Photographs: Reuters

Ever wondered, how is the compensation structured for CEOs or CXOs (executive directors). Is the high pay package really justified? Who ends up taking the larger share in the pie?

A recent study by Indian Business School, Hyderabad, says that chief executive officers (CEOs) in India are paid considerably higher compensation than executive directors.

According to the study, executive compensation in corporate India has gained prominence since the liberalisation of the Indian economy in 1993-94, and the subsequent rise of India as a leading centre for international investment and the rapid increase in participation in Indian equity markets by retail investors.

Further, the report points out that the salaries for senior management have grown sharply since 1994. Senior executive salaries are now sizable in the Indian context, particularly, when compared against non-managerial employee salaries.

. . .

The framework behind executive compensation in India

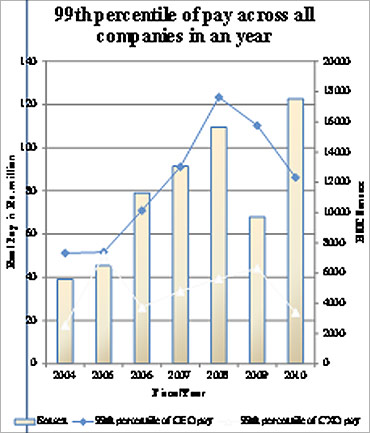

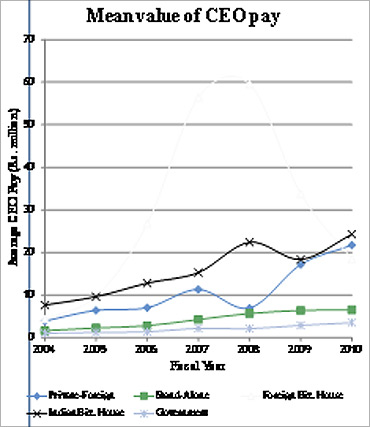

The study, 'Executive Compensation in India', covering 2,500 top companies in the country, shows that the real value of both CEO and CXO compensation has been witnessing a sharp rise in the recent years.

This has prompted concerns that have so far been restricted mainly to developed markets. Regulators in India have, alongside their counterparts in developed and emerging markets, sought to exert renewed focus on the issue of executive compensation in the wake of the financial crisis (Reserve Bank of India).

Historically, executive salaries in India had been low and tightly structured as per government regulations. In the early nineties, pursuant to the Companies Act 1988, salary caps had been increased from approximately Rs 7,500 per month in 1974 (approx. $950) to of Rs 15,000 in 1993 (approx. $500) per month for managers working in firms with capital of Rs 150 million (approx. $50 million in 1993).

...

The framework behind executive compensation in India

Recent data and more comprehensive analysis to this effect is set out in this report; however, as early as 2002, it was noted in a small study of prominent Indian firms that growth in pay packages of managers in the period between 1979-2001 was approximately five times that of the growth of employee salaries in these firms.

While in the United States, the gap between the CEO and CXO has grown substantially. The CEO pay, for instance, has increased six-fold from 1980 to 2003.

Likewise in India, the real value of both CEO and CXO compensation has been following a sharply increasing trend in recent years.

...

The framework behind executive compensation in India

Further the study highlights that CXO pay is less sensitive to stock market movements. CXO pay has a much lower sensitivity to stock market movements and hence a much lower variation across time.

In fact, the CXO pay is largely dependant on the firm size. The bigger the firm, higher the pay. However, it is less than that of the CEO.

...

The framework behind executive compensation in India

In India, CEO and CXO pay is considerably higher (about 30 per cent for both CEOs and CXOs) for firms that are part of large business groups and increases significantly with the proportion of promoters' equity."

Clearly, the distribution of the CEO and CXO pay is highly convex with the largest Indian firms compensating their CEOs at least one order of magnitude more than the other firms.

Second, even though we observe this rightward skew in CXO compensation as well, the differences are not as pronounced as that for the CEOs.

...

The framework behind executive compensation in India

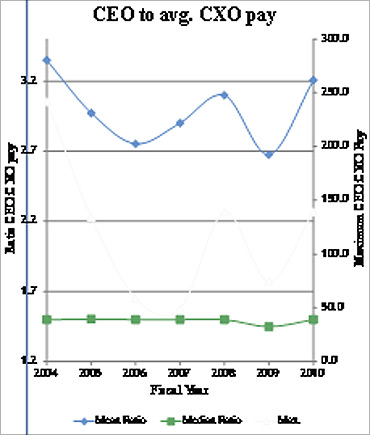

It is also highlighted that the ratio of CEO and CXO pay displays high dispersion both across time and firms.

Further, the study points out that the effect of financial crisis on executive compensation was primarily restricted to CEOs and did not extend to the CXOs.

Surprisingly, it is also noted that the median pay for CXOs has decreased from 2009 to 2010, whereas the median CEO pay has been secularly rising during the time period of our analysis.

...

The framework behind executive compensation in India

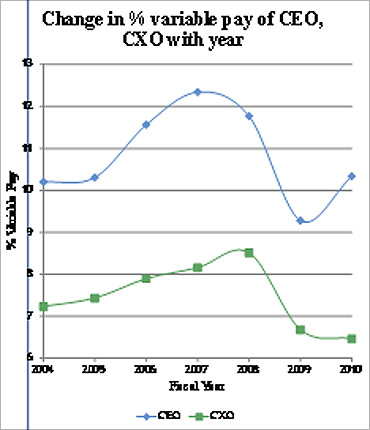

Here, the report highlights variation in mean variable pay for CEOs and CXOs across the years. Variable pay is defined as the ratio of "bonus and commissions" as a percentage of total remuneration. This is potentially an indicator of the fraction of CEO and CXO pay that is related to performance.

For each year, this percentage is averaged across all firms to get the mean variable pay percentage. We observe that consistent with CEO pay being more sensitive to firm performance, the variable component of CEO compensation is considerably more than the variable component of CXO compensation.

It is also observed that the variable component of CEO compensation increased till 2007 and then dipped in 2008 and 2009 before increasing again in 2010. In contrast, the variable component of CXO compensation increased every year till 2008, but decreased in 2009 and stayed flat in 2010.

...

The framework behind executive compensation in India

Referring to policy implications from this study, it said domestic policy should be at par with global standards.

According to the report, current tools in executive compensation law and policy may not be fully cognisant of the role of vertical and horizontal agency costs.

It also points out that disclosures and corporate oversight, among others measures, must be meaningful and fulfil the intended regulatory rationale.

Along with it, the report also raises questions that if the compensation is only performance based, will it lead to rise in insider trading or risk trading. . . .

article