| « Back to article | Print this article |

The man behind IndiGo's amazing success

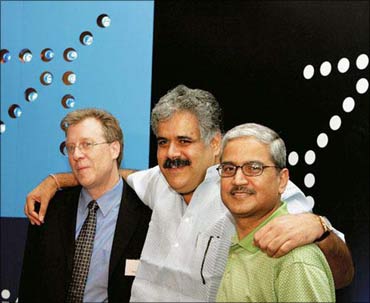

InterGlobe Enterprises managing director Rahul Bhatia likes to keep a low profile, but his business makes him visible all over India -- and, increasingly, the world.

InterGlobe's domestic airline IndiGo, with its two-tone blue livery and enviable on-time performance, has become a familiar, favoured brand.

IndiGo was on the front pages recently because of a reported order for 180 new Airbus aircraft, worth $15 billion.

At the Paris Air Show in 2005, the company made headlines for a similar reason. It ordered 100 aircraft, at $6.5 billion, when IndiGo had not even been launched.

Click NEXT to read on . . .

The man behind IndiGo's amazing success

Bhatia, 49, keeps on surprising his peers in a business meant for the big boys. IndiGo soon completes five years of flying. It can now fly abroad, according to the rules, if it wants.

It is already India's largest low-cost carrier, second-largest in terms of passengers carried.

Bhatia took what amounted to a leap of enterprise, if not faith, in launching the airline. He had behind him a degree in electrical engineering from Canada, and a two-year stint at IBM, when he came back to India to scale up the operations of Delhi Express.

That was a small airline representation firm started by his father Kapil Bhatia. Out of it grew Bhatia's InterGlobe Enterprises.

Click NEXT to read on . . .

The man behind IndiGo's amazing success

He knew where to look for expertise. For technology, he tied up with New York-based Cendant which took a stake in InterGlobe Technologies -- a BPO and IT services firm specialising in travel, transportation and hospitality.

For the airline, Bhatia roped in former US Airways CEO Rakesh Gangwal as partner for his solid credibility and global access. For his business jet venture he picked American corporate jet maker Hawker-Beechcraft.

IndiGo is equally owned by Rahul Bhatia and Rakesh Gangwal. The two first met in the corridors of United Airlines' headquarters in Chicago in 1985, while Bhatia was handling some IT work for the airline.

The Kolkata-born Gangwal is an engineer from IIT Kanpur, and has had a long career in aviation with Air France, United Airlines and US Airways.

Click NEXT to read on . . .

The man behind IndiGo's amazing success

Despite appearances, success for IndiGo has not come easy. An early advantage, however, was the careful planning that Bhatia and Gangwal did before the airline started operations.

People who know Bhatia say he is obsessive about detail and quality. They describe how at first IndiGo's executives, including staff at the check-in counters, air crew and sales and marketing staff were hired only after Bhatia met each of them individually.

IndiGo has set industry standards in such critical but unglamorous areas as turnaround time. Its ground staff has been trained to deplane all passengers in six minutes and unload and load the hold within 10 minutes.

An IndiGo aeroplane can be ready to fly again in 25 minutes or less, even at a busy airport like Delhi. (Other airlines take more than 30 minutes.)

Click NEXT to read on . . .

The man behind IndiGo's amazing success

Time saved on the ground means more time spent in the air, earning money. IndiGo's aircraft spend more than 11 hours a day in the sky, compared to eight or 10 hours by other airlines' aircraft. This number is likely to rise when the airline goes international.

Add to this about 100 employees per aircraft, compared to 130-plus at other low-cost majors like SpiceJet and GoAir, efficient new engines, lightweight body paint and seats, and strict instructions to remove dirt, dust and waste from the aeroplane at every turnaround (to shed every superfluous gramme), and it's clear that IndiGo understands how to work the margins.

The airline was among the first to have its aircraft taxi to the terminal after landing, using one engine only. Shutting down the second engine saves fuel. In the air, moderating the aeroplane's speed saves fuel. These minor economies significantly reduce the fuel bill.

New aircraft are better than old. When it goes shopping, IndiGo uses six-year sale and leaseback agreements.

Click NEXT to read on . . .

The man behind IndiGo's amazing success

This means the lessor takes the aeroplane back after six years, so the airline can induct a new one in its place.

The chief benefit of a such a lease agreement is that IndiGo's aircraft need not go for frequent overall checks, which may call for major repairs. Such a check is normally done when the aircraft is about eight years old.

Bhatia's airline can take you there, and his hotels can accommodate you after you arrive.

InterGlobe Hotels, a joint venture since 2004 with French hospitality group Accor (another instance of Bhatia teaming up to draw upon someone else's expertise), owns the Ibis hotel chain.

Click NEXT to read on . . .

The man behind IndiGo's amazing success

There are 850 Ibis hotels in 40 countries, according to InterGlobe's web site. In India, Bhatia aims to have 200 hotels by 2015, with 6,000 rooms.

Three are open, in Gurgaon, Pune and Mumbai, and seven expected in 2011. More are being built.

With its rooms priced at $100 a night, about Rs 4,600, Ibis aims to serve young executives, as well as the middle class. The hotels are pegged between a three- and a four-star service level; between guesthouse and luxury hotel.

"There is an enormous void in value-for-money lodging in the country," Bhatia told Business Standard in August 2010, "and we think the gap will only grow."

Click NEXT to read on . . .

The man behind IndiGo's amazing success

Bhatia's business plan exploits the potential links between hotels and airline, in a number of lucrative ways.

There are obvious efficiencies like setting up a single joint call centre or undertaking common bulk purchases for both enterprises.

IndiGo and Ibis can also cross-sell each other's services -- the airline flies 30,000 people a day, and they are a potential market.

Bhatia can also arrange with large companies which move large numbers of employees around to transport and accommodate their staff.

Click NEXT to read on . . .

The man behind IndiGo's amazing success

But Bhatia's low-cost hotel strategy has nothing directly to do with IndiGo's low-cost approach. The hotel venture began before IndiGo's first order of aircraft in 2005, though the first Ibis in India opened in 2008.

Then, Accor builds the hotels cheaply (the hundreds of sites worldwide offer economies of scale), at locations that Bhatia's side chooses.

Tier I and II cities are the target, as is proximity to major business districts -- because leisure travel is too seasonal to promise the breakeven 67 per cent annual occupancy rate.

Click NEXT to read on . . .

The man behind IndiGo's amazing success

In the metros, Bhatia has said he will put some Ibis properties next to seven-star hotels. Apart from tempting patrons away, companies will happily pay $100 a night even during a downturn. Bhatia expects an annual return on capital of 20 per cent.

The total capital involved in Ibis for India is estimated at Rs 3,000 crore (Rs 30 billion). InterGlobe Hotels will have to invest Rs 1,500 crore (Rs 15 billion)by 2015, of which Bhatia's share is Rs 900 crore (Rs 9 billion) -- this at a time when he also has to pay for IndiGo's stream of new aircraft.

Since his businesses are privately held, little financial information is given out, beyond InterGlobe Enterprises' projected annual revenue of Rs 6,900 crore (Rs 69 billion). On financials especially, Bhatia likes to keep his profile low.