| « Back to article | Print this article |

This is what Mr Mukherjee must focus on now

Now that the United Progressive Alliance has trounced the Left Front in Kolkata and the Union government is back to work, Finance Minister Pranab Mukherjee must devote his energies to improving fiscal management if his budgetary arithmetic has to be prevented from going awry.

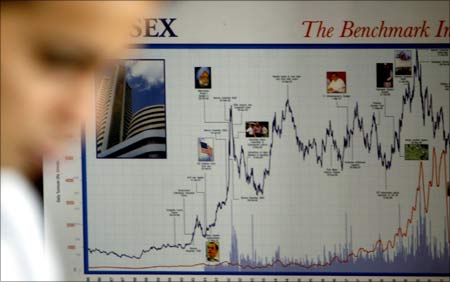

The danger signals are all up. His ministry has now acknowledged the Reserve Bank of India's earlier warning that economic growth in fiscal 2011-12 is likely to be lower than budgeted originally.

A sharp deceleration in the denominator will mean a sharp increase in the fiscal deficit-to-gross domestic product (GDP) ratio.

The timely arrival of the monsoon augurs well for the economy, which may surprise the markets and policy makers. But this cannot be taken for granted.

Click NEXT to read on . . .

This is what Mr Mukherjee must focus on now

Moreover, reports of investment deceleration suggest that some kind of a crowding-out of private investment may already be happening as a result of persistently high government borrowing.

The most worrisome aspect of recent fiscal trends is the sharp increase in the government's subsidy bill. Total subsidies -- food, fertilisers and petroleum -- have been persistently high and as a percentage of GDP went up from less than 1.5 per cent till 2007 to close to 2.5 per cent in 2008-09 and above 2.0 per cent in 2009-10.

While Mukherjee has budgeted for a lower ratio this fiscal, there is little evidence so far that he will be able to meet his budgetary targets -- not with the continued foot-dragging on petroleum and fertiliser subsidies and pressures to increase food subsidy.

The only thing that has saved the Union government's fiscal strategy so far, especially in the face of sluggish revenue receipts, is the less-than-budgeted defence expenditure.

Click NEXT to read on . . .

This is what Mr Mukherjee must focus on now

Mukherjee must thank Defence Minister A K Antony for helping him on the expenditure front, though it is not clear with what consequences for defence preparedness and national security.

It was widely expected that immediately after the state Assembly elections were wrapped up the government would attend to the extant fiscal challenge. Apart from the heroic increase in petrol prices, no other action has been taken.

On the other hand, it appears that the finance ministry may not be able to meet the divestment target it had set. While no one expects last year's bonanza to be repeated this year, even budgeted amounts may not be forthcoming if the overall approach to macroeconomic management remains lacklustre.

Click NEXT to read on . . .

This is what Mr Mukherjee must focus on now

The delay in tax reform -- with the introduction of a Goods and Services Tax still on hold and the apparent inability of major political parties to focus attention on issues pertaining to revenue mobilisation and revival of growth -- is raising fresh concerns about the sustainability of even 8.0 per cent economic growth.

With the international economic environment remaining precarious and far from stable and with regional security re-emerging as a major policy concern, the gathering clouds do not bode well for growth, revenue generation and fiscal correction.

It is not our intention to sound needlessly alarmist, but the time has come to ring a warning bell. India's macroeconomic authorities must focus on fiscal stabilisation and Mukherjee has to provide the leadership as finance minister.