| « Back to article | Print this article |

Trillions of dollars hidden in these tax havens!

The total amount of money stashed away in tax havens has been estimated at a whopping $11.5 trillion by the Tax Justice Network.

The Britain-based Tax Justice Network promotes transparency in international finance and opposes secrecy. Its major area of concern is tax havens.

Politicians, businessmen and non-residents across the world seek refuge in tax havens with their unaccounted income as these havens impose nil or only nominal taxes. These havens typically have laws or administrative practices under which businesses and individuals can protect them from any kind of scrutiny by tax authorities.

In India, the Supreme Court has stated that stashing black money in foreign banks amounts to 'national plunder' and has asked the government to give it all the information it has on Indians who have siphoned-off their illicit money to tax havens.

India is one of the world's largest exporters of illicit capital with an outflow of $104 billion between 2000 and 2008, according to Global Financial Integrity (GFI).

Click NEXT to find out more on the world's much sought after tax havens...Trillions of dollars hidden in these tax havens!

A tax haven, Luxembourg has been included in 'grey list' of nations with questionable banking arrangements by the G20.

There is no tax on bank interest, investment dividends, or capital gains for non-residents. Many people form part of trusts created just to evade taxes.Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

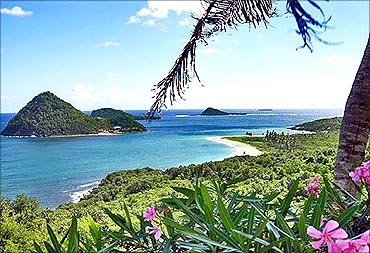

Dominica

It is an island between the Caribbean Sea and the North Atlantic Ocean, about half way between Puerto Rico and Trinidad and Tobago.The Dominican economy depends on agriculture, primarily bananas, and remains highly vulnerable to climatic conditions and international economic developments.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

The Cayman Islands (Grand Cayman, Cayman Brac, Little Cayman) in the Caribbean Sea, 240 km south of Cuba and 268 km northwest of Jamaica, are a thriving offshore financial centre. The island has no direct taxation regulation.

More than 68,000 companies were registered in the Cayman Islands as of 2003, including almost 500 banks, 800 insurers, and 5,000 mutual funds.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

In the Channel Islands, no tax is paid by corporations or individuals on foreign income and gains.

Real estate-based investment trusts are attracted to Channel Island for the low tax rates.

Guernsey-Jersey

Non-residents are not taxed on local income. Local taxation is at a fixed rate of 20 per cent in Jersey, Guernsey, & Alderney and nil in Sark.Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Bermuda does not levy income tax on foreign earnings, and allows foreign companies to incorporate there under an 'exempt' status.

Businesses are allowed a total exemption from income and capital gains taxes. Anguilla Anguilla has few natural resources, and the economy depends on luxury tourism, offshore banking, lobster fishing, and remittances from emigrants.Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

No tax is levied on your income in Dubai. There is no tax on income from a property if you rent it out for profit.

There are no tax audits and no information shared with government agencies. However, it might not be a very safe place for hoarders of illicit wealth to park their funds as Dubai has double taxation avoidance treaties with many nations, including India, making it possible for it to disclose sensitive information.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Liberia

A West Africa nation it borders the North Atlantic Ocean, between Cote d'Ivoire and Sierra Leone.

Liberia has been a popular tax haven for registering ships as the country does not tax foreign source shipping income of non-resident Liberian registered corporations.

However, Civil war and government mismanagement has destroyed much of Liberia's economy.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

British Virgin Islands have low incorporation and trust maintenance fees.

Antigua and Barbuda

Investment banking and financial services also make up an important part of twin-island nation lying between the Caribbean Sea and the Atlantic Ocean. Banking majors like Bank of America, Barclays, Royal Bank of Canada, and Scotia Bank have subsidiaries in Antogua.Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Monaco

Monaco does not levy a personal income tax.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Switzerland offers a safe haven for those seeking anonymity and protection on bank accounts. The high level confidentiality attracts the richest from all over the world to save huge funds in the country.

Switzerland does not apply capital gains taxes, except for professional equity and real estate traders. Switzerland passed its banking secrecy laws in 1934 during a worldwide depression and under the threat of espionage by France and Nazi Germany.Swiss cantons levy a small wealth tax of maximum 1 per cent of your net assets. It levies a withholding tax on all interest earned in the personal Swiss accounts of European Union residents.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Belize aims to be the most attractive tax haven. The names of directors & shareholders of offshore companies are kept confidential and companies are incorporated within 3 days.

A Central American nation, Belize borders the Caribbean Sea, between Guatemala and Mexico.

Investment banking and financial services comprise an important part of the economy.

It has no capital gains tax. It is an island nation located on the eastern boundary of the Caribbean Sea with the Atlantic Ocean.Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Malta

It has succeeded in attracting foreign investors as a result of its strong infrastructure, labour force and its continuously increasing number of banks.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Known as one of the most attractive tax havens in Europe, Cyprus's taxation practices are widely appreciated across the country. It levies a low corporate tax of 10 per cent, has no capital gains tax, no withholding tax on offshore companies.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Seychelles' growth has been led by its tourist sector and tuna fishing. In recent years, the government has encouraged foreign investment to upgrade hotels and other services.

It is, per capita, the most highly indebted country in the world according to the World Bank, with total public debt around 122.8 per cent of GDP.

St. Kitts & Nevis

These islands in the Caribbean Sea are about one-third of the way from Puerto Rico to Trinidad and Tobago.

St. Kitts and Nevis is heavily dependent upon tourism revenues, which has replaced sugar, the traditional mainstay of the economy.

Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

It is part of the Lesser Antilles and consists of two groups of islands in the Caribbean Sea: Cura and Bonaire, just off the Venezuelan coast, and Sint Eustatius, Saba and Sint Maarten, located southeast of the Virgin Islands.

The islands' economy depends mostly upon tourism, international financial services, international commerce and shipping and petroleum.

The islands form an autonomous part of the Kingdom of the Netherlands.

US Virgin Islands

These Caribbean islands lie between the Caribbean Sea and the North Atlantic Ocean to the east of Puerto Rico. Tourism is the primary economic activity.

It offers a 90 per cent exemption from US income taxes and 100 per cent exemption from all other taxes and customs duties to certain qualified taxpayers.

Click NEXT to read on . . .

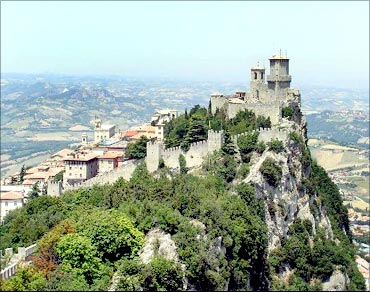

Trillions of dollars hidden in these tax havens!

San Marino has a highly stable economy, with the lowest unemployment rate in Europe, no national debt and a budget surplus.

Panama

This Central American nation borders both the Caribbean Sea and the North Pacific Ocean, between Colombia and Costa Rica.

Panama has a well-developed services sector. Services include operating the Panama Canal, banking, the Colon Free Zone, insurance, container ports, flagship registry, and tourism.

Panama has the second most unequal income distribution in Latin America. The government has recently implemented both tax and social security reforms.

Nauru

Nauru has no taxes. The only tax imposed here is an airport departure tax.Click NEXT to read on . . .

Trillions of dollars hidden in these tax havens!

Niue

This island in the South Pacific Ocean is situated to the east of Tonga. Income tax has been lowered, and import tax may be reset to zero except for items like tobacco, alcohol and soft drinks.Tax on secondary income has been lowered from to 10 per cent.

In 2003, Niue became the world's first 'WiFi nation', in which free wireless Internet access is provided throughout the country by The Internet Users Society-Niue.