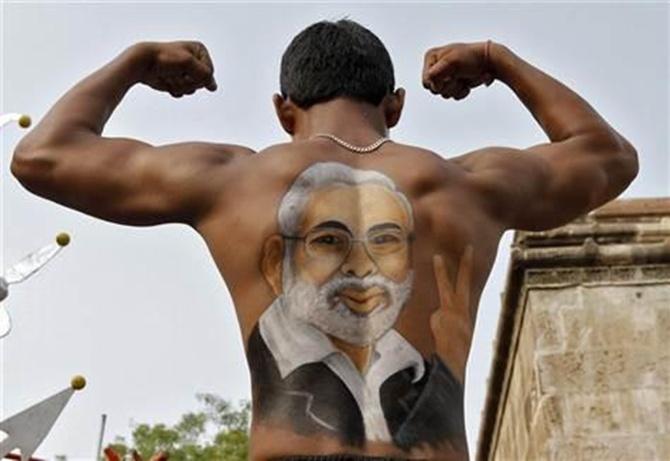

Photographs: Courtesy, PIB Abheek Barua

The Budget is in keeping with the cautious approach of the government visible in the Railway Budget, notes Abheek Barua

What is it about Budgets that invariably leave me with a mix of bewilderment, information fatigue and niggling sense of disappointment that things could be pitched better?

One reason is that Budget-watchers like myself refuse to learn from the past. Despite being disappointed time and again, we keep expecting a compact set of 'bold' initiatives that go well beyond the fiscal domain and set the agenda of big-bang reforms in motion.

What we get instead is an overdose of minutiae that completely overwhelm the few big ideas that make a fleeting appearance.

Besides, the big ideas turn out to be proposals to be mulled over by committees in the future -- not table-thumping, concrete announcements.

This Budget was no exception, and those of us (and indeed there were many) who felt that the new government has a limited window of opportunity to push through some of the more difficult but necessary economic measures have reason to feel disappointed.

Budget: Not a bang, but not a whimper either

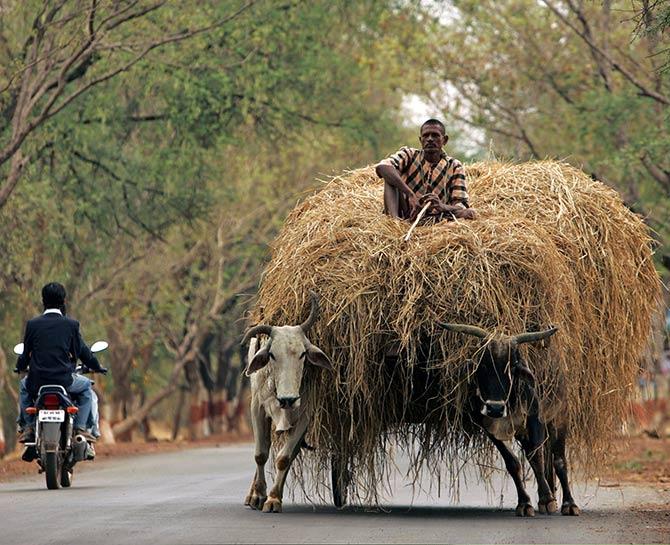

Photographs: Reuters

However, one needs to be fair to the new finance minister.

He has barely had a month in office, and this is too short a period to knit together concrete policy proposals, let alone implement them.

Once you accept this basic fact, then there are a number of positives that can be identified if you care to trawl through the copious speech.

For one thing, there is an attempt to bring back a sense of realism and credibility to the fiscal aggregates.

Thus, a decision to leave 'wiggle room' of up to 4.5 per cent for the fiscal deficit-to-gross domestic product ratio while 'officially' holding on to the 4.1 per cent target of the interim Budget would turn out to be a good thing, even if it implies that the government has to borrow a little more from the market.

Budget: Not a bang, but not a whimper either

Photographs: Reuters

That would not only answer some of the questions surrounding the credibility of the numbers (that Arun Jaitley's predecessor squirmed through in many an interview), but also help the finance minister avoid ruthless cuts in expenditures were his tax revenue targets not to materialise.

However, does that mean that the finance minister give up on budget discipline?

The emphasis right at the beginning of the Budget speech on fiscal consolidation and the problems with intergenerational equity that arise with reckless spending should be music to any economist's years.

Second, I would give the finance minister his due for both identifying some of the critical problems and promising to address them within a reasonable time-frame.

This includes an overhaul of the subsidy regime, a new urea policy and a promise to end the goods and services tax impasse within a year.

Budget: Not a bang, but not a whimper either

Photographs: Reuters

While I cannot entirely disagree with the cynics, who will point out that we have heard all this from other finance ministers and finally political imperatives (the endless cycle of state elections, for instance) invariably get in the way of good economics, I am willing to give Mr Jaitley greater odds of pushing these things through.

I base my optimism on the simple fact that Mr Jaitley does not have the bogey of "coalition politics" either to deter him or to use as an excuse. In terms of clear signals of continuing liberalisation, I thought that the increase in consolidated foreign investment limits in both insurance and defence were, in my scheme of things, the proverbial "big deal" -- and I am somewhat curious to know why the response at least from the markets has been so tepid.

Third, I would argue that much of the reform that is needed going forward has more to do with seemingly innocuous changes in things like transfer pricing rules and tax rates (where there are obvious distortions), as well as the removal of regulatory and legal bottlenecks.

This is really the stuff that bothers companies -- both Indian and multinational -- and makes doing business in India a nightmare.

Thus, Budget-watchers need to focus more on the "micros" of fiscal and regulatory policy going forward than the traditionally high-profile macro-announcements.

Budget: Not a bang, but not a whimper either

Photographs: Reuters

The Budget has its fair share of these initiatives, and my sense is that once people read the fine print, they would find more reason to cheer.

However, as a card-carrying Budget analyst, it would be remiss on my part not to comment on the credibility of some of the assumptions.

The nominal GDP growth of 13.6 per cent that underpins the Budget's math seems a little optimistic, and would assume real GDP growth of 5.5-5.7 per cent.

With manufacturing still in the doldrums and agriculture likely to be hit by a weak monsoon, there is the proverbial downside risk to this.

The 17.7 per cent growth in tax revenues assumes a fair increase in collection of tax efficiency over 2013-14, and the risk is that the exchequer will be hurt by the double whammy of an unrealistic tax-efficiency assumption and lower GDP growth.

On the expenditure side, the food and oil subsidies are together kept at the same levels that the interim Budget had targeted, while the fertiliser subsidy bill is set about Rs 5,000 crore (Rs 50 billion) higher.

Budget: Not a bang, but not a whimper either

Photographs: Reuters

These could easily go up -- because of price volatility, for example.

The finance minister might end up needing more wiggle room for his fiscal deficit than even 0.4 per cent of GDP!

However, this could be made up from divestment receipts.

The National Democratic Alliance government is far less squeamish than the United Progressive Alliance one about divestment, and if proceeds of sale of stake in entities like Specified Undertaking of the Unit Trust of India are factored in, the amount could exceed the budgeted amount of Rs 63,425 crore (Rs 634.25 billion).

Is this the kind of budget that will suddenly ramp up growth overnight or tame inflation?

Perhaps not.

However it is in keeping with the cautious approach of the government visible in the railway Budget, and points to the fact that the government does not expect to work miracles and is in it for the long haul.

I hope the rest of the world, particularly the financial markets, learns to accept this fact.

The writer is with HDFC Bank. These views are personal

article