| « Back to article | Print this article |

The great Indian consumer boom

Explosive economic growth rates have thrown up a large middle-class in India with formidable purchasing power, collectively.

According to estimates, there are about 404 million consuming or aspiring consumers in India.

More and more Indians are now showing a paradigm shift in the consumption pattern with a large number of people spending huge sums on eating out at good restaurants, buying luxury cars and designer clothing, acquiring newer and fancier gadgets, etc.

Click NEXT to read on . . .

The great Indian consumer boom

Gold and silver prices in India are at all-time high of close to Rs 21,000 per ten grams and Rs 45,500 per kg, driven by firm global trends, brisk buying for the ongoing marriage season and rising demand from industrial units.

Trading activity gathered momentum after gold in global markets, which normally set a price trend at the domestic front, rose to a record-high of $1,428.70 an ounce.

Click NEXT to read on . . .

The great Indian consumer boom

Automobile companies have reported the highest ever sales in India in the last few months, particularly in Spetember 2010.

The car sales will rise 12-13 per cent in the ongoing fiscal, almost half of what was achieved in the last financial year, according to the Society of Indian Automobile Manufacturers.

SIAM had already predicted that the total sales of cars in domestic market to be 17,14,925 units in 2010-11.

In 2009-10, domestic passenger car sales stood at 15,26,259 units as against 12,20,475 units in 2008-09, an increase of over 25 per cent.

Click NEXT to read on . . .

The great Indian consumer boom

Airline traffic growth in India remained in double digits over the last few months, the exorbitant airfares notwithstanding.

Airline passenger traffic has now risen above pre-recession levels, at an average growth rate of almost 21 per cent.

Click NEXT to read on . . .

The great Indian consumer boom

India's per capita income grew by 10.5 per cent to Rs 44,345 in 2009-10 against Rs 40,141 in the year-ago period, according to the government data.

Per capital income means income of each Indian if national income is evenly divided among the country's population of 117 crore (Rs 1.17 billion).

The per capita income was slightly higher than Rs 43,749 as calculated by the Central Statistical Organisation in its advance estimates for FY10.

With rapid increase in the purchasing power of its middle class population, India will experience a consumer boom supported by a sudden growth in demand for household products in the next few years, a study has said.

Click NEXT to read on . . .

The great Indian consumer boom

Data collected by the Jersey-based fund manager Ashburton show the number of people in India earning more than $3,000 dollars (about Rs 135,000) a year is set to explode.

This level is widely viewed by economists as a trigger for the creation of a consumer society.

Click NEXT to read on . . .

The great Indian consumer boom

In India the number of households enjoying that level of income is expected to double from last year's 47 million to 116 million by 2010.

In 1995, only 12 million Indian families earned as much.

Click NEXT to read on . . .

The great Indian consumer boom

Indians have bought more than 150 million mobile phones in 2010, taking the total number of cellular users to over 700 million.

According to the Telecom Regulatory Authority of India, the wireless phone user base grew 2.55 percent to 687.71 million in September, from 670.60 million in the previous month.

With this, the total telephone subscriber base in the country, both wireless and wireline, touched 723.28 million. The total telephone density reached 60.99 per cent.

Click NEXT to read on . . .

The great Indian consumer boom

The overall PC market sales in India in 2010 are close to 8 million units.

Desktop PC sales accounted for nearly two-thirds of total PC sales, representing a 15% increase year-on-year.

The sales of Notebook computers grew at 52% year-on-year.

Click NEXT to read on . . .

The great Indian consumer boom

The number of Indians travelling abroad has been constantly rising. The number of outbound Indians jumped by a million in 2010, and is estimated to be close to 15 million.

Click NEXT to read on . . .

The great Indian consumer boom

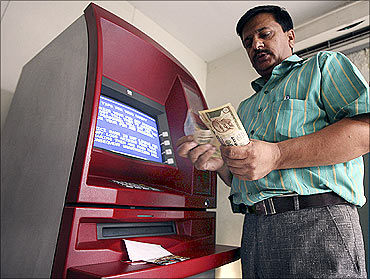

More people are now moving towards using the ATM for their banking needs. According to a survey by Banknet India, 95 per cent people now prefer this modern channel to traditional mode of banking.

Increased ATM usage is also helped by the fact that customers have now the flexibility of using ATMs of other banks.

ATMs are now seen to be more than mere cash dispensing machines. Customers use ATMs to recharge their mobile phone pre-paid connections, pay their utility bills, even mutual fund transactions.

Click NEXT to read on . . .

The great Indian consumer boom

The Indian stock markets are the top performers among the world's 10 biggest markets, according to data compiled by Bloomberg.

Indian bourses are close to their all-time highs. As compared to some other emerging markets, the Indian bourses have been relatively booming. A good monsoon, creditable corporate results, a fast-growing economy, rising demand in the country, a consumer boom, and a generally positive outlook for the economy and the markets has seen Indian stock prices rise.

The huge influx of foreign institutional investor funds into the stock market and robust government spending on major sectors too has provided a major impetus to the markets.

