| « Back to article | Print this article |

The king of poverty relinquishes throne

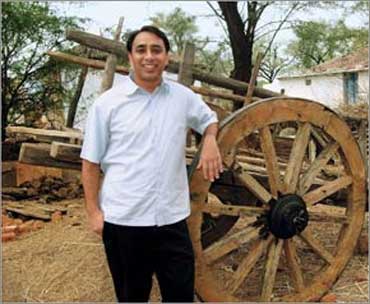

Clad in his trademark kurta pyjama Vikram Akula has never been at a loss for words while articulating to the media the pivotal role that micro-lending can play to liberate the rural poor from the clutches of money lenders. It earned him the status of poster boy for the microfinance industry.

Yet, this consummate promoter of all things related to microfinance - including himself - has been avoiding the media like the plague ever since "inter-personal issues" led to the unceremonious exit of Suresh Gurumani, former chief executive of SKS Microfinance, last year.

Word from the grapevine was that Akula wanted complete control over SKS, and Gurumani came off second best in the tussle for control that ensued.

Akula founded SKS as a non-profit organisation in 1997 but left the firm to join McKinsey and Company as a management consultant in 2004. He returned in 2005 after SKS was converted into a for-profit company. He was appointed as the executive chairman earlier this year.

Click NEXT to read more...

The king of poverty relinquishes throne

Last week, Akula decided to tell the world "his side of the story" amidst murmurs that SKS' board was likely to terminate his role because of a growing rift between him and the senior management.

While media relations for SKS are handled by Adfactors Public Relations, Akula appointed Ogilvy Public Relations to arrange meetings with a few journalists in Mumbai on November 21. The meeting, however, was postponed for a couple of days to coincide with SKS' board meeting.

The scheduled meeting with journalists never happened but post the board meet, SKS issued a statement that Akula had stepped down as the chairperson and member of the board. He will remain a consultant to the company till the end of March, 2012 to assist with transition.

Click NEXT to read more...

The king of poverty relinquishes throne

No official statement was issued that explained the cause of Akula's resignation. According to senior SKS officials, who requested anonymity because of the sensitivity of the issue, the board was not satisfied with the way that Akula had been running the company at a time when it was battling multiple crises of mounting losses, deteriorating asset quality, poor loan recoveries and absence of fresh funding.

According to some people familiar with the development, Akula signed a confidentiality pact with SKS, which prevented him from speaking to the press.

He has also signed a non-compete agreement with the microfinance company for which he will get a fee but was not offered a severance package even though his term as executive chairman was till March, 2016.

Akula was personally not available for comments. But in a statement he said he will continue to remain involve in the microfinance industry "at a policy level".

Click NEXT to read more...

The king of poverty relinquishes throne

"I will also be involved in a mobile banking initiative. This type of technology - with its ability to help lower costs and increase convenience - will create an improved platform for microfinance," he said.

Akula had an epic rise between 1998 and 2010 as he steered SKS through the labyrinth of the rural financial world, making it the largest microfinance institution in the country.

He was a graduate in Philosophy and English from Tufts, did his masters in International Relations from Yale and doctorate in political science from the University of Chicago.

He brought Gurumani from Barclays Bank to run SKS in 2008 and together they successfully raised over Rs 1,600 crore (Rs 16 billion) two years later through an initial public offer, which was the first ever by a microfinance firm.

Click NEXT to read more...

The king of poverty relinquishes throne

Almost immediately after the public issue things started going downhill for both SKS and Akula.

Akula's ex-wife Malini Byanna in a television interview accused SKS of mismanagement and flouting corporate governance norms. She even claimed that Akula did not disclose the criminal complaints against him when SKS was going public. Akula has been denying these charges.

SKS and other micro-lenders were also accused of charging exorbitant rate of interest to poor borrowers and following coercive methods for loan recoveries leading to increased number of suicides in rural villages of Andhra Pradesh, the largest market for microfinance companies in India at that time.

In October, 2010 the Andhra Pradesh government passed a legislation curbing micro-lending activities by private firms in the state. It severely affected SKS profitability and eroded its net worth.

Click NEXT to read more...

The king of poverty relinquishes throne

SKS' earnings have been shrinking ever since with the shares plunging 87 per cent in past one year. In July-September, 2011 the company's net loss widened to Rs 385 crore from Rs 219 crore in the previous quarter.

While Akula cannot be blamed for the eroding financial performance of SKS in the last one year, which is largely on account of restricted micro lending activities in Andhra Pradesh, SKS management was not pleased with the way he was handling the situation.

"Vikram was not able to provide strategic direction. He did not give adequate time when it was needed, and stayed overseas for many months," said a source.

Click NEXT to read more...

The king of poverty relinquishes throne

The official version, however, remains that Akula wanted to resign on his own.

The move will see Akula losing his control on the company he founded as he does not own any equity shares other than the stock options given to him.

Like at the time of Gurumani's exit, Akula and SKS senior management continue to keep mum about the events behind the closed boardroom doors.