will not legislate to create fresh liability."

Jaitley said he has taken important steps that were necessary but not taken in the last 10 years to put the economy back on track.

...

Please click here for the Complete Coverage of Budget 2014 -15

What Modi's package offers for the common man, economy

Photographs: Reuters

The budget for 2014-15 raised the threshold income tax exemption limit from Rs 2 lakh to Rs 2.5 lakh and investments under 80C by Rs 50,000 to Rs 1.5 lakh, and raised interest exemption on housing loan on self-occupied property by Rs 50,000 to Rs 2 lakh.

The exemption limit for senior citizens has been raised from Rs 2.5 lakh to Rs 3 lakh. The tax sops could leave up to Rs 40,000 in the hands of assessees.

However, there is no change in rate of surcharge either for the corporates or individuals and the education cess of three per cent will also continue.

Baggage allowance for passengers returning from abroad has been raised from from Rs 35,000 to Rs 45,000.

The Budget makes cigarettes, tobacco, pan-masala, gutka and cold-drinks costlier by raising excise duties while CRT TVs used by poor, LCD and LED TV panels of less than 19-inches will be cheaper through cuts in customs duties.

Direct tax proposals in the budget involve a sacrifice of Rs 22,200 crore while indirect tax proposals will yield a revenue of Rs 7,525 crore.

Assuaging sentiments of foreign investors deterred by the change brought in 2012, Jaitley announced that all fresh cases arising out of retrospective amendments of 2012 in respect of indirect transfers will be scrutinised by a high level committee to be constituted by the CBDT before any action is initiated.

…

Please click here for the Complete Coverage of Budget 2014 -15

What Modi's package has for the common man, economy

Photographs: Reuters

"I hope the investor community both within India and abroad will repose confidence on our stated position and participate in the Indian growth story with renewed vigour," he said, offering a stable and predictable tax regime.

He also said the government will revive the revised Direct Taxes Code (DTC) taking into account the comments of stakeholders.

The Service Tax net has been widened by inclusion of radio-cabs and online ads to mop up additional revenue by pruning the negative list.

The Finance Minister said government will promote FDI by raising the cap to 49 per cent in Defence and Insurance with full Indian management and control.

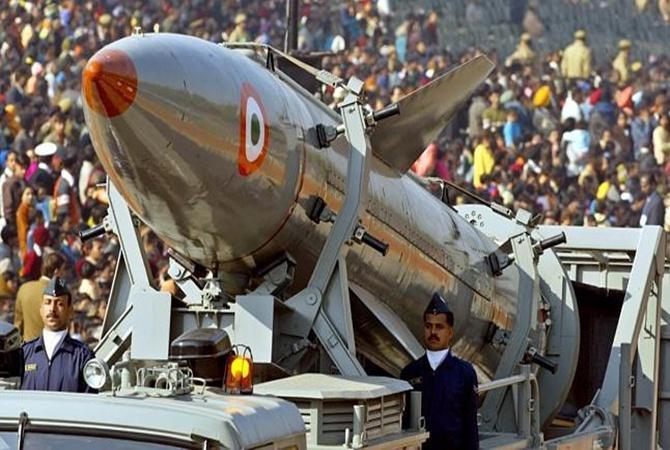

The Budget raises defence spending by 12.5 per cent to Rs 2.29 lakh crore. Non-plan expenditure for the current year has been estimated at Rs 12,19,892 crore with additional amount for fertiliser subsidy and capital expenditure for armed forces.

The total expenditure estimates stand at Rs 17,94,892 crore. Gross tax receipts will be Rs 13,64,524 crore, of which Centre's share will Rs 9,77,258 crore. Non-tax revenues for current financial year will be Rs 2,12,505 crore and capital receipts other than borrowings will be Rs 73,952 crore.

The Budget pegs the fiscal deficit for the current fiscal at 4.1 per cent of the GDP and 3.6 and 3 per cent in 2015-16 and 2016-17 respectively.

Jaitley said he began working with constraints based on the targets set by his predecessor. In 45 days, this is the best he could do, he said. The budget made a commitment to undertake an overhaul of the subsidy regime while promising protection to the marginalised sections.

…

Please click here for the Complete Coverage of Budget 2014 -15

What Modi's package has for the common man, economy

Photographs: Reuters

Asked about the budget not giving a clear roadmap for subsidy reforms, Jaitley said an Expenditure Management Commission will be constituted to look in the issue.

In an apparent reference to the previous government, he said slow decision-making had resulted in a loss of opportunity and two years of sub-5 per cent growth in the economy has resulted in challenging situation.

He said government intends to usher in a policy regime that would bring the desired growth, lower inflation, sustained level of external sector balance and prudent policy stance.

The Finance Minister said the present situation presents a challenge of slow growth in manufacturing sector, in infrastructure and also the need to introduce fiscal prudence.

The tax to GDP ratio must be improved and non-tax revenue increased, he said while pruning the negative list for levy of service tax.

"India today needs a boost for job creation. Our manufacturing sector in particular needs a push for job creation," he said.

…

Please click here for the Complete Coverage of Budget 2014 -15

What Modi's package has for the common man, economy

Photographs: Reuters

Jaitley further said growth in infrastructure and construction sectors is necessary to revive the economy and generate jobs for millions of young boys and girls.

Manufacturing sector is of paramount importance for the growth of our economy and this sector has multiplier effect on creation of jobs and announced various incentives to facilitate investments in the sector, Jaitley added.

The budget contained a slew of measures to fast-track projects mostly in public-private-public partnerships, which finds renewed focus in the minister's speech.

It also announced proposal for investment of Rs 38,000 crore for fast-tracking highways to augment the country's arterial network.

The real estate sector and infrastructure have got a boost in the budget which has proposed tax incentives for new new investment instruments--Real Estate Investment Trusts (REIT) and Infrastructure Investment Trusts (InvITs)--to help long term funds from foreign and domestic investors.

Please click here for the Complete Coverage of Budget 2014 -15

article