Click NEXT to read on . . .

The great Indian consumer boom

There has been a paradigm shift in Indian retail. India's growing prosperity, the large population of under 25-year-olds who have grown up in a booming economy, means that lifestyles and shopping habits are shifting in favour of malls.

Driving the growth is a rapid rise in middle-class salaries and the emergence of a high-income class, with 1.7 million households earning more than $100,000 a year.

Click NEXT to read on . . .

The great Indian consumer boom

Price is no deterrent to a discerning consumer in India, it seems. Be it the latest bag from Louis Vuitton, the new convertible from the Audi stable or even a limited edition Rolex, or a full-fledged yacht, the consumer lifestyle market in India continues to see consumers buying more expensive luxury items and climbing up the value chain.

India's luxury car market is estimated to have out-performed other Asian countries in sales last year by rising 40 per cent year on year.

The reasons for the growth of the luxury industry are not hard to find. The luxury industry is still in a nascent stage in India and is growing at a scorching pace as the aspiration for better products is on the rise.

The consumer market in India has shown a high growth trajectory and by 2025 is expected to become the world's fifth biggest consumer market as incomes and living standards are bound to grow, according to an Assocham study.

Click NEXT to read on . . .

The great Indian consumer boom

The Indian traveller is not just spending big money on overseas travel, even domestic travel has boomed in the last few years.

Now, flying to your favourite vacation destination or travelling on board super luxury trains in India is no more the exclusive reserve of the rich and famous.

Click NEXT to read on . . .

The great Indian consumer boom

The demand for consumer durables, like LCD television sets, washing machines, refrigerators, air-conditioners, home theatre systems, high-end digital cameras and handycams, etc has been growing fast in India.

The rising demand for white goods as reflected in the year-on-year growth of these products in the Index of Industrial Production over the last few months has led to a surge in investor interest for listed companies in the sector.

Analysts tracking the sector do feel sales will continue to be strong. But, going ahead, profitability might take some hit due to rising raw material costs.

Click NEXT to read on . . .

The great Indian consumer boom

Real estate prices across India are at their zenith. Over the last few years, real estate prices in most metros have seen a sharp rise, with annual return of 30 per cent being quite common.

Although some of these prices seem to be exorbitant, the housing industry in India is not really seeing a recession. Even though interest rates are high -- and the Reserve Bank of India is thinking of hiking them further to curb runaway inflation -- the number of Indians buying expensive real estate is rising by the day.

Click NEXT to read on . . .

The great Indian consumer boom

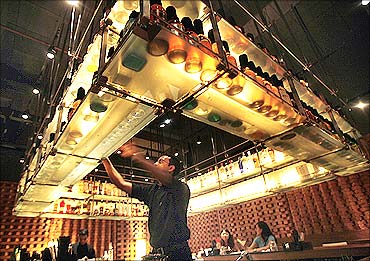

Eating out till a few decades ago was frowned upon in India. Today, Indians are spoilt for choice between going to high end Italian eateries to Chinese joints to having multi-course meals at five-star restaurants.

Pubs, lounges, exclusive bars/clubs that offer a fine evening out along with good food are fast becoming the in thing.

And money doesn't seem to be a problem for the gentry frequenting these restaurants.

Click NEXT to read on . . .

The great Indian consumer boom

Complementing India's retail phenomenon is an exponential increase in consumer credit.

The rise of so-called organised retail is also critical to the mall boom in India.

Corporate chains today have a tiny share of India's $300-billion-plus retail business but this is set to rise to about one fifth of the market within five years, according to estimates from Technopak, a research and consultancy firm.

Click NEXT to read on . . .

The great Indian consumer boom

Fashion aspirations of Indians, even in small towns, were for long ignored by many a designer. Today, small town India is as eager and as clued into national and global luxury brands as anyone else.

Designer clothing is no more donned by film stars and Page 3 celebrities. . . numerous Indians now have the means and the access to luxury branded clothing and match the richest in their glamorous lifestyle.

Click NEXT to read on . . .

The great Indian consumer boom

India's economic recovery losing steam?

And yet, contrary to forecasts of India seeing good growth momentum in coming months, Paris-based OECD on Monday cautioned the country's economic recovery appears to be 'losing steam'.

"There are signs of regained growth momentum in the Chinese economy owing to a strengthening of investment and retail sales. India's economic recovery appears to be losing steam," it said.

OECD comprises of a grouping of mostly developed nations that account for over 60 per cent of the global economic output.

The observation by the Organisation for Economic Cooperation and Development came even as Indian economy recorded robust growth of 8.9 per cent in the first half of this fiscal and the government projecting the economy to expand by up to over 9 per cent this fiscal.

The observation is based on OECD's Asian Business Cycle Indicators (ABCIs), which looks at the short term economic climate of Asian economies.

ABCI is mainly based on composite index (that assesses change in economic fluctuations) and diffusion index (that provides a broader picture of overall economic activity).

So you tell us -- is the Indian economic boom a reality or is it just a bubble that might soon burst?