Viveat Susan Pinto in Mumbai

Charlie had his chocolate factory, so did the Cadbury family. But neither had America's favourite cookie, Oreo.

Around the world, it's always been a power brand of Kraft Foods, the largest confectionery, food, and beverage corporation.

But why did Kraft launch its blockbuster sandwich cookie in India under the Cadbury brand name, that too a year after acquiring the British chocolate maker?

Anand Kripalu, the boss of Kraft and Cadbury in India sums it up: "Oreo has a strong chocolate connect and in India, who can beat the legacy of Cadbury built over a 100 years"?

The $50-billion foods major, which has been eyeing an India presence for long, has chosen to leverage the strengths of the local unit of Cadbury seeking synergies with the latter's portfolio when launching its products.

. . .

The 'Kraft' of wooing India

Image: Kraft Foods Inc CEO Irene Rosenfeld.Photographs: John Gress/Reuters

The result: the rollout of powdered beverage Tang (launched last month) and biscuit brand Oreo (a week ago).

Kripalu, who is president, South Asia Indo China, Kraft Foods, and managing director, Cadbury India, says, "as categories we will focus on confectionery, that is, chocolate, gum and candy, powdered beverages and biscuits. Dairy is a different animal. We are not going to divert focus for now. Our hands are full."

So dairy is clearly not on Kraft's mind as of now. The focus, as Kripalu says, remains on Tang and Oreo.

The reason for this, say company insiders, is Cadbury has no core competence in distributing dairy products.

Its infrastructure is equipped to handle confectionery and powdered beverages (Bournvita), which it has been doing with its legacy portfolio. The only new addition to the list is biscuits.

. . .

The 'Kraft' of wooing India

But we have found that there is a high degree of overlap between biscuits and creams and our legacy system for chocolates," says Kripalu.

"We have not had to revamp distribution. In terms of supply chain, movement of stock, it rides beautifully on the mother system."

Since Kraft is a fairly late entrant in the Indian marketplace, speed counts, say analysts. Leveraging the strengths of its acquired unit then makes ample sense in a market that is growing fast.

The organised packaged foods market in India is estimated to be over Rs 10,000 crore (Rs 100 billion), growing at over 15 per cent per annum.

If one looks at individual categories, the growth rates are even more.

The Rs 2,000-crore (Rs 20-billion) chocolate market, for instance, is growing at 20 per cent per annum.

Biscuits, a Rs 8,000-crore (Rs 80-billion) category, is growing at over 20 per cent per annum, while milk food drinks, a Rs 3,000-crore (Rs 30-billion) category, is growing at 10-12 per cent per annum, according to industry estimates.

. . .

The 'Kraft' of wooing India

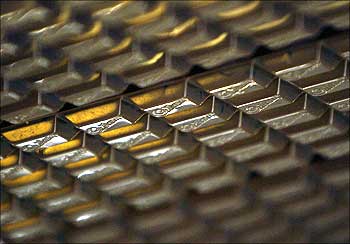

Image: A bar of Cadbury Fruit and Nut chocolate moves along the production line of the Bournville factory in Birmingham, central England.Photographs: Darren Staples/Reuters

Even dairy products (minus liquid milk), a Rs 3,000-crore category, is growing at over 20 per cent per annum.

But getting into dairy would mean setting up a cold-chain infrastructure and supply chain, which would have cost Kraft precious time, say industry experts. Kripalu hints as much, "Setting up a new distribution system is not easy. It takes time."

The current reach of the Rs 2,500-crore (Rs 25-billion) Cadbury India is 1.8 million stores.

Though comparatively smaller than firms such as Hindustan Unilever, whose overall reach is estimated to be close to 7 million stores, analysts say that for a confectionery major, Cadbury's reach is significant.

It leads the chocolate market with a share of 70 per cent. In gums and candy, it has a share of over 35 per cent. Kripalu says, "The time was just right to expand the portfolio. We can take on a little more and do it well."

. . .

The 'Kraft' of wooing India

Image: Sanjay Khosla, Kraft Foods Inc executive vice president and Kraft International president.Photographs: John Gress/Reuters

The strategy of sticking to confectionery, powdered beverages and biscuits also ties in well with Kraft's '5-10-10' game plan for emerging markets, which is about five categories, 10 power brands and 10 markets.

These five categories include chocolates, gum & candy, biscuits, coffee and powdered beverages.

The power brands are Jacobs coffee, Tang, Oreo, chocolates Lacto and Milka, Cadbury, Trident gum, Halls candy, Biskuat (which is a biscuit), and Club Social, a snack brand. The ten markets are Brazil, China, Russia, New Zealand, Australia, Indonesia, South Africa, Poland, Ukraine and Mexico.

With four power brands from the 5-10-10 portfolio already present in India, Kraft appears to have achieved half its objective here.

It is to be seen whether some more from the list makes their way to India. Kripalu isn't dropping names for now.

He simply says, "The 5-10-10 philosophy is a guide. We have much work to make the current launches a success."

. . .

The 'Kraft' of wooing India

Image: Anand Kripalu.In a recent interview to Business Standard, Anand Kripalu, president, Kraft Foods, & MD, Cadbury India, explained how the first seeds have been sown.

Excerpts:

Now that Tang and Oreo have been launched, what action standards have you set for the two?

Tang is a grocery item. Something that the mother picks up when she goes shopping and then comes homes and prepares it.

We intend to explode the distribution on Tang. With Oreo, the objective is to make it one of India's favourite biscuits.

We will build the brand on special family moments.

. . .

The 'Kraft' of wooing India

Given that chocolates are also part of the 5-10-10 philosophy that Kraft has for emerging markets, what prevented you from taking on the distribution of Toblerone?

This comes back to the power of focus.

Our portfolio is strong enough to help us achieve the objective we have on chocolates.

As and when we see there is an opportunity with Toblerone, we will think about it.

Tang and Oreo are big new plays that we have taken over. The timing we felt was not appropriate with Toblerone.

How do you propose to move on the manufacturing front?

Tang is being produced at our plant in Hyderabad, while Punjab-based Bector Foods is the third-party manufacturer for Oreo.

The existing system can handle ramp-ups in production. That is not an issue.

. . .

The 'Kraft' of wooing India

Will more products from the Kraft system make their to India?

Just because we launched two products in quick succession that doesn't mean we will dive into further launches.

We have to invest significantly and make these products a success.

What does Kraft bring to the table?

Kraft has brought sheer investment power to the table.

They have allowed us to play on a much wider canvas.

The third thing is that we have now embarked on a journey of enhanced systems and processes.

The culture is very empowering.

A lot of the support that we get is based on what we ask.

In the end, we are looking to build Cadbury from a pure-play confectionary and Bournvita business to a foods company.

The first seeds have been sown.

article