| « Back to article | Print this article |

Top 5 cities real estate fund managers are betting on

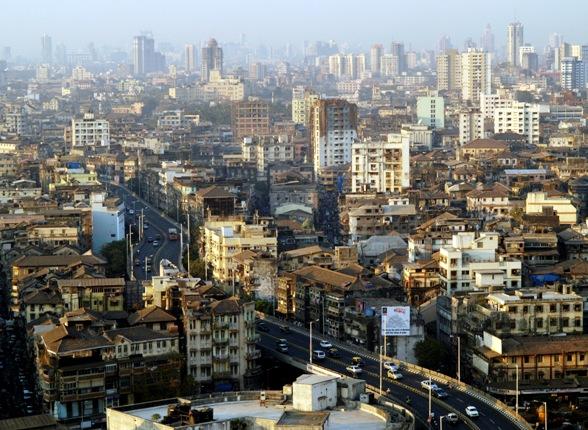

Real estate-focused private equity (PE) funds are turning their attention to bigger cities. Reason: Lack of investment opportunities in Tier-II and -III cities and higher return possibilities in large ones.

According to industry estimates, since PE investments started in 2005, as much as $14 billion has been invested in about 700 transactions with around 300 developers across 33 cities in India.

From 33 cities, large PE investors' focus is now only in the top three or six markets.

Click NEXT to read more...

Top 5 cities real estate fund managers are betting on

Take, for instance, Delhi-based Red Fort Capital. The realty fund manager has investments in six cities but now it is focusing only on Mumbai and the national capital region markets. Red Fort has 22 investments in Kolkata, Hyderabad, Chennai and Bangalore besides Mumbai and the NCR.

It is not without reason that Red Fort is focusing on these two cities.

"There are more opportunities in these cities than smaller ones," said Subhash Bedi, co-founder and managing director of Red Fort Capital, at a recent realty event here.

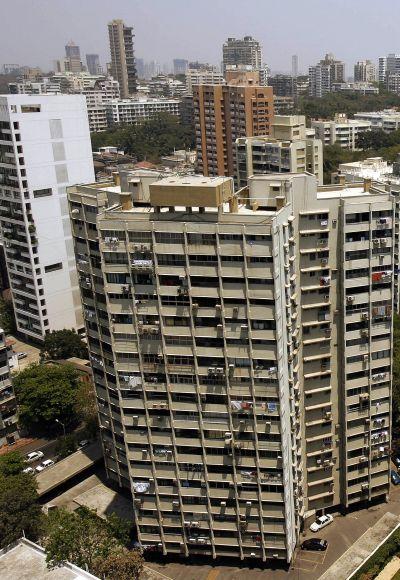

Prime land in Mumbai has appreciated 35.2 per cent in the past two years, the highest in the country, on the back of change in development norms coupled with an increase in residential prices.

NCR and Bangalore have seen 24.9 per cent and 26.1 per cent increase, respectively, over the past two years, according to Prime Asia Development Index launched by global consultant Knight Frank.

Click NEXT to read more...

Top 5 cities real estate fund managers are betting on

According to sources, HDFC Property Fund, which had earlier made investments in cities such as Coimbatore and Mysore, is now focusing the top six or seven cities.

HDFC Property Fund's top executives did not respond to calls or messages on the subject.

"Many funds have gone back to Tier-I cities because job creation in Tier-II and -III cities was more of a hype than a reality.

They (smaller cities) were more of an investment destination than user destination," said Amit Bhagat, managing director and CEO at ASK Property Investment Advisors.

Click NEXT to read more...

Top 5 cities real estate fund managers are betting on

Bhagat says cities such as Nagpur, Jaipur, Mohali and Chandigarh have more investors in residential properties than actual users.

"In Mumbai and NCR, initially, investors buy properties and users replace them subsequently but in many Tier-II and -III cities, investors stay longer," he adds.

Bhagat says that ASK has been focusing on the top five to six cities since the beginning and would continue to focus on that.

"We invest in the top five-to-six cities and focus on city-centric projects or those in suburbs," says Bhagat.

Click NEXT to read more...

Top 5 cities real estate fund managers are betting on

Ajay Piramal group-owned Piramal Fund Management has investments in five cities such as Mumbai, Bangalore, the NCR and so on and planning to stick to the same number of cities.

"There is enough opportunity for deployment within these target cities so the need to go to a sixth city does not arise for the moment.

If we were to take a call on another destination for investments, it would therefore naturally need to be predicated by the hiring of a local team," said Khushru Jijina, managing director, Piramal Fund Management.

Interestingly, the strategy of PE funds to narrow their focus or stick to the set of cities where they have invested earlier, coincides with real estate developers going back to their home markets after they expanded to multiple cities during the boom times of 2005-08.

Click NEXT to read more...

Top 5 cities real estate fund managers are betting on

Some of the biggest developers such as DLF and Parsvnath expanded to multiple cities like Mumbai, but soon exited them to reduce their debt burden.

Narrowing approach

* Red Fort which earlier invested in six cities now focusing only on Mumbai and NCR

*HDFC Property Fund is believed to be focusing on top cities

* Piramal Fund Management is sticking to a five-city strategy now

*ASK Property Investment Advisors continues to focus on top 5 to 6 cities