| « Back to article | Print this article |

13 global cities top in luxury home prices

Interestingly, a year later, the rate of growth in Asia is more subdued when supply and demand imbalances are fuelling prime property prices in cities such as Paris, London and Helsinki, according to the Knight Frank's Prime Global Cities Index.

The gap between the performance of Europe and Asia's top cities has narrowed as efforts by Asian governments to cool housing inflation have started to take effect and European prime housing markets come out of the downturn, says the Knight Frank study. Click NEXT to find out 13 cities that have seen the highest rise in luxury home prices...13 global cities top in luxury home prices

1. Paris (France)

The prime property in Paris recorded the strongest growth in prices in the Knight Frank Prime Global Cities Index.

13 global cities top in luxury home prices

Hong Kong's fast paced growth has seen property prices jump by 15 per cent on an annual basis (March 2010-March 2011). Overall, the cities in the Index recorded an average annual price growth of 6.6 per cent in Q1 2011 compared to 12.7 per cent a year earlier due to the slower pace of growth in the Asian cities.

Click NEXT to read more...

13 global cities top in luxury home prices

Click NEXT to read more...

13 global cities top in luxury home prices

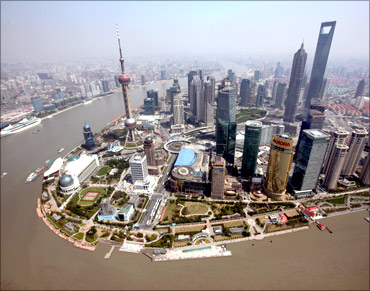

The fast growing Shanghai's real estate market saw a significant rise of 11 per cent in luxury property prices.

"In Asia, government cooling measures have started to impact on the prime housing markets in Hong Kong, Shanghai, Beijing and Singapore. In Q1 2010, average annual price growth across these four cities stood at 54.6 per cent, whereas in Q1 2011 this figure fell to 11.1 per cent," says the Knight Frank study.Click NEXT to read more...

13 global cities top in luxury home prices

Beijing is ranked as the second fastest growing realty market in China, saw prices rise by 10 per cent.

An year ago there was a clear continental divide when it came to the performance of the world's prime property markets. Asian cities dominated the top rankings for price inflation while Europe and the US trailed far behind.Click NEXT to read more...

13 global cities top in luxury home prices

Highlighting the dominance of European cities, London saw a rise of 8.6 per cent in luxury home prices. Global buyers in the London prime market make up 50 per cent of the market.

In the last two years, the highest price in the global market has breached the 6,000 pounds/sq ft barrier. The 10,000 pounds/sq ft barrier will be breached at some point this decade. The first market to break this barrier is likely to be London.Click NEXT to read more...

13 global cities top in luxury home prices

Singapore is the fourth city from Asia to be listed among the top 10 cities.

Here, the luxury property prices rose by 8.6 per cent. Global buyers constitute 30 per cent of buyers in Singapore.

There are lots of luxury addresses in Hong Kong or Singapore, but these are less established markets and there is still the scope for new prime localities to emerge, says the Knight Frank study.

Click NEXT to read more...

13 global cities top in luxury home prices

In Zurich, prices rose by 8 per cent. In the next property cycle (which has already started), the city will see the consolidation of an elite tier of global city markets, where the top addresses will become increasingly bought over by wealthy buyers as long-term secure investments.

Click NEXT to read more...

13 global cities top in luxury home prices

The capital city of Ukraine, Kiev saw property prices rise by 3.2 per cent. Beisdes being a major administrative, cultural and scientific centre, Kiev is also a preferred business destination.

Click NEXT to read more...

13 global cities top in luxury home prices

Geneva saw a rise of 1.6 per cent in luxury property prices. Geneva has been described as the third European financial centre after London and Zurich.

Hailed as world's most compact metropolis, Geneva is one of the most expensive cities in the world.

Click NEXT to read more...

13 global cities top in luxury home prices

Monaco also found the place among the top global cities with property rates rising by 1.1 per cent.

Click NEXT to read more...

13 global cities top in luxury home prices

St Petersburg is ranked among the toppers in the premium realty market. The prices rose by 1.1 per cent at St Petersburg.

Moscow's prime residential market recorded the weakest performance, with prices declining by 8 per cent in the year to Q1 2011.

Click NEXT to read more...

13 global cities top in luxury home prices

New York is the only city from America to be ranked in the top luxury home realty list. Luxury property prices rose by 1 per cent. Global buyers constitute 15 per cent of buyers in Singapore.

In Los Angeles, prices dropped by 2.2 per cent